Are you tired of spending hours researching different ETFs to build your investment portfolio? Or are you looking for ways to balance your ETF portfolio? Say hello to the XEQT – the All-in-One ETF that does all the work for you.

As a busy individual who wants to invest in the stock market but doesn’t have the time or expertise to manage it, I was intrigued by the XEQT. And after using it for some time, I knew I had to share my experience with others. So here’s my XEQT Review.

In this XEQT review, I’ll delve into the ins and outs of XEQT, discuss its pros, cons and key features, and give you my personal take on whether it’s a suitable option for both novice and seasoned investors.

So, let’s dive in and explore what XEQT has to offer!

XEQT is an aggressive All-in-One ETF managed by BlackRock that provides long-term capital growth to investors through investing solely in stocks with no bonds, and offers low fees. It aims for 100% equities with diversification across countries and sectors. Suitable for novice and seasoned investors, XEQT can be held in registered and unregistered accounts.

XEQT Overview

Launched on August 7, 2019, the XEQT is an All-in-One ETF managed by BlackRock. The iShares Core ETF Portfolios are easy-to-use one-basket portfolios that assist investors in achieving their long-term investment objectives.

Each ETF portfolio follows a strategic asset allocation strategy to assist investors with varying investment objectives and risk profiles. Of all the five All-in-One ETFs of iShares, only XEQT has a 100% equity allocation.

iShare ETF Equity Allocation iShares Core Income Balanced ETF Portfolio (XINC) 20% iShares Core Conservative Balanced ETF Portfolio (XCNS) 40% iShares Core Balanced ETF Portfolio (XBAL) 60% iShares Core Growth ETF Portfolio (XGRO) 80% iShares Core Equity ETF Portfolio (XEQT) 100%

Source: www.blackrock.com

What is XEQT ETF?

iShares Core Equity ETF Portfolio (XEQT) is an aggressive All-in-One ETF managed by BlackRock that provides long-term capital growth to investors through investing in 100% stocks and zero bonds. It offers an extremely low Management Expense Ratio (MER) and management fees compared to average mutual funds and robo-advisors.

XEQT aims to hold 100% of stocks and invests in a small amount of cash or cash equivalents. This ETF portfolio also provides investors with diversification across different countries and sectors.

Currently, it is made up of 99.74% equities and 0.26% cash and/or derivatives. XEQT stock is suitable for novice and seasoned investors and can be held in registered and unregistered accounts.

Key Facts about XEQT ETF (As of January 16, 2024)

- Net Assets: CAD 2,418,014,880

- Inception Date: August 7, 2019

- Exchange: Toronto Stock Exchange

- MER: 0.20%

- Management Fee: 0.18%

- Price: 27.76

- Distribution Yield: 1.37%

- Dividend Schedule: Quarterly

- Number of Holdings: 4

- Number of Underlying Holdings: 9762

- Account Eligibility: RRSP, TFSA, RRIF, RESP, DPSP, RDSP, Non-Registered

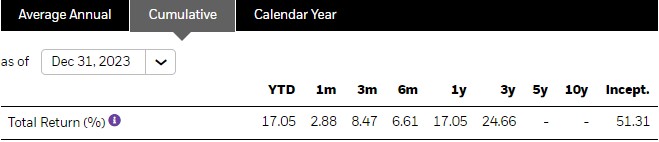

XEQT ETF Return/Performance

Shortly after its debut on the Toronto Stock Exchange, the world went into a global pandemic that brought all topsy turvy. Even with this, all isn’t lost with XEQT ETF; you only have to be patient to realise potential gains.

Despite its limited historical performance, XEQT has had an attractive performance in less than two years compared to other ETFs.

As of January 16, 2024, the ETF has generated 40.47% cumulative returns since inception (August 7, 2019).

Source: www.blackrock.com

Note: The above performance does not guarantee future performance.

