Are you tired of the constant hustle of managing your investment portfolio? Do you want a hassle-free and effective way to grow your hard-earned money? Well, buckle up because I have some exciting news that will change how you invest!

As someone who has been investing for quite some time, I’ve encountered several investment options that promise high returns but fail to deliver. However, I recently stumbled upon the iShares Core Growth ETF (XGRO) and am thrilled to present my comprehensive and unbiased XGRO review.

In this XGRO review, I will take you on a deep dive into the world of the iShares Core Growth ETF (XGRO). We’ll explore its asset allocation, top holdings, advantages, drawbacks, and more. This review will equip you with the knowledge you need to decide whether XGRO is the right investment option for you.

Whether you’re a seasoned investor looking to optimize your portfolio or a newbie dipping your toes into the investment world, get ready to discover everything you need to know about XGRO in 2024 and beyond.

XGRO is an iShares ETF portfolio focused on long-term capital growth through diversified equity and fixed-income securities mix. It has been trading on the Toronto Stock Exchange since 2007, previously known as iShares Balanced Growth CorePortfolio Index ETF. With approximately 80% equity and 20% bond exposure, XGRO carries a "low to medium" risk rating.

- XGRO is an inexpensive ETF with an MER of 0.20%.

- It is continuously monitored and also rebalanced quarterly.

- XGRO provides exposure to ETFs that are diversified across regions and asset classes.

- Easy to use and acquire

- Offers global diversification

- The ETF is heavily weighted towards the US markets

- Provides exposure only to equity ETFs managed by BlackRock Canada

- Its MER is higher than its other components individually

What is iShares Core Growth ETF (XGRO)?

The iShares Core Growth ETF (XGRO) is an ETF portfolio created by BlackRock that trades on the Toronto Stock Exchange. It was first introduced as iShares Balanced Growth Core Portfolio Index ETF in 2007, but it was renamed iShares Core Growth ETF Portfolio in 2018.

The portfolio consists of 8 funds with approximately 80% equity and 20% bond exposure, making it a low-medium risk investment vehicle suitable for both new and seasoned investors in Canada.

Its objective is to provide long-term capital growth while diversifying investments without requiring investors to track or manage anything.

It invests in a portfolio of ETFs managed by BlackRock Canada to provide exposure to globally diversified equity and fixed-income securities.

Key Facts about XGRO ETF (As of January 16, 2024)

- Inception Date: June 21, 2007

- Ticker Symbol: XGRO.TO

- Assets Under Management: $1.859 Billion

- Exchange: Toronto Stock Exchange

- Management fee: 0.18%

- Management expense ratio: 0.20%

- Dividend Schedule: Quarterly

- Distribution yield: 1.62%

- 12-month trailing yield: 1.83%

- Currency Traded: CAD

- Frequency of rebalancing: Quarterly

- Eligible Accounts: Most registered (TFSA, RRSP, etc.) and non-registered available

Benefits and Downsides of XGRO ETF

Like every other ETF in Canada, XGRO has its good and ugly sides. Let’s look at the pros and cons of this iShares ETF.

Pros

- XGRO is an inexpensive ETF with an MER of 0.20%.

- It is continuously monitored and also rebalanced quarterly.

- XGRO provides exposure to ETFs that are diversified across regions and asset classes.

- Easy to use and acquire

- Offers global diversification

Cons

- The ETF is heavily weighted towards the US markets

- Provides exposure only to equity ETFs managed by BlackRock Canada

- Its MER is higher than its other components individually

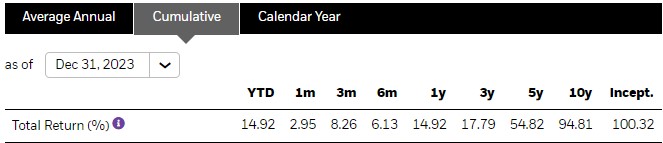

XGRO Performance

The iShares XGRO ETF was launched in 2007 and has, since its inception, performed well.

The ETF was launched with a different name, the iShares Balanced Growth CorePortfolio Index ETF (CBN), and different investing objectives. It was later renamed in 2018, and its priorities changed.

The recorded performance accounts for the ETF’s performance before its priorities were changed to provide long-term growth for investors.

Here is the performance of the XGRO ETF as of January 16, 2024:

Source: www.blackrock.com

XGRO Fees

The XGRO ETF charges the following fees:

- Management Fees: 0.18%

- Management Expense Ratio (MER): 0.20%

These fees are cheaper than the average equity mutual fund fee of 1.98% and can help you save a lot of money.

Your trading commissions can even pile up to erase your fee if you trade in small amounts frequently.

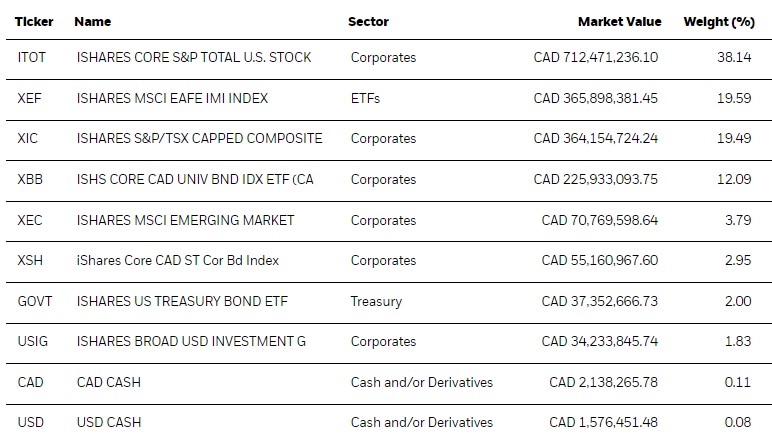

XGRO Holdings

As of January 16, 2024, the XGRO ETF comprises eight iShares ETF funds which are as follows:

