Are you looking for a less risky investment vehicle with a balanced allocation to bonds and stocks? Then you want to check out VBAL ETF!

No doubt! That is not an easy task considering the growing number of investment vehicles that are dominantly investing in stocks or bonds, exposing you to higher risk.

But I have good news for you. There are now balanced ETF portfolios that limit investment risk by investing heavily in stocks and bonds. One of the leading balanced ETF portfolios in the industry is Vanguard Balanced ETF Portfolio (VBAL).

Whether you’re looking for a passive balanced portfolio or a less risky and aggressive one to make the most of your money, VBAL has you covered. Based on my personal experience, I present my unbiased VBAL review covering everything you need to know about it and the key things you can learn from my experience.

Are you ready to join me on this journey? Great! 1.2.3. Go!

VBAL ETF Summary

Vanguard Balanced ETF Portfolio (VBAL) is one of the All-in-One ETFs of Vanguard Canada that has become popular in Canada and beyond because of its performance since its inception. Vanguard Canada is one of the world’s leading stocks and bonds managers. There’s no complete mention of the best ETFs in Canada without mentioning them.

Launched on January 25, 2018, VBAL is a growing wave of Vanguard’s all-in-one ETFs that help investors in Canada, and other parts of the world make the most of their money. As one of the All-in-One ETFs of Vanguard Canada, only VBAL and VCNS have an equal allocation on stocks and bonds.

VBAL is a Vanguard Canada-managed ETF with 60% equity and 40% fixed-income global allocation, aiming for long-term capital growth and income. It diversifies investments and seeks to avoid volatility. The portfolio allocation may be adjusted by Vanguard Canada's sub-advisor.

- Stress-free portfolio management eliminates the need for frequent rebalancing.

- Global diversification.

- Easy to buy and sell.

- Low fees compared to high mutual funds and

- Robo-advisors fees.

- Not too risky or aggressive.

- Trading fees can increase in the long run.

- Tax charges may apply when updating your risk characteristics.

- Slightly higher fees compared to competitors.

What is VBAL ETF?

Vanguard Balanced ETF Portfolio (VBAL) is an all-in-one ETF portfolio managed by Vanguard Canada with 60% equity and 40% fixed-income global allocation. It is one of the All-in-One ETFs of Vanguard Canada that seeks to provide long-term capital growth and income to investors through stock and bond investment.

VBAL stock allows investors to diversify their portfolios across different securities, countries, and sectors to avoid heavy volatility. It aims to use stocks and bonds to give investors moderate income plus long-term capital growth.

VBAL strives to invest 60% in stocks and 40% in bonds to achieve its investment objective. However, from time to time, the portfolio allocation may be reconstituted and rebalanced according to the discretion of Vanguard Canada’s sub-advisor.

Key Facts About VBAL ETF (As of January 16, 2024)

- Inception Date: January 25, 2018

- Management Fee: 0.22%

- MER: 0.24%

- Price/Earnings Ratio: 14.8x

- Price/Book Ratio: 2.2x

- Return on Equity: 13.4%

- Earnings Growth Rate: 12.9%

- 12-month Trailing Yield: 2.14%

- Listing Currency: CAD

- Distribution Yield: 2.42%

- Exchange: Toronto Stock Exchange

- Account Eligibility: RRSP, TFSA, RRIF, RESP, Non-Registered

Pros of VBAL ETF

- Stress-free portfolio management eliminates the need for frequent rebalancing.

- Global diversification.

- Easy to buy and sell.

- Low fees compared to high mutual funds and Robo-advisors fees.

- Not too risky or aggressive.

Cons of VBAL ETF

- Trading fees can increase in the long run.

- Tax charges may apply when updating your risk characteristics.

- Slightly higher fees compared to competitors.

VBAL ETF Asset Allocation

- Stocks: 60.32%

- Bonds: 39.63%

- Short-term reserves: 0.05%

Source: www.vanguard.ca

To manage its 13,023 stocks effectively, VBAL allocates them to seven underlying ETF funds with a conservative 60/40 stock-to-bond split. The funds consist of assets from several markets worldwide across various sectors. This gives you an excellent range of market exposure.

