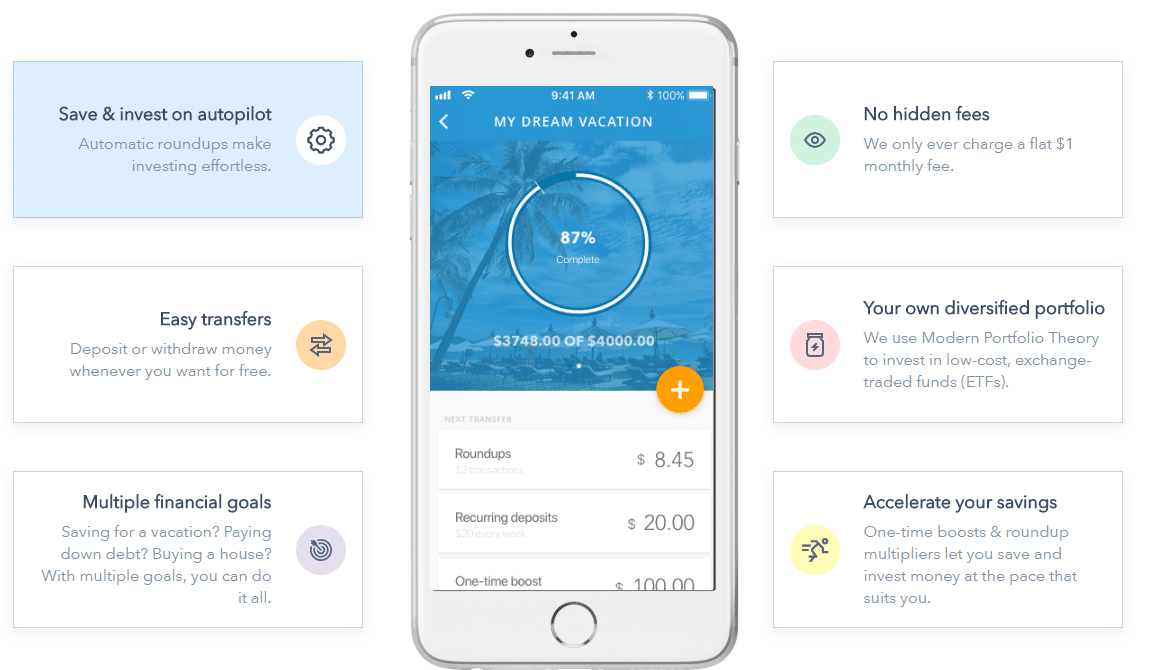

The Moka app (formerly called Mylo) is an investment platform designed to help Canadians manage their spending, save more, and invest wisely by using the extra dollars from their purchases. With Moka, you can invest as little as your spare change.

The app automates your savings and investments with minimal effort, making it easy with automated micro-investments that go straight into your account each time you make a purchase. Moka is the Canadian equivalent of Acorns and Digit in the U.S. and Moneybox in the U.K.

After using the Moka app for more than two years and saving hundreds of dollars through roundups, I decided to write this unbiased review to help you make an informed decision. This Moka review will cover what Moka offers, how it works, its pros and cons, fees, how to use it, and more.

What is Moka?

Moka Fnancial Technologies Inc. is a fintech company in Canada established by Phil Barrar in 2017. The Moka app is a software dedicated to assisting Canadians and their international users in attaining financial independence through investment and savings.

In Canada, the Moka app was the first goal-based investment and savings automated app, helping Canadians to invest their money and build their wealth quickly. This app automatically rounds up all of your purchases and invests the change.

There is no need for investing experience, and you are not expected to change your lifestyle. Moka teaches you how to convert your spending habits into saving habits.

Moka is a solution for practically everyone trying to improve their wealth due to its intuitive investment tools, investment automation, and $0 account minimums.

The app was formerly known as Mylo until it was rebranded to Moka in 2020 after spreading from Canada to Europe and France. The Moka app has been downloaded by over 750,000 Canadians and already has a 4.4/5 rating on the App Store.

Just recently, Moka announced that it’s joining forces with Mogo so as to reach out to more people and enhance its services.

How Does The Moka App Work?

The Moka App is aimed at making investment and savings simple and stress-free for all its clients. After you sign up, connect your bank account(s), set a savings goal, and your preferred method of funding, the Moka app helps you save small amounts of money.

Your lifestyle isn’t affected and you don’t have to deprive yourself of anything. The Moka app simply rounds up your purchases to the nearest dollar and saves the extra dollar difference.

For example, if you buy a cup of coffee for $3.25 with your credit card. The Moka app rounds up your purchase to $4.00 and saves the extra $0.75 in your Moka account. If you order that coffee everyday for one year, that’s $273.75 you have saved up. Your money would be automatically transferred from your chosen funding account to your Moka account.

On Mondays, roundups from your chequing account are withdrawn and invested into a Moka investment account. You can withdraw your money at any time.

The best part is the Moka also gives you the option of adding a Multiplier which you can use to increase your savings for every purchase you make with precisely zero efforts from you.

Features of The Moka App

Though Moka is not a robo-advisor or a DIY trading platform, it offers some amazing features for its investors.

1. Moka Investing Portfolios

Your Moka savings may be invested in a TFSA, RRSP, or non-registered account.

Your spare change is invested in ETFs’ diversified portfolio automatically, so you don’t have to do anything but relax and watch your savings rise.

