With the launch of its All-in-One ETFs, Vanguard joins the league of the best Canadian ETFs providers. Vanguard’s All-in-One ETFs allow you to benefit from a low-cost, globally diversified portfolio of equities and bonds.

They eliminate the stress involved in rebalancing your portfolio when you make contributions or when the performance of the portfolio assets changes. All you need to do is to buy shares of individual ETFs or increase your funding as required.

The rest is handled by the professional managers of Vanguard, allowing you to have a hands-off investment experience. Here I review one of the popular All-in-One ETFs of Vanguard, known as VEQT, using my personal experience.

At the end of this VEQT stock review, you should be able to learn lessons from my experience in determining whether or not to buy VEQT ETF.

Let’s get started.

VEQT is a Vanguard Canada-managed ETF with a 100% equity allocation, making it more aggressive. Investors in VEQT need above-average risk tolerance and long-term investment objectives due to its medium risk indicator. VEQT ETF provides longer-term capital growth through equity investment and is traded on the Toronto Stock Exchange. It is ideal for low-cost passive investing without rebalancing concerns.

- Instant international diversification.

- Low management fees (compared to mutual funds).

- Easy to use and purchase.

- Rebalance-free.

- Hands-free portfolio management.

- More volatility (with 100% in equities).

- Limited asset allocation.

- Slightly higher fees compared to other all-in-one ETFs.

Vanguard Canada All-in-One ETFs: VEQT Stock Overview

Launched on January 29, 2019, VEQT is the product of Vanguard Canada, one of Canada’s popular All-in-One ETFs providers. It is also one of the world’s stocks and fixed-income managers, managing more than $6 trillion in assets.

Vanguard Canada All-in-One ETFs are revolutionary products that simplify investment by providing long-term capital growth through bonds and stocks.

However, of all the All-in-One ETFs of Vanguard Canada, only VEQT has 100% equity allocation, making it the most aggressive portfolio.

ETF Portfolio | Asset Allocation |

Vanguard Growth ETF Portfolio (VGRO) | 80% equity and 20% fixed income |

Vanguard Conservative Income ETF Portfolio (VCIP) | 80% fixed income and 20% equity |

Vanguard Conservative ETF Portfolio (VCNS) | 60% fixed income and 40% equity |

Vanguard Balanced ETF Portfolio (VBAL) | 60% equity and 40% fixed income |

Vanguard All-Equity ETF Portfolio (VEQT) | 100% equity |

Source: www.vanguard.ca

What is VEQT?

VEQT ETF is one of the All-in-One ETFs provided and managed by Vanguard Canada, which has a 100% equity allocation, making it more aggressive than other ETFs.

Stocks in aggressive portfolios usually have higher exposure and more fluctuations than balanced or growth portfolios.

With its medium risk indicator, investors in VEQT need to have above-average risk tolerance in addition to long-term investment objectives. VEQT ETF is traded on the Toronto Stock Exchange under the “VEQT” ticker symbol.

VEQT stock holds many ETFs as a fund of funds to provide investors with longer-term capital growth through equity investment. It is best for investors looking for low-cost passive investing and does not want to worry about rebalancing.

Key Facts About VEQT ETF (As of January 16, 2024)

- Net assets: $2.518 billion

- Management expense ratio (MER): 0.24%

- Management fee: 0.22%

- Return on Equity: 13.4%

- Price/book ratio: 2.2x

- Price/earnings ratio: 14.8x

- Number of stocks: 13,023

- Earnings growth rate: 7.6%

- Exchange: Toronto Stock Exchange

- Ticker symbol: VEQT

- Account Eligibility: RRSP, TFSA, RRIF, RESP, DPSP, RDSP

Benefits and Downsides of VEQT ETF

Like other all-in-one ETFs, VEQT ETFs also have pros and cons. Here are the major ones.

Pros

- Instant international diversification.

- Low management fees (compared to mutual funds).

- Easy to use and purchase.

- Rebalance-free.

- Hands-free portfolio management.

Cons

- More volatility (with 100% in equities).