ETF | Allocation (%) |

Vanguard US Total Market Index ETF | 25.85% |

Vanguard Canadian Aggregate Bond Index ETF | 23.48% |

Vanguard FTSE Canada All Cap Index ETF | 18.10% |

Vanguard FTSE Developed All Cap ex North America Index ETF | 12.06% |

Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged | 8.28% |

Vanguard US Aggregate Bond Index ETF CAD-hedged | 7.88% |

Vanguard FTSE Emerging Markets All Cap Index ETF | 4.35% |

Source: www.vanguard.ca

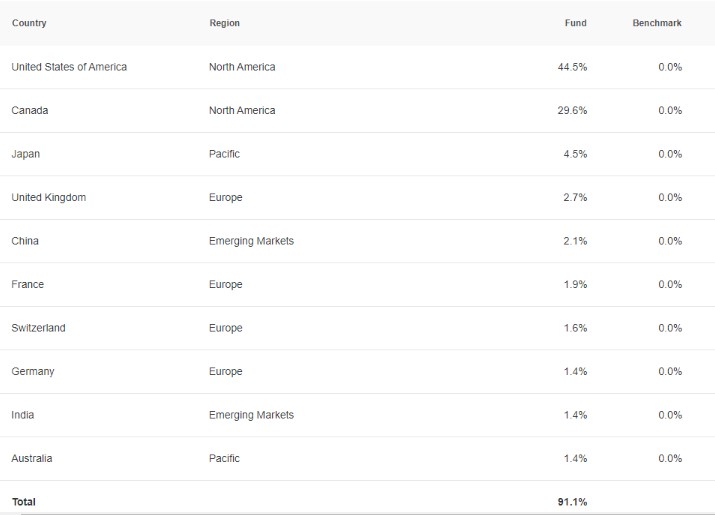

VBAL ETF Geographic Allocation

VBAL ETF offers risk management through global diversification to 50 countries. While VBAL primarily consists of North American stocks and bonds, it has some geographical diversification. Here are the top 10:

Source: www.vanguard.ca

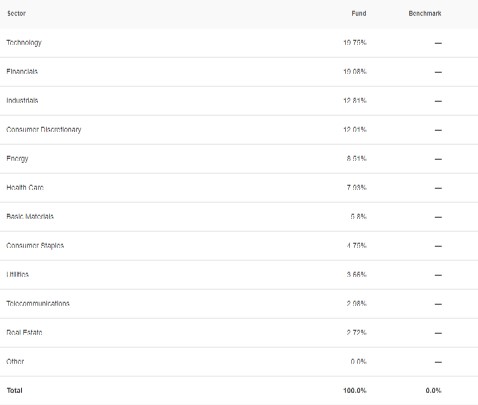

VBAL ETF Sector Allocation

Savvy investors look for not only geographical diversification but also diversification across sectors. VBAL ETF has a portfolio that is well-diversified across several industries. Here is the sector allocation of VBAL, with the major being Financials and the least being Telecommunication:

Source: www.vanguard.ca

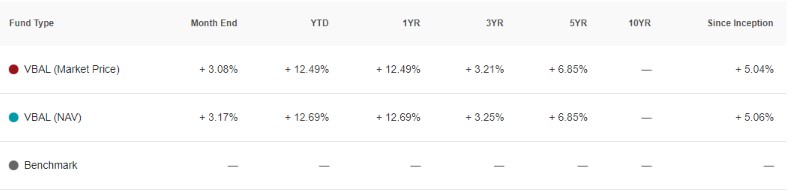

VBAL ETF Return/Performance

Gauging the performance of new portfolio ETFs is tricky because they’ve been around for only a few years and launched shortly before the induced tailspin from the pandemic.

As a 3-year-old ETF, VBAL has had 17.44% returns in 1 year, 27.01% in three years, and cumulative returns of 13.89% since inception (January 25, 2018).

That’s to say, VBAL is growing speedily compared to its competitors.

Source: www.vanguard.ca

VGRO ETF Fees

ETFs offer a good way to reduce your fees, and All-in-One ETFs are even better. VBAL has two fees: Management fee and Management Expense Ratio (MER). These are charged as follows:

- Management Fee: 0.22%

- MER: 0.24%.

From the above, you know that VBAL has low fees compared to mutual funds and Robo-advisors, who charge up to 2% on fees. You could save a lot of money in management fees by choosing VBAL ETF.

