If you’re looking for an alternative investment vehicle, VGRO may be just what you’re looking for. As one of the best ETFs in Canada, VGRO is a well-diversified All-in-One ETF portfolio that serves the long-term investment objectives of both new and seasoned investors in Canada.

VGRO provides a low-cost alternative to costly mutual funds for managing your money. It offers a clean 80/20 stock so investors can split high-performing equities and bonds. It has gained popularity over the 60/40 split with its 80/20 split.

Based on my over 2-year experience with VGRO, I keep counting more reasons to sustain my investment with VGRO EFT. VGRO keeps up with investment trends in a way that mitigates risk.

However, since everyone has a different financial situation and investment objective, it is essential to know the two sides of VGRO: the good and the ugly. You will learn about all of this from my experience.

As you continue reading this VGRO review, you will learn about VGRO ETF, its pros and cons, and whether or not it’s the right investment vehicle for you.

Here we go!

VGRO ETF Summary

The Vanguard Group, one of the world’s biggest stock and fixed-income managers, manages the Vanguard Growth ETF Portfolio (VGRO). VGRO was launched in January 2018 and is part of a growing wave of ETFs that offer a simplified all-in-one investment solution.

VGRO offers a low-cost and super simple platform. It currently trades at around $27.08. If you own VGRO shares, you won’t bother about rebalancing. VGRO has a low to medium risk rating and trades on the Toronto Stock Exchange under the “VGRO” ticker symbol.

Of all the five significant ETF portfolios of Vanguard Canada, only VGRO and Vanguard Conservative Income ETF Portfolio (VCIP) have high exposure to equities with low weighting on fixed-income securities.

VGRO is a diverse Vanguard All-in-One ETF, made up of various ETFs in a single package. It is globally diversified across sectors and seeks 80% equity and 20% fixed income. No rebalancing is needed for low-medium risk portfolios, as VGRO is already balanced. It is a low-cost investment platform that offers broad international exposure, making it less risky compared to mutual funds and Robo-advisors.

- Low management fee

- Ease of use and possession

- All-in-one global diversification in one neat package

- Tax benefits (such as on TFSA and RRSP)

- High liquidity

- Hands-free portfolio management – no need to rebalance

- Growing trading commissions (i.e., you trade with a commission-based broker)

- Fees are a bit higher than some competitors

- More inclined to the Canadian market.

- You can save more money by buying individual ETFs.

What is VGRO ETF?

VGRO is a Vanguard All-in-One ETF, which implies that it contains a variety of various ETFs in a single package. VGRO is well-diversified both internationally and across different sectors.

Traded on the Toronto Stock Exchange (TSX), VGRO comprises many other Vanguard Index ETFs and seeks to invest in approximately 80% equity and 20% fixed income.

You don’t need to rebalance your VGRO portfolio with a low to medium-risk indicator. Your portfolio is already balanced because each unit is balanced.

VGRO, like most all-in-one exchange-traded funds, is well-diversified. This is a great benefit because broad international exposure reduces investment risks. Additionally, VGRO is a low-cost investing platform as opposed to mutual funds and Robo-advisors.

Key Facts about VGRO ETF

- VGRO Stock Price: $29.88

- Inception date: January 25, 2018

- Management Fee: 0.22%

- Distribution yield: 0

- Management Expense Ratio (MER): 0.24%

- Net assets: $3.355 billion

- 12-month trailing yield: 0

- Eligible accounts: RRSP, RRIF, RESP, TFSA, DPSP, RDSP, non-registered accounts

- Listing currency: CAD

- Asset Allocation: 80% equity and 20% fixed income

- Average Annual Return: 81%

Pros of VGRO ETFs

- Low management fee

- Ease of use and possession

- All-in-one global diversification in one neat package

- Tax benefits (such as on TFSA and RRSP)

- High liquidity

- Hands-free portfolio management – no need to rebalance

However, like other ETF portfolios, VGRO has some drawbacks, which I also experienced. Let’s take a look:

Cons of VGRO ETFs

- Growing trading commissions (i.e., you trade with a commission-based broker)

- Fees are a bit higher than some competitors

- More inclined to the Canadian market.

- You can save more money by buying individual ETFs.

VGRO Asset Allocation

VGRO seeks to invest in approximately 80% equity and 20% fixed income. Hence, VGRO has the following asset allocation:

- Stocks – 80.46%

- Bonds – 29.50%

- Short-term reserves – 0.04%

You don’t have to think about rebalancing your portfolio with VGRO asset allocation because it is handled automatically. This is a big plus as most people don’t have the time, interest, or knowledge to rebalance their asset allocation by themselves.

