Are you seeking an investment vehicle with long-term capital appreciation while limiting risk exposure? Do you want an all-in-one ETF portfolio that provides long-term capital appreciation to investors through equity and fixed-income allocations?

As someone who prefers the ease and simplicity of ETFs, I was excited to discover ZGRO. This fund offers geographical diversification with holdings in Europe, North America, Asia, and beyond.

In this ZGRO review, I will comprehensively analyse BMO Growth ETF (ZGRO), including its equity and fixed-income allocations, management fees, performance, and pros and cons.

I will also compare it with other similar ETFs available in Canada to help you make an informed investment decision.

So, if you want to diversify your portfolio with an all-in-one ETF that offers geographical diversification and long-term capital appreciation, read on to learn more about ZGRO.

The BMO Growth ETF (ZGRO) is an all-in-one ETF portfolio that offers long-term capital appreciation to investors. Its equity and fixed-income allocations are heavily weighted in equities (80%) and fixed-income assets (20%). With a low-medium risk rating, it is traded on the Toronto Stock Exchange as "ZGRO" and has management fees of 0.18%, limited by expenses incurred through the underlying. ZGRO provides geographical diversification, with holdings in Europe, North America, Asia, and other regions.

BMO Growth ETF (ZGRO): A Brief Overview

BMO Growth ETF (ZGRO) is one of four All-in-One ETFs of the Bank of Montreal (BMO) ETF Portfolios launched on February 15, 2019.

With more than 130 ETFs, BMO gives investors the flexibility they need to stay on top of their investment in Canada, depending on their financial objectives and risk tolerance.

Of the four All-in-One ETFs of BMO, only ZGRO has more allocation on equity and less on fixed come (bonds). They are all managed by BMO Asset Management Inc., and you can purchase them using a discount brokerage account.

ETF Asset Allocation BMO Growth ETF (ZGRO) 80% equity and 20% bonds BMO Balanced ETF (ZBAL) 60% equity and 40% bonds BMO Conservative ETF (ZCON) 60% bonds and 40% equity BMO Balanced ESG ETF (ZESG) 60% equity and 40% bonds

Source: www.bmogam.com

What is ZGRO?

BMO Growth ETF (ZGRO) is an all-in-one ETF portfolio that provides long-term capital appreciation to investors through equity and fixed-income allocations. It is heavily weighted in equities (80%), and its remainder is fixed income assets (20%).

As a fund of funds, ZGRO management fees (0.18%) are limited by the expenses incurred through the underlying. It holds a low-medium risk rating and is traded on the Toronto Stock Exchange under the “ZGRO” ticker symbol.

Also, ZGRO gives you geographical diversification, with holdings in Europe, North America, Asia, and beyond.

Key Facts about ZGRO (January 16, 2024)

- Inception Date: February 15, 2019

- Minimum Investment: $38.80

- Annual Management Fee: 0.18%

- Management Expense Ratio (MER): 0.20%

- Rebalancing Frequency: Quarterly

- Listing Currency: CAD

- Asset Allocation: 80% equity and 20% fixed income·

- Annualised Distribution Yield: 2.51%

- Account Eligibility: RRSP, TFSA, RRIF, RESP, DPSP, Non-Registered

Benefits and Drawbacks of ZGRO

Like other All-in-One ETFs, ZGRO has its good and ugly sides. What are they? The following are the pros and cons of ZGRO ETF:

Pros

- Automatic quarterly rebalancing

- Low fund management fee

- Low MER

- Diversified portfolio

- Ease of use and convenience to buy

Cons

- Low returns compared to other ETFs.

- More inclined to the Canadian market.

As you can see, the good side of ZGRO overrides its ugly side, making it one of Canada’s best ETFs. But that’s enough to make a decision. Let’s dip down to it.

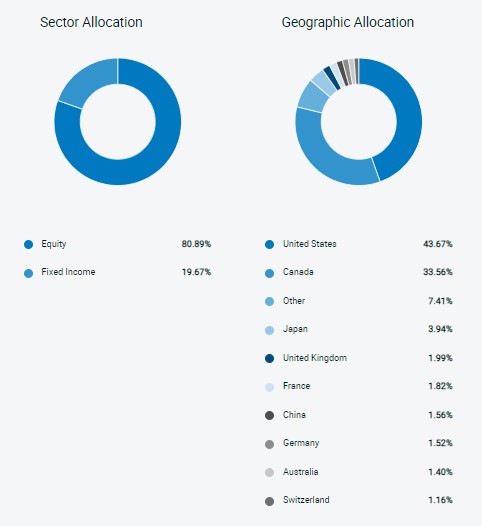

ZGRO Asset Allocation

ZGRO has the following asset allocation:

- Stock: 80.79%

- Fixed Income: 19.21%

- Cash and Cash Equivalents: 0.00%

Each asset allocation responds differently to market changes and economic activities based on their distinct characteristics.

By so doing, they all work together to provide investors with a diversified portfolio with the perfect combination of risk, security, yield, and growth.

ZGRO Holdings

ZGRO has ten holdings. It is automatically rebalanced quarterly to achieve an optimal balance for its 80/20 weighting and ensure that only top-performing assets are included in its portfolio.

Also, ZGRO pays out its distribution quarterly. You can take out in cash or reinvest automatically.

Source: www.bmogam.com

The above ETFs offer global diversification through investing in Canadian, the US, and other foreign stocks and bonds.

Let’s take a broader view of ZGRO geographic allocation.

ZGRO Geographic Allocation

In addition to its excellent asset allocation diversification in various sectors represented within ZGRO’s holdings, ZGRO also offers solid geographical diversification.