VBAL Stock Eligibility

Here are the seven eligible investment vehicles VBAL can be invested in:

- RRSP

- RRIF

- RESP

- TFSA

- DPSP

- RDSP

- Non-registered accounts

With these multiple options, VBAL got you covered in all your investment needs.

How to Buy VBAL Stock?

VBAL is an excellent choice for a wide range of investors. However, it may not be suitable for everyone. After using VBAL for over a year, I can confidently say that it is particularly well-suited for investors seeking an All-in-One ETF portfolio that provides balanced exposure to both stocks and bonds.

It is especially beneficial for those who desire a less risky and less aggressive portfolio with automatic rebalancing capabilities, while still aiming for long-term capital growth and income.

When purchasing VBAL stock, several options are available, each with its own merits. However, my preferred method for acquiring All-in-One ETFs like VBAL is through zero-commission online brokers.

In Canada, two prominent zero-commission online brokers have gained widespread recognition: Wealthsimple Trade and Questrade. Wealthsimple Trade stands out as the country’s first and only brokerage to offer fee-free trades on all types of transactions, whether they involve stocks or bonds.

Personally, I find Wealthsimple Trade an excellent choice due to its zero-commission policy on all trades. If you’re interested in utilizing Wealthsimple Trade, you can easily open your account by following this link.

That being said, opting for Questrade is also a viable option. You can open your Questrade account by following this link. While Questrade doesn’t charge fees for purchasing stocks, there is a fee ranging from $4.95 to $9.95 for selling stocks.

Is VBAL ETF Safe?

VBAL ETF is less aggressive than VGRO or VEQT; it suffers less volatility during market downturns. With a long-term mindset, you should invest in VBAL and be ready to see your portfolio move up and down the charts.

Volatility is expected from any portfolio with heavy weightings in stocks, and VBAL is no exception. VBAL is a good investment if it matches your risk tolerance and returns expectations.

Based on my experience, VBAL is one of the safest stocks in the industry because it is less risky and less aggressive.

Note: This information is based on my personal experience and the findings of this VBAL review. I can’t guarantee the future safety of VBAL.

VBAL ETF vs XBAL Stock

iShares Core Balanced ETF Portfolio (XBAL) is one of VBAL’s top competitors. iShare’s XBAL has similarities with Vanguard Canada’s VBAL in many ways.

For example, both ETFs share a similar investment objective of providing long-term capital growth and income to investors by investing heavily in stocks and bonds. They also have equal investment allocation of 60% to stock and 40% to bonds.

However, the two ETFs have some differences. XBAL has a relatively low management fee (0.18%) and MER (0.20%) compared to VBAL’s relatively higher management fee (0.22%) and MER (0.24%).

Also, VBAL has a relatively higher distribution yield (2.14%) than XBAL’s somewhat lower distribution yield (1.99%).

Overall, both ETFs are great by what they offer, and you can’t make the wrong choice investing with any of them due to their low-medium risk indicator.

Final Thoughts on VBAL Review

This VBAL review shows why it’s a favourite investment vehicle for Canadian investors and many worldwide investors. Within just three years of existence, VBAL has performed admirably compared to its competitors.

To make this VBAL ETF review unbiased, I highlighted the major characteristics of both VBAL and XBAL to help you make an informed decision.

Even though XBAL tends to have the top characteristics at the moment, from my story, you have learned not to give up on any ETF because of its current performance.

Instead, you should focus on the portfolio characteristics and invest through a zero-commission online broker. By doing so, you will be able to make a cost-effective decision in the long run.

FAQs on VBAL Review

Is VBAL ETF a Good Investment?

Based on my experience, VBAL is a good investment for those looking for long-term capital growth and income with minimum risk.

Is VBAL ETF risky?

Like any other investment vehicle, VBAL stock is not immune to risk.

However, VBAL is less risky and less aggressive because of its balanced allocation of stocks and bonds. This makes it suitable for both novice and experienced investors.

However, to trade VBAL safely, you must be comfortable with market fluctuations due to its heavy stock allocation.

What is the Vanguard Balanced ETF Portfolio stock symbol?

The Vanguard Balanced ETF Portfolio symbol used to trade on Toronto Stock Exchange is VBAL.

What is the Vanguard Balanced ETF Portfolio stock price?

As of January 16, 2024, Vanguard Balanced ETF Portfolio (VBAL) stock price is $28.08. However, this is subject to change from time to time.