Here are the seven VGRO allocations to underlying Vanguard funds as of January 2024:

ETF | Allocation |

Vanguard US Aggregate Bond Index ETF CAD-hedged | 3.82% |

Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged | 4.04% |

Vanguard FTSE Emerging Markets All Cap Index ETF | 5.66% |

Vanguard Canadian Aggregate Bond Index ETF | 11.65% |

Vanguard FTSE Developed All Cap ex North America Index ETF | 16.28% |

Vanguard FTSE Canada All Cap Index ETF | 23.82% |

Vanguard US Total Market Index ETF | 34.73% |

Source: Vanguard.ca

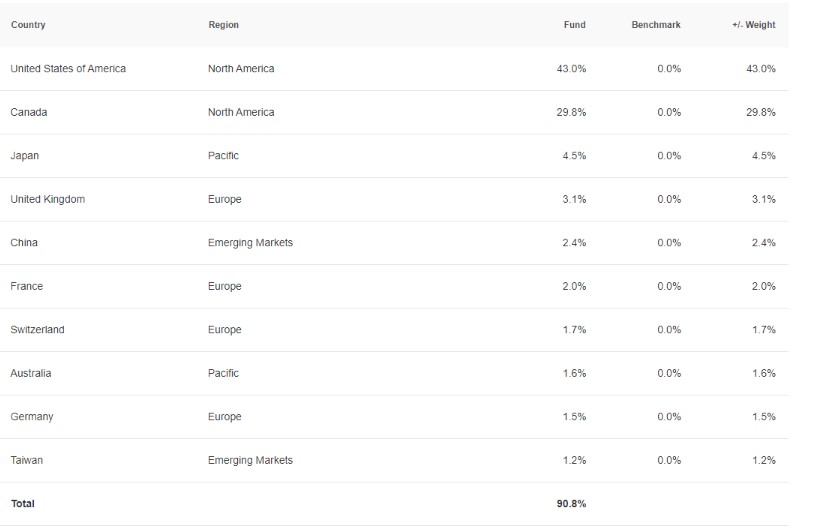

VGRO Market Allocation

VGRO ETF is also globally diversified with its top 10 market allocation for equities. The United States and Canada are the most weighting countries, and the remainder is split over the other countries.

Source: Vanguard.ca

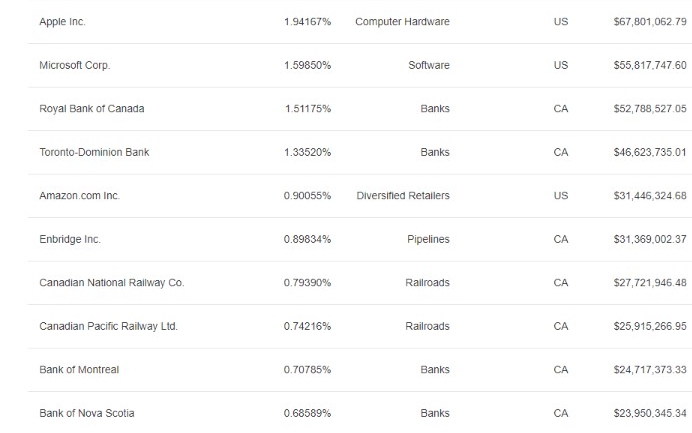

VGRO Holdings

VGRO holds and will continue to hold many large companies around the world. The top ten holdings comprise leading blue-chip companies in the United States and Canada.

VGRO has a total of 12819 holdings. Here are the top ten holdings:

Source: Vanguard.ca

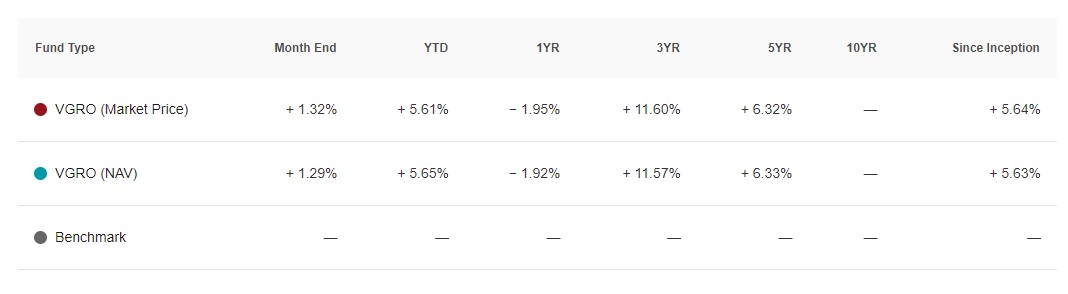

VGRO Returns/Performance

How has the VGRO stock performed since its inception? VGRO All-in-One portfolio is relatively new and has returned

The cumulative growth of VGRO from inception (January 2018) to September 2022 is $10,000. The following is a display of one month to three years’ return.

Source: Vanguard.ca

VGRO Fees

VGRO ETF fees are much lower than many actively managed funds or robo-advisors. As an investor, it is good to understand how the fees are calculated.

VGRO fees are categorized into two:

- Management fee: 0.22%

- MER: 0.24%.

With VGRO ETF, the MER includes the management fee. It is annually charged as a percentage of your investment in the ETF. The payment is automatic, and you might not notice.