- Limited asset allocation.

- Slightly higher fees compared to other all-in-one ETFs.

VEQT ETF Asset Allocation

As of the time of writing this review, VEQT has the following asset allocation:

- Stock: 99.96%

- Short-term reserves: 0.04%

As you can see, VEQT is not entirely made up of 100% equities. Instead, it’s rolled over to 100% with the minor (0.12%) allocation to short-term reserves.

VEQT Stock Underlying Holdings

VEQT holds a total of 13,420 stocks. To manage these stocks entirely, VEQT allocates them to four underlying Vanguard funds as follows:

ETF | Weight (%) |

Vanguard US Total Market Index ETF | 42.72% |

Vanguard FTSE Canada All Cap Index ETF | 29.98% |

Vanguard FTSE Developed All Cap ex North America Index ETF | 20.00% |

Vanguard FTSE Emerging Markets All Cap Index ETF | 7.29% |

Source: Vanguard.ca

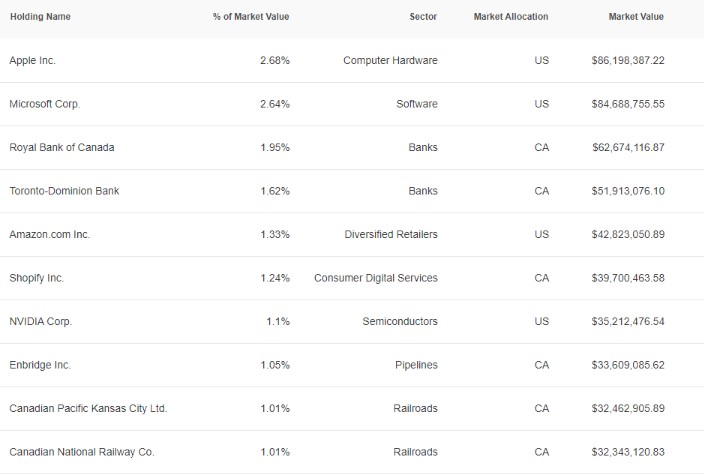

VEQT Stock 10 Top Holdings

Vanguard brings together four of its other ETFs to create this All-in-One ETF (VEQT). Each ETF invests in the most prominent companies and sectors worldwide, giving you ultimate equity diversification.

Here, I’ll show you the top 10 VEQT holdings, but you can split your investment dollar up in many ways. VEQT has a total of 12844. Here are the top 10:

Source: Vanguard.ca

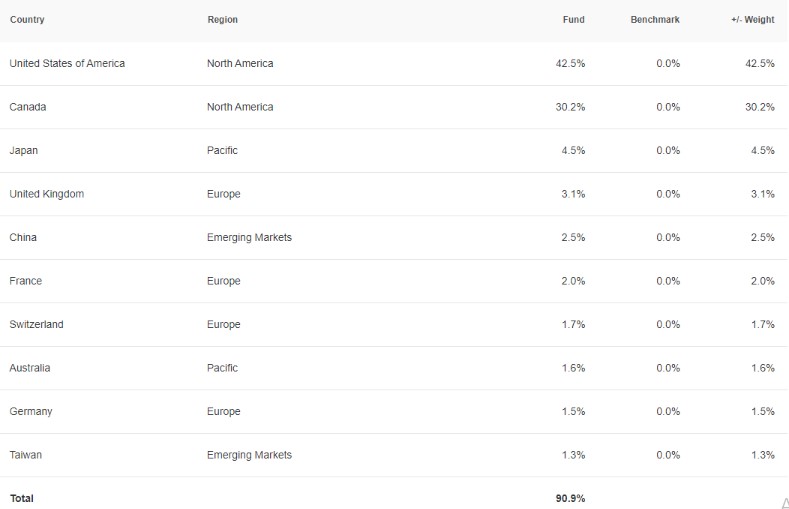

VEQT Geographic Allocation

Looking at the geographical diversification or market allocation, you will discover that VEQT ETF is well spread to give you the best. Among the 50 different markets VEQT operates, here are the ten countries with the major allocation:

Source: Vanguard.ca

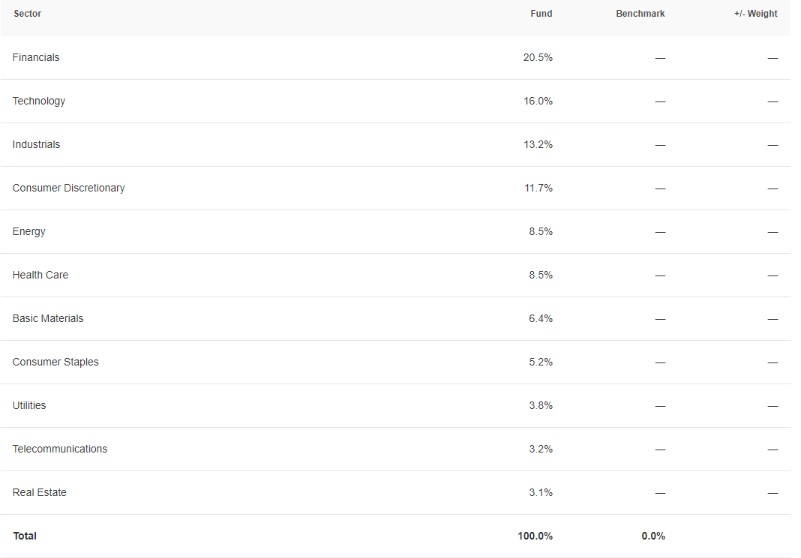

VEQT Sector Allocation

When it comes to sector exposure, VEQT ETF has a balanced diversification, with Financials and Technology taking the lead spot. Here is the sector allocation of VEQT:

Source: Vanguard.ca

VEQT Returns/Performance

Founded in 2019, VEQT is a relatively new ETF compared to other common indexes ETFs. As a result, VEQT has limited historical information for in-depth performance analysis.

VEQT ETF is a long-term passive investment product, and you shouldn’t worry much about its monthly performance. Some companies go up in value over time, while others go lower. VEQT gives you instant access to a well-diversified long-term strategy.

As of January 16, 2024, VEQT has had a cumulative return of $59.62 since inception – according to its market price.

Source: Vanguard.ca

Note: Past ETFs performance does not guarantee future success.

VEQT Stock Fees

The following constitutes the fees of Vanguard All-Equity ETF Portfolio (VEQT), which are low compared to the fees of mutual funds in Canada:

- Management fee: 0.22%

- MER: 0.24%

The Management fees and MER are almost the same, but the MER includes the management fees. The MER is expressed as a percentage of your investment in the ETF. It is automatically charged annually, so you don’t have to worry about tracking your payments.

For every $10,000 you invest in VEQT, you pay $24 yearly in fees. Of course, you are getting an excellent deal considering you invested in over 13,000 stocks.

ETFs such as VEQT save you money by managing your portfolio through a discount broker with zero commission.

How to Buy VEQT Stocks

Virtually every investor in Canada can invest in VEQT ETF. However, this all-in-one ETF portfolio is more suitable for investors looking for a 100% equity all-in-one portfolio, those looking for global diversification, people with longer-term investment objectives, and investors with above-average tolerance.

Are you one of these? There are many ways you can get VEQT stock in Canada. However, the popular means Canadians use to get VEQT ETF is through Wealthsimple Trade and Questrade.

Two major ways of buying VEQT in Canada are DIY and Robo-advisor.

To Do-it-Yourself, open an account with any no-commission online brokerage in Canada, such as Wealthsimple Trade or Questrade.

- Wealthsimple Trade: You are entitled to trade thousands of stocks and bonds with no commissions through Wealthsimple Trade. A $25 welcome bonus awaits you when you make a $100 initial deposit in equity. To get started, open a Wealthsimple Trade account.