This offers you shelter from potential losses you can incur if you invest in one geographic area. ZGRO has the following geographic allocation:

Source: www.bmogam.com

Let’s look at the return of ZGRO right from inception.

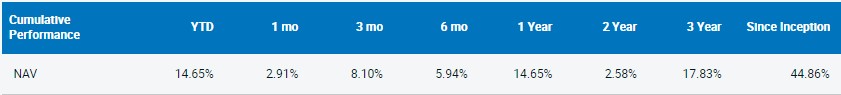

ZGRO Return/Performance

As a new ETF in the market, the historical performance of ZGRO is limited. Based on the current performance of ZGRO and understanding that ETFs generally have a solid track record, this investment will pay off in the long run.

Since 2019, ZGRO has produced gains, even when the world was in economic trouble. However, it has had 18.82% cumulative performance since its inception.

Source: www.bmogam.com

It is important to note that even though an investment asset’s history performance can provide insight into its potential, it is just one of many factors to consider.

When looking for a proper view of the performance of an ETF, I explore the ETFs’ constituents and examine their overall performance.

ZGRO Fees

Regarding fees, ZGRO is a top alternative compared to mutual funds. Here are the two major fees of ETFs:

- Annual Management Fee: 0.18%

- Management Expense Ratio (MER): 0.20%

With this low management and MER fee, you have the potential to invest more and yield more returns. I am a living witness.

How To Buy ZGRO ETF in Canada

ZGRO ETF is not restricted to a specific class of investors in Canada. While everyone is guaranteed to buy this ETF, it’s more suitable for investors looking for long-term capital growth, those who want global exposure to a diversified portfolio of fixed income and equity ETFs and those looking for a moderate income.

Once you’ve confirmed that your investment objective, risk tolerance, and time horizon align with ZGRO, you can safely buy the ETF.

If you want to invest in ZGRO ETF, look no further. Canada’s two most popular brokerage platforms offer ZGRO ETF at zero commission.

- Questrade: Questrade is a well-known brokerage platform in Canada, offering a wide range of investment assets, including stocks, ETFs, and mutual funds. With Questrade, you can purchase ZSP ETFs without any commission fees, although you will be charged $4.95 for selling your ETFs. One of the platform’s advantages is its user-friendly interface on desktop and mobile devices.

Questrade is an online discount brokerage established in 1999 with a $25 billion asset under management. Its popularity in Canada lies in its low commission, low trading fees, and multiple ranges of accounts. As a result, both beginners, intermediate and seasoned investors in Canada find Questrade attractive for DIY and active management investing. Key Features

- Wealthsimple Trade: Wealthsimple Trade is a well-known finance platform in Canada, especially popular among the younger generation. You can purchase and sell ZSP ETF in Canada without any commission fees through Wealthsimple Trade.

Wealthsimple Trade is a great trading platform that offers commission-free buying and selling of thousands of stocks. Its user-friendly interface and mobile-optimized investing dashboard make it easy to navigate and accept various payment methods, such as bank transfers and debit cards. In addition to traditional online stock trades, Wealthsimple Trade allows you to engage in other investment activities. It supports both taxable and registered (non-taxable) accounts such as RRSP and TFSA, and there is no minimum balance requirement when opening an account, making it accessible for investors with little money.

On the other hand, if you’re looking for a hands-on method of buying ZGRO ETF, you may need to consult a Robo-advisor. A Robo-advisor will help you build a low-cost ETF portfolio that will rebalance automatically as you fund it or as your portfolio derails from its target allocation.

With Robo-advisor, fees may be expensive compared to the fees of zero-commission online brokerages, but it’s worth it.

VGRO Vs ZGRO

ZGRO and VGRO are all-in-one ETFs that provide investors with a diversified portfolio of equity and fixed-income assets. However, they have some differences in their allocation and fees.

ZGRO has a more significant allocation to equities, with 80% of its assets in equity holdings and 20% in fixed-income holdings. On the other hand, VGRO has a 60% allocation to equities and 40% to fixed-income holdings.

In terms of management fees, ZGRO has a lower expense ratio of 0.18%, while VGRO has an expense ratio of 0.25%.

Those seeking a more aggressive strategy may prefer ZGRO’s higher allocation to equities, while those seeking a more balanced approach may prefer VGRO’s more significant fixed-income allocation.

RELATED: VGRO

Final Thoughts on ZGRO ETF Review

Investing in ETFs can be a smart and straightforward way to build wealth over time. BMO Growth ETF (ZGRO) is an excellent option for those seeking long-term capital appreciation through equity and fixed-income allocations. With its low management fees, geographic diversification, and balanced asset allocation,

If you’re new to investing or just looking for a hands-off approach, ZGRO might be a great option to consider. But remember, it’s always important to do your own research and understand your investment goals and risk tolerance.

So, what are you waiting for? Start investing today!

FAQs on ZGRO Review

How risky is ZGRO?

As of the time of writing this review, ZGRO has a low to medium risk rating. However, this is subject to change. It is important to note that every investment vehicle has its benefits and risks.

But the risk doesn’t necessarily mean bad investment. It only means you can lose money through the investment, especially with poor strategy and unsuitable investment.

Is ZGRO a Good ETF?

Yes, based on my personal experience. ZGRO is a good ETF because it gives you access to a low-cost portfolio of well-diversified assets based on your risk tolerance and investment objective.

How often does ZGRO rebalance?

ZGRO is rebalanced every quarter by BMO Global Asset Management’s investment fund manager.