If you invest $10,000 in VGRO, you will only pay an MER of $24 annually. This is much lower than what you would pay for a Canadian equity mutual fund which would charge around 2.5%, or a robo-advisor, which would charge about 0.70%.

Compared to individual ETFs, the MER is higher. However, I’m okay with it because my portfolio is automatically rebalanced and lower than mutual funds and Robo-advisors.

VGRO ETF Investment Accounts for Canada

You can invest with VGRO ETF on eight investment vehicles as follows:

- TFSA

- RRSP

- RRIF

- RESP

- RDSP

- DPSP

- Non-registered

Anything beyond or less than the above is unqualified for VGRO investment.

How To Buy VGRO ETF?

VGRO is an exchange-traded fund; anyone can buy it on the stock market. However, this ETF portfolio is most suitable for investors seeking long-term capital growth, those looking for global and diversified diversification across different sectors, and people who can stand the ups and downs of the stock market.

If you are one of the above categories, congratulations, VGRO is for you! If you already have a VGRO account with an online brokerage, you can buy VGRO ETF.

First, log in and select the account you want to purchase from. Remember to use a registered account so you can save on tax later. You can easily buy Vanguard All-in-One ETF with your registered account.

Once you select the account, go to the buy ETF section, enter the ticker symbol “VGRO”, and input the number of shares you want to buy. If you are unsure how many shares your money can get, you can easily use the dollar-to-share calculator.

Once you have decided on how many shares to buy, you can finalize your order by selecting “Market Order” and submitting. You can preview your order on the next page, and if everything looks good, go ahead and place your order, and you are ready to go.

Questrade and Wealthsimple Trade are two great options for buying VGRO ETFs. Questrade is one of the major online discount brokerages in Canada. With a different range of multiple investment vehicles such as stocks, bonds, mutual ETFs, mutual funds, etc., Questrade got you covered on your VGRO investment.

Although you’re charged anything from $4.95 – $9.95 when you sell, you can buy ETFs free of charge on Questrade. All you need is to create a free Questrade account, deposit a minimum of $1000 and begin trading with a 50% bonus.

If you’re uncomfortable with Questrade, you can use Wealthsimple Trade, the only brokerage in Canada with zero commission on any trade.

One thing I like about Wealthsimple Trade is that you can open an account and start trading for as low as $1.

VGRO vs XGRO

The truth is that these two great ETF portfolios have similarities, such as similar investment objectives and a wide range of diversification.

However, the two have some differences. iShares Core Growth ETF Portfolio (XGRO), which Blackrock manages, has a relatively lower MER (0.20%) vs. Vanguard VGRO MER (0.25%)

Also, iShares Core Growth ETF Portfolio (XGRO) has a relatively low management fee (0.18%) vs. Vanguard VGRO (0.22%).

Also, VGRO has a home bias because it is more inclined to the Canadian market, while XGRO is more inclined to the US market.

Even though it’s hard to identify which is the best among these two great ETFs, at least now you know their similarities and differences; it’s up to you to make a choice.

VGRO All-in-One ETF vs Individual Holdings: Which is Better?

If you’re considering going the DIY path to save cost, you can invest in any of the VGRO’s underlying ETFs. Comparably, purchasing an individual ETF is less expensive than buying an All-in-One ETF.

Also, paying a small fee to avoid rebalancing can be worthwhile as it can quickly add up over time and impact your portfolio growth.

The MER of VGRO all-in-one is 0.25%, and the MER of VGRO underlying ETFs with a similar allocation is just 0.16%. This implies that for every $10,000 you invest, you save $9 annually.

Although it may not sound like much, your fees increase as the portfolio becomes larger.

Moreover, a popular investing strategy minimises risk as the investment period draws close. Investors usually raise their bond holdings when they near retirement to mitigate volatility risk.

Final Thoughts on VGRO Review

Now you can dictate that my VGRO review is positive. It’s so because its performance, MER, management fee, asset allocation, and stock price are consistent with its investment objective.

Besides being a low-cost alternative to mutual funds and Robo-advisors, VGRO is also easy to use for purchase for both new and seasoned investors.

However, since the VGRO all-in-one ETF is relatively costly in management fee compared to underlying VGRO individual holdings… you can begin with an individual ETF and later upgrade to the all-in-one ETF.

Also, you can purchase XGRO ETF, which has some appealing differences from VGRO. However, the choice is yours!

FAQs on VGRO ETF Review

Is VGRO a Good ETF?

Yes. This is especially because of its ease of use, low MER, low management, and low-medium risk indicator.

Is VGRO Tax Efficient?

Yes. VGRO is tax-efficient if you invest in one of its tax-free eligible accounts, such as TFSA and RRSP, without contributing more than expected.

How Much Money Does Vanguard Growth ETF Portfolio Make?

The total of Vanguard Growth ETF Portfolio assets under management (AUM) is $2.4 billion.