- Questrade: Questrade also allows you to purchase VEQT ETF for free (but when selling ETF, $4.95 – $9.95 charges apply.) Select and open a Questrade account that suits your needs to get started. A Robo-advisor is your go-to for hands-on and low-cost ETF portfolio management methods.

A Robo-advisor can help you make your portfolio rebalance automatically when you deposit or when your portfolio veers off course from its target allocation.

The fact is that while Robo-advisor’s fees may be higher than those of zero-commission online brokerages, you can’t compare the service.

VEQT vs XEQT: Which is Better?

iShares All-Equity ETF Portfolio (XEQT) is one of the All-in-One ETFs managed by Black Rock. It was launched on August 7, 2019.

Like VEQT ETF, XEQT also has a 100% asset allocation on stocks intending to provide investors with longer-term capital growth.

However, VEQT has a relatively higher management fee (0.22%) and MER (0.24%) compared to XEQT’s relatively low management fee (0.18%) and MER (0.20%).

Unlike VEQT, which has a medium risk indicator, XEQT has a low-to-medium risk indicator. VEQT and XEQT are great ETFs that appeal to different investors.

If you’re looking for an ETF portfolio with a low-medium risk indicator and low fees and MER, XEQT is better. But if you’re looking for a medium-risk ETF portfolio without regard to high fees and MER, VEQT could be better for you.

VEQT vs VGRO

Vanguard’s Growth Portfolio (VGRO) is a consecutive portfolio comprising 80% equity and 20% fixed income. VGRO is not 100% made up of equities like VEQT.

So you should buy VGRO if you’re looking for a portfolio with an 80/20 slit across equities and fixed income. But if you’re looking for a portfolio with 100% equities, you should opt for VEQT.

Final Thoughts on VEQT Stock Review

While VEQT is a new exchange-traded fund in the market, it has performed admirably since its launch. Investing in a single VEQT ETF offers immediate diversification across different markets and sectors.

But remember, VEQT stock is a pure-equity portfolio. Even though it has the potential to yield decent returns, it can be riskier than growth and balanced portfolios.

That’s why I shared this VEQT Stock review to make you realize that before purchasing this ETF, you need to identify your investment objective, risk tolerance, and time horizon.

By so doing, you can determine whether VEQT is suitable for you. If not, you should consider XEQT or other all-in-one ETFs.

FAQs on VEQT Review

Is VEQT stock a good investment?

Yes, with admirable performance since inception, VEQT is a good investment for any investor with above-average risk tolerance looking for a 100% stock portfolio without worrying about rebalancing.

How risky is VEQT?

VEQT ETF has a medium risk indicator. This implies you must have the above-average risk tolerance to trade safely with this portfolio.

Does VEQT Have Dividends?

VEQT stock has 3.3% dividends that are distributed or scheduled annually.

Can investing in VEQT ETF make you rich?

There’s no guarantee investing in VEQT ETF will make you rich. This is despite the fact that its past performance is admirable. Remember that past performance doesn’t guarantee future performance.

Also, even though VEQT stock is a low-cost ETF diversified portfolio, how much you earn depends on your investment goal and market volatility.

Can You Lose All Your Money in VEQT Stock?

It depends. You can gain or lose in VEQT Stock. When you invest in the VEQT ETF, you share in the gains and losses of the underlying assets. If those assets increase in value, individual shares will typically rise, and you will earn a profit.

You will earn profits if the individual shares and the overall value of those assets increases. However, if the overall value of the VEQT ETF decreases, every unit within the fund will decrease in value. Therefore you will suffer a loss.

How Do I Reinvest Dividends in Vanguard ETF?

Reinvesting dividends is another way to make investing automatic and add to your investment’s growth. The Vanguard’s dividend reinvestment program allows you to reinvest your dividends without fees or commissions.

By reinvesting your dividends, you’re automating your investment and boosting the growth of your portfolio. Thankfully, reinvesting your dividends in Vanguard ETF is so simple. All you need is to choose the “reinvest” option when you buy ETF shares.

Thank you for this. Quite detailed and comprehensive. I have had experience with a number of other ETFs, and they have almost similar features and offers with VEQT.