Motusbank is a modern digital bank offering Canadians a wide range of financial products and services. Founded in 2019, Motusbank is a subsidiary of Meridian Credit Union, one of the largest credit unions in Canada, with over 75 years of experience in the financial industry.

The online-only bank offers a full suite of banking products, including savings and chequing accounts, mortgages, loans, and credit cards. The bank also provides innovative digital tools and features that make banking easier, such as mobile banking apps, online account opening, and instant approval for credit products.

So if you are considering opening an account with Motusbank, this comprehensive Motusbank review will provide you with valuable insights into what the bank has to offer, the pros and cons, and help you make an informed decision about your banking needs.

Let’s dive in.

Pros

- Motusbank offers 1% on its savings account

- No transaction fees on its savings and chequing accounts

- You can automate your savings on Motusbank

- Offers a wide range of banking solutions

- Your deposits up to $100,000 per separate deposit is insured by the CDIC

Cons

- Motusbank does not offer credit cards at the moment

- There is no physical branch.

An Overview of Motusbank

Motusbank is a federally chartered online-only bank owned by the Meridian Credit Union, Ontario’s largest credit union and the third largest in Canada, with over $20.6 billion in assets under management and over 227,000 members.

Motusbank offers low-cost banking solutions like other digital banks due to its low operation cost. The digital bank competes directly with other online-only banks in Canada, like Tangerine, EQ bank, and Simplii Financial.

The bank is fully digital and does not have any physical locations. You must conduct all your banking online and call their customer support service when required. However, the bank is a Canada Deposit Insurance Corporation (CDIC) member, so there’s nothing to worry about.

Despite being a new digital bank established in 2019, Motusbank has competitive all-around banking solutions, including no-fee chequing accounts, high-interest savings accounts, mortgages, personal loans, lines of credit, and investment products.

Is Motusbank Safe & Legit?

Yes. Motusbank is absolutely safe and legit. Motusbank is registered with the Canada Deposit Insurance Corporation (CDIC), which insures your deposit of up to $100,000 per separate deposit.

Also, Motusbank’s parent company, Meridian Credit Union, has existed for over 75 years and is Ontario’s largest credit union and Canada’s 3rd-largest credit union.

Furthermore, Motusbank uses advanced encryption to protect your personal information and card details against fraudsters. This means you have nothing to worry about using motusbank.

Motusbank Products

Motusbank offers registered and unregistered accounts, ranging from savings, chequing, TFSA, RRSP, RRIF, and GIC accounts. Let’s take a look at them one after the other.

1. Motusbank Mortgages

Whether you’re refinancing or buying a new home, Motusbank got you covered with the following competitive mortgage rates:

- 1-year fixed mortgage = 5.81%

- 2-year fixed mortgage = 6.44%

- 3-year fixed mortgage= 6.43%

- 4-year fixed mortgage = 6.22%

- 5-year variable mortgage= 8.47%

- 6-month convertible fixed mortgage = 6.79%

2. Motusbank GICs

If you’re looking for guaranteed returns on your investment, Motusbank Guaranteed Income Certificate (GIC) has competitive interest rates as follows:

Long-Term Non-Redeemable GICs | Interest Rates |

GICs | ● 1-year GIC = 4.65% ● 18-month GIC = 4.55% ● 2-year GIC = 4.30% ● 3-year GIC = 4.20% ● 4-year GIC = 4.15% ● 5-year GIC = 4.05% |

RRSP | ● 1-year RRSP GIC = 4.70% ● 18-month RRSP GIC = 4.60% ● 2-year RRSP GIC = 4.35% ● 3-year RRSP GIC = 4.25% ● 4-year RRSP GIC = 4.20% ● 5-year RRSP GIC = 4.10% |

TFSA | ● 1-year TFSA GIC = 4.70% ● 18-month TFSA GIC = 4.60% ● 2-year TFSA GIC = 4.35% ● 3-year TFSA GIC = 4.25% ● 4-year TFSA GIC = 4.20% ● 5-year TFSA GIC = 4.10% |

RRIF | ● 1-year RRIF GIC = 4.70% ● 18-month RRIF GIC = 4.60% ● 2-year RRIF GIC = 4.35% ● 3-year RRIF GIC = 4.25% ● 4-year RRIF GIC = 4.20% ● 5-year RRIF GIC = 4.10% |

The bank also has short-term non-redeemable and escalator GIC rates. Check them out here.

3. Motusbank No-Fee Chequing Account

Motusbank offers a no-fee chequing account with no Interac e-Transfer transfer fee and minimum balance requirement.

The no-fee chequing account has 0.15% interest rates with 25 free cheques on the first order. This is in addition to the unlimited bill payments, debit purchases and withdrawals.

Furthermore, the no-fee chequing account has direct deposit options with mobile cheque deposits.

4. Motusbank Savings accounts

The Motusbank savings account offers a 1% interest rate, which is high compared to banks and other digital banks.

However, you can open a single or joint savings account on Motusbank, so long as you’re a Canadian resident who has reached the age of majority with a valid email address.

Like the chequing account, the Motusbank savings account has no monthly fee and minimum balance requirements.

The savings account has unlimited debit purchases and free ATM withdrawals with The Exchange Network in the Allpoint Network in Canada and the US.

Motusbank also offers competitive rates on the following registered savings accounts.

- TFSA Savings Account: This account allows you to deposit and withdraw your money tax-free. Interest and dividends in a TFSA savings account are not taxable. The contribution limit varies annually, but you can deposit up to $6,000 in your TFSA savings account this year. Motusbank offers 2.25% introductory interest rates on its TFSA savings account and 1.25% afterward.