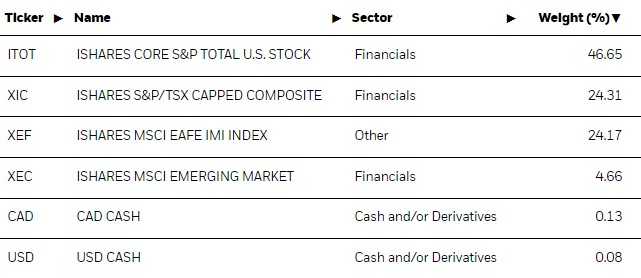

XEQT ETF Holdings

For XEQT to manage its funds effectively, it allocates them into four underlying ETFs and two cash groups.

As of January 16, 2024, XEQT has the following stock holdings:

Source: www.blackrock.com

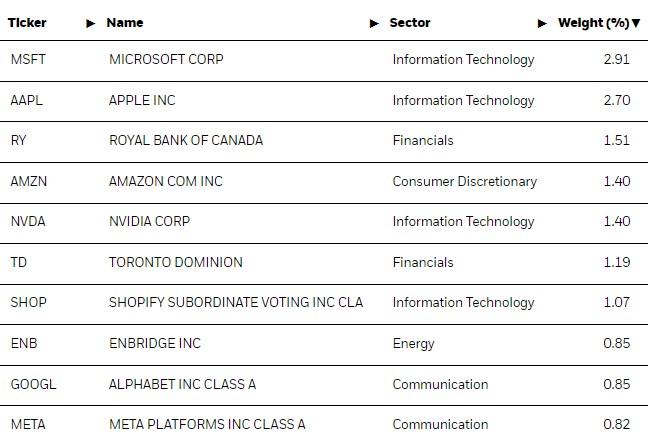

Also, XEQT ETFs offer investors exposure to 9,762 different stocks from various sectors worldwide. XEQT holdings include assets from commercial firearms, tobacco, nuclear weapon, and other potentially controversial companies. So, if you are looking for a socially responsible portfolio, XEQT is not for you.

As of January 16, 2024, XEQT has the following aggregate underlying holdings:

Source: www.blackrock.com

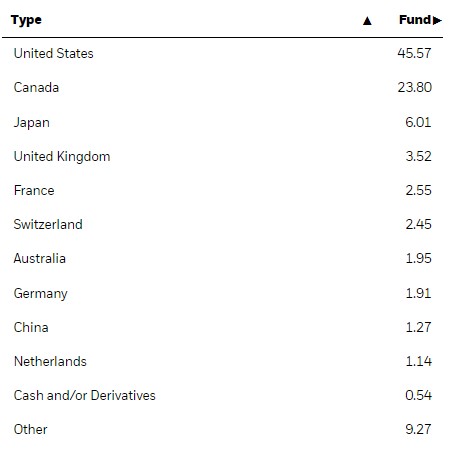

XEQT ETF Geographic Allocation

As a globally diversified portfolio, XEQT has international exposure across different countries. Savvy investors look for great geographical diversification.

Most times, when one part of the world is experiencing financial downturns, another might be experiencing growth. Making sure your investments span the globe is a wise move.

As of January 16, 2024, XEQT has the following 10 top geographic allocations:

Source: www.blackrock.com

Note: XEQT geographic allocations can change from time to time.

XEQT ETF Fees

One benefit of XEQT that lured me to the bank is its fees. When I compared the fees of XEQT with the fees of mutual funds, I didn’t think twice. Regarding ETFs, XEQT offers much lower fees than other actively managed funds.

Here’s a picture of what I’m talking about:

- Management Expense Ratio (MER): 0.20%

- Management Fee: 0.18%

XEQT’s 0.18% management fee and 0.20% MER make it a cost-effective investment platform. For example, investing $10,000 in XEQT ETF will only pay $20 yearly as management fees. In contrast, you will pay $250 yearly if you invest in a mutual fund.

XEQT ETF has one of the lowest fees in the industry, plus you don’t have to worry about rebalancing your portfolio with XEQT. So the fee is worth it. Over an extended period, you can save thousands by investing in XEQT.

XEQT ETF Asset Allocation

XEQT aims to provide long-term capital growth to investors by investing in 100% equities. However, as of the time of writing this review, XEQT has the following asset allocation:

- Stock: 99.96%

- Cash and/or Derivatives: 0.04%

How to Buy XEQT ETF in Canada

BlackRock has no restriction on who can buy XEQT ETF. Everyone can buy this ETF – be they a novice or experienced investor.