Source: www.blackrock.com

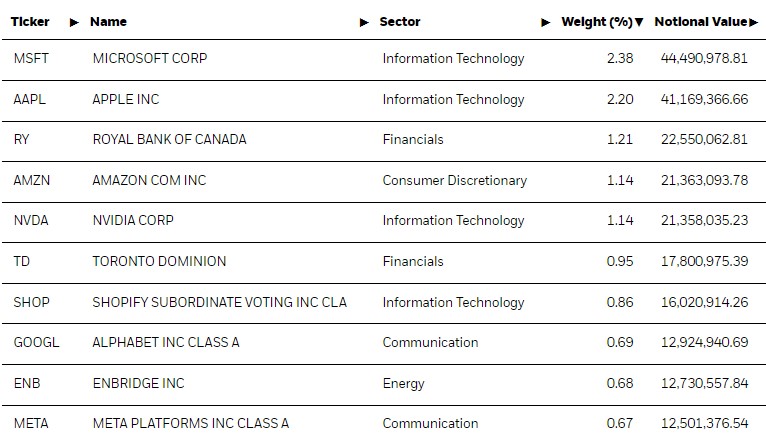

XGRO Aggregate Holdings

As of January 16, 2024, the iShares XGRO ETF holds about 21,281 assets, with its top 10 comprising technology and financial stocks.

Source: www.blackrock.com

XGRO Asset Allocation

- Equity: 80.49

- Fixed Income: 19.42

- Cash and/or Derivatives: 0.10

Source: www.blackrock.com

iShares XGRO has an asset allocation split of almost 80% equity and 20% fixed-income assets, making it a growth investment portfolio.

The portfolio doesn’t require manual rebalancing, reducing trading fees and eliminating the need to monitor the asset mix constantly.

XGRO Vs ZGRO

XGRO and ZGRO are all-in-one ETFs offered by different companies but with similar asset allocation strategies and investment objectives. However, XGRO has an asset allocation split of approximately 80% equity and 20% fixed-income assets, while ZGRO has a split of approximately 60% equity and 40% fixed-income assets.

Also, XGRO has a slightly lower management fee of 0.18%, while ZGRO has a fee of 0.20%. XGRO may have a slightly higher risk level due to its heavier weighting in equities, while ZGRO may be slightly less risky due to its heavier weighting in fixed-income assets.

RELATED: ZGRO Review (2024): BMO ETF Growth Portfolio

XGRO Vs VGRO

XGRO and VGRO are all-in-one ETFs offered by different companies with similar investment objectives but some key differences.

VGRO has an asset allocation split of approximately 80% equity and 20% fixed-income assets, which is the same as XGRO.

VGRO has a slightly higher management fee of 0.25% compared to XGRO’s 0.18%. Its underlying holdings are primarily from Vanguard, while XGRO’s underlying holdings are primarily from BlackRock.

Furthermore, VGRO and XGRO have similar risk levels due to their similar asset allocation strategies.

RELATED: VGRO Review: Vanguard iShares Core Growth ETF

Is XGRO Worth It?

Determining whether XGRO is worth it depends on your financial goals and investment strategy.

XGRO is a low-cost, all-in-one ETF offering diversified equity and fixed-income asset portfolio. It can be an attractive option for investors who want exposure to a broad range of assets with a single investment without having to manage individual holdings themselves.

Additionally, XGRO has a low management fee of 0.18%, which is lower than many actively managed funds and can help keep costs down over the long term.

However, it’s important to note that XGRO’s asset allocation may not be suitable for all investors. It has a relatively high weighting in equities, which can result in greater volatility and potential for loss.

How To Buy XGRO ETF in Canada

If you’re comfortable with a higher level of risk and seeking long-term capital growth with strong returns, iShares XGRO could be an excellent choice for you.

When it comes to purchasing ETFs, the most cost-effective option is through discount brokers. In Canada, some of the top choices include Questrade, Qtrade, and Wealthsimple Trade.

Qtrade is a Canadian online brokerage platform that offers a variety of investment services, including trading stocks, ETFs, mutual funds, options, and bonds. It was founded in 2001 and is known for its user-friendly platforms and exceptional customer service.

Questrade is a Canadian online brokerage platform that offers a range of investment services, including trading stocks, ETFs, mutual funds, options, and bonds. It was founded in 1999 and is known for its low fees and user-friendly platforms.

Final Thoughts on XGRO Review

I hope this XGRO review has provided you with valuable insights into this popular ETF portfolio. XGRO is a well-diversified investment option suitable for investors with a long-term horizon looking for growth in their portfolio.

With its low-cost structure and the convenience of being a one-stop shop for investors, XGRO is worth considering.

However, it’s important to remember that investing always carries risk, and you should consult with a financial advisor to ensure that XGRO aligns with your investment goals and risk tolerance.

So, if you’re ready to take the next step in your investment journey, consider trying XGRO. Open an account with one of the discount brokers like Questrade, Qtrade, or Wealthsimple Trade, and start your investing journey with XGRO today.

FAQs on XGRO Review

Is XGRO a Good Investment?

Capital YES. This is based on the above five interesting facts of XGRO, which include an impressive low management fee (0.18%), low MER (0.20%) and high average annual return (5.80%), among others.

Also, as an investment vehicle with a low-medium risk level, XGRO is a good investment for new and seasoned investors.

How Risky is XGRO?

With a low-medium risk profile, XGRO is less risky than other investment vehicles. A low-medium level implies a low chance of losing your hard-earned money with XGRO.