- RRSP Savings Account: This registered account is designed for retirement savings. Unlike TFSA, deposits and earnings on RRSP are not taxable, but withdrawals are taxable. You must convert your RRSP to RRIF by December 31 of the year you reach the age of 71. Motusbank RRSP savings account offers a 1% starting interest rate with no monthly fees.

RECOMMENDED: TFSA vs RRSP: Which to Choose?

5. Motusbank Personal Loans and Lines of Credit

This online-only bank offers competitive personal loans and lines of credit. You can get up to $35,000 in personal loans with 1 to 5-year terms.

Furthermore, you can receive a personal line of credit, secured line of credit or home equity line of credit (HELOC) with a 7.20% interest rate.

However, $5,000 is the minimum loan amount for Motusbank. The application process is hassle-free, and you can get quick approval once you qualify.

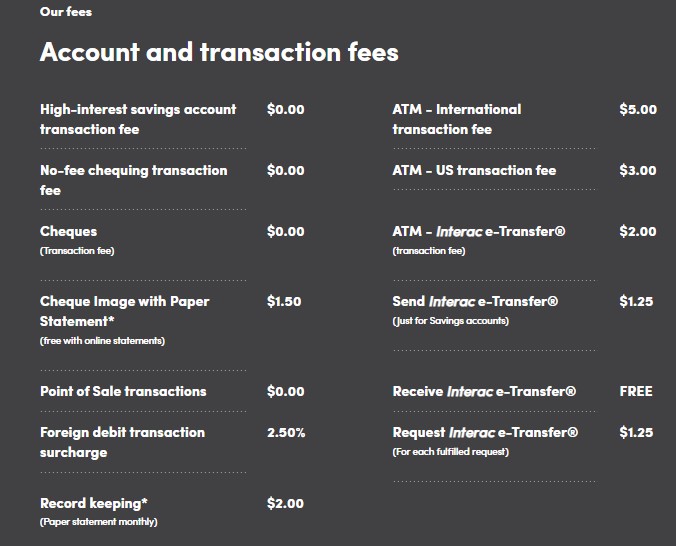

Motusbank Fees

As an online-only bank, Motusbank has a low operational cost, unlike brick-and-mortar banks. Hence, it offers free transactions on savings and chequing accounts.

The bank doesn’t also charge a fee on Point-of-Sale transactions and online cheque viewing. However, Motusbank charges the following banking fees:

Source: motusbank.ca

Motusbank vs EQ Bank

Motusbank and EQ Bank are modern digital banks offering Canadians innovative banking solutions. Motusbank is a subsidiary of Meridian Credit Union, whereas EQ Bank is a standalone digital bank. This means that Motusbank has the support and backing of a larger financial institution, while EQ Bank operates independently.

While EQ Bank offers high-interest savings accounts with no fees and no minimum balance requirements, Motusbank offers a tiered interest rate on its savings account, with higher rates for larger balances.

Motusbank offers a free account with no monthly fees, while EQ Bank does not offer a traditional chequing account. Motusbank also offers personal loans and lines of credit, while EQ Bank does not currently offer these products.

If you are looking for a digital bank with the support of a larger financial institution, Motusbank may be a good option for you. EQ Bank may be better if you prioritise high-interest savings accounts and flexible banking solutions.

Features | motusbank | EQ Bank |

Account Types | Chequing, Savings, TFSA, RRSP, RRIF | Savings, TFSA, RSP, GICs, |

Savings Interest Rate | 1% | 1.25% |

Interac transaction fee | Free | Free |

Account Minimum | None | None |

NSF Fee | $45.00 | None |

CDIC Insurance | Yes | Yes |

Final Thoughts on Motusbank Review

So if you are looking for a digital bank that offers competitive rates and innovative features, you should consider Motusbank. As a subsidiary of Meridian Credit Union, Motusbank provides a full range of banking products and services, all accessible from the comfort of your home.

From savings and chequing accounts to mortgages, loans, and investment products, Motusbank has got you covered. While it may not have a physical presence, its advanced security measures and CDIC insurance provide peace of mind to its customers.

Motusbank is a top choice for those seeking a modern and user-friendly banking experience. So why wait? Open an account with Motusbank today and start experiencing the future of banking!

FAQs on Motusbank Review

Is motusbank a Real Bank?

Absolutely. Motusbank is a real bank that functions the same way traditional banks do. Location is the only difference between motusbank and brick-and-mortar banks. While motusbank is entirely located online, brick-and-mortar banks have a physical presence.

Does Motusbank Have a Debit Card?

Yes. Motusbank issues debit cards to its savings and chequing account customers. However, it doesn’t issue credit cards.

How Safe is Motusbank?

Motusbank is absolutely safe because it’s owned and operated by Ontario’s largest credit union and Canada’s 2nd-largest credit union, Meridian Credit Union.

In addition to advanced encryption that protects your personal information and card details, your deposit of up to $100,000 per separate deposit is insured by the CDIC on motusbank.

When Did Motusbank Start?

Motusbank started operating in Canada on 2 April 2019 after being launched by the Meridian Credit Union.

Where is Meridian Credit Union Headquartered?

The Meridian Credit Union is headquartered in St. Catharines, Ontario, Canada.

Is Meridian a CDIC Member?

The Meridian Credit Union is not a member of the CDIC. However, the credit union is insured by the Financial Services Regulatory Authority of Ontario (FSRA).

Who is Meridian Owned By?

Meridian is owned by its members. As of the time of writing this motusbank review, Meridian has over 370,000 members.