However, XEQT is more suitable for investors looking for long-term capital growth, those with low-medium risk tolerance, investors who want 100% exposure to equity securities, and those looking for global diversification.

Are you one of them? Buying XEQT stock doesn’t involve a complicated process. It is as simple as identifying the means you want to use and taking the next step of buying your stock.

When looking for cost-effective means to buy your XEQT in Canada, you have two major options: Wealthsimple Trade and Questrade.

- Wealthsimple Trade is a zero-commission online broker that allows you to buy stocks and bonds without a fee. Create a Wealthsimple Trade account to purchase your XEQT today.

Wealthsimple Trade is a great trading platform that offers commission-free buying and selling of thousands of stocks. Its user-friendly interface and mobile-optimized investing dashboard make it easy to navigate and accept various payment methods, such as bank transfers and debit cards. In addition to traditional online stock trades, Wealthsimple Trade allows you to engage in other investment activities. It supports both taxable and registered (non-taxable) accounts such as RRSP and TFSA, and there is no minimum balance requirement when opening an account, making it accessible for investors with little money.

- Questrade is also a zero-commission online broker that allows you to buy an ETF without a fee, except for a small selling fee of $4.95 to $9.95. Create your Questrade account to purchase your XEQT today.

Questrade is an online discount brokerage established in 1999 with a $25 billion asset under management. Its popularity in Canada lies in its low commission, low trading fees, and multiple ranges of accounts. As a result, both beginners, intermediate and seasoned investors in Canada find Questrade attractive for DIY and active management investing.

Key Features

- Free tax-loss harvesting

- Low management fees

- Several investment options

- Automatic portfolio rebalancing

- Active management

- Ease of use

XEQT vs VEQT: Which to Choose?

Vanguard All-Equity ETF Portfolio (VEQT) is one of Vanguard Canada’s All-in-One ETFs that share a similar investment objective with iShares Core Equity Portfolio (XEQT).

Both ETF portfolios were established in 2019, resulting in their limited but appealing historical performance. Just as XEQT has a 100% equity allocation, VEQT has the same.

However, the two ETFs differ in fees. XEQT has a relatively low management fee of 0.18% and a low MER of 0.20%. On the other hand, VEQT has a comparatively higher management fee of 0.22% and a higher MER of 0.25%.

Additionally, XEQT has a low-to-medium risk indicator carrying both novice and seasoned investors along, while VEQT has a medium risk indicator favouring those with above-average risk tolerance.

Overall, these two ETFs are great and stand by what they offer. You can’t make a wrong choice with any of them.

Final Thoughts on XEQT Review

As someone who has used XEQT for about a year, I must be frank that this ETF is ideal for you compared to other ETFs if you’re looking for 100% exposure to equities.

Based on my experience, the diversification of XEQT and the dividend yield attract novice and experienced investors. Also, due to the composition of XEQT, it has lower fees than the fees of Robo-advisors mutual funds. This is a great plus.

However, while you may be excited by XEQT’s lower fee to the bank, that feeling may not last long. In just a decade, the story may be different. As a result of compounding results, you may be charged higher fees in the future. However, this is common to many All-in-One ETFs.

Additionally, if you are not disciplined enough, your investment behaviour will hurt your return, compounding your management fee. Like every other investment, XEQT is not risk-free. It is entirely dependent on stock fluctuations.

If you can afford this, you can proceed to the following stage and buy your XEQT or invest in one of the major alternatives to XEQT.

All the best.

FAQs on XEQT ETF Review

Is XEQT a good ETF?

XEQT is a good ETF because it is a low-cost alternative to mutual funds and Robo-advisors advisors. Besides having global diversification and growing dividend yield, XEQT is also easy to buy and sell.

How risky is XEQT ETF?

XEQT is not as risky as the other All-in-One ETFs out there. With a low-to-medium risk indicator, it’s suitable for both novice and seasoned investors who are comfortable with significant swings in the value of their portfolios (due to 100% stock allocation).

Does XEQT rebalance?

XEQT doesn’t require you to rebalance your portfolio. That is handled automatically by professional portfolio managers. As a result, you can use your time, effort, and money to focus on other aspects of your life.