Based on the amount of risk you choose to take, Moka has five different portfolio options as follows:

Portfolio | Allocation |

Conservative | 100% Money Market ETF fund |

Conservative – Moderate | Moderate – 40% Money Market ETF fund, 60% Fixed Income ETF Fund |

Moderate | 60% Fixed Income ETF Fund, 40% Equity ETF Fund |

Moderate – Aggressive | 40% Fixed Income ETF Fund, 60% Equity ETF Fund |

Aggressive | 20% Fixed Income ETF Fund, 80% Equity ETF Fund |

Moka’s Financial Technologies’ subsidiary, Tactex Asset Management, is in-charge in investing your money and managing your portfolio.

Note: Moka also provides a socially responsible investing (SRI) portfolio that invests in businesses that are working to make the world a better place by complying with environmental, social, and corporate governance guidelines.

2. Moka Goals

Moka would require you to set a savings goal before you start your savings or investment. This is fantastic because everyone needs to set financial targets.

Moka makes it easy to set your savings goals. But you need to consider the purpose of your savings, the amount you want to save, the type of account that suits your needs (you can choose from TFSA, RRSP or unregistered accounts), and the timeframe of your goal.

You can even create as many savings goals as you want and edit them at any point. Once you are done with setting your savings goal(s), you can begin funding immediately.

Moka Funding Options

Moka has three options for funding as follows:

1. Roundups

Roundups are Moka’s brilliant way of helping you save money conveniently, even with your spare change.

With this type of funding, anytime you make a purchase, the amount is rounded up to the nearest dollar. The extra change is deposited in your account. The amount may not be significant, and you may not even be aware that it has been deducted from your account.

Therefore, if you think the roundups are taking so long, you can use the multiplier method to boost the speed of achieving your goals.

2. One-Time Investments

With Moka one-time deposits, you can conveniently deposit a lump sum amount to your account. This funding option helps you to save money prior to spending, allowing you to expand your investment more quickly.

All you need to do is to visit the Moka app, click your goal, and then tap the “Add funds” button to make a one-time deposit of any amount you want.

3. Recurring Deposits

Recurring deposits help you achieve your targets quicker by making a recurring deposit of a specific amount, such as a $10 deposit every week.

Every week, Moka would automatically withdraw the money and transfer it to your Moka account.

If you are interested in this kind of funding, you need to set your recurring deposit goals and choose the funding rules that best suit your needs.

Moka Fees

Moka fees are surprisingly affordable. With all its amazing features, it only charges users a monthly fee of $7.99 plus tax.

Plan | Monthly Fee | Features |

Moka (Basic tier) | $3.99 | >Automated saving features |

Moka 360 (premium tier) | $15 | >$360 refund if you don't save what you pay in your first year |

How to Open a Moka account

Opening a Moka account is simple and takes a few minutes through the following steps:

- Open Moka through this link.

- Create an account, provide your details, answer a few questions and set your financial goals and risk tolerance.

- Link your bank account to the app and start funding.

Congratulations, you are now on the path to reaching your goals!

Also, if you refer anyone to use the Moka app, you will be rewarded with $5. Multiply that by the number of people you can refer! Isn’t that great enough? Sure, it is. That will definitely boost your speed in reaching your investment goals.

How to Withdraw Your Money from Your Moka Account

Making a withdrawal from your Moka account is also simple. You can make a withdrawal on Moka at any time with no penalties or fees.

All you need is to send a Withdrawal Request to your Portfolio Manager through your Moka App. The money will be transferred directly to the account you linked as your funding source.

If you place a withdrawal before 1 pm (Monday- Friday), you can receive your money the same day. However, if you place a withdrawal later than 1 pm, your money will be transferred the next day.

Note: Withdrawals are not processed on weekends.

How to Delete Your Moka Account

To delete a Moka account, you need to reach out to a Moka representative through the app’s “Chat with us” section.

Also, you can delete your Moka account by sending an account deletion request from the email address that you used to create the account to support@moka.ai.

Is Moka Safe?

Yes. Moka is as safe as any other financial app in Canada. It uses the same security measures as most banks in Canada, including 256-bit encryption, SSL connections and other strict security measures.

Moka is regulated by IIROC in Canada and your funds are held by a custodian institution tha is insured by the CIPF. This ensures that your deposits are covered up to $1 million should Moka go bankrupt.

Is Moka Worth It?

Absolutely, Moka is definitely worth it because there is so much to gain and nothing to lose. Moka helps you save and invest your spare change in a seamless way.

Also, Moka charges a flat fee of $1 per month, which means whether you have $100 or $1,000,000, you will still pay the flat fee. This way, you are able to grow your investments.

So, Moka is absolutely worth it.

Is the Moka App Free?

Yes. You can download the Moka app for free on your Android or iPhone. However, there is a fee attached to creating an account.

A flat monthly fee is charged by the portfolio manager (Tactex Asset Management) fee as follows:

- $2 for unrestricted non-registered accounts.

- $3 for unlimited registered accounts (including TFSAs, RRSPs, and SRI accounts).

Moka Reviews: My Rating Formula

Here are my Moka review 5-star ratings:

How Does Moka App Compare to Other Investment Apps in Canada?

No doubt, automated investment is becoming more common in Canada, which means there is more competition out there.

Qtrade is a Canadian online brokerage platform that offers a variety of investment services, including trading stocks, ETFs, mutual funds, options, and bonds. It was founded in 2001 and is known for its user-friendly platforms and exceptional customer service. Questrade is a Canadian online brokerage platform that offers a range of investment services, including trading stocks, ETFs, mutual funds, options, and bonds. It was founded in 1999 and is known for its low fees and user-friendly platforms.

1. Qtrade Investor

With a history dating back to 2000, Qtrade Direct Investing is among Canada's oldest trading platforms, catering to beginner and advanced investors with equal aplomb. Its intuitive design and well-thought-out interface make it an excellent choice for novices, while its advanced research tools cater to the needs of more experienced investors.

2. Questwealth by Questrade

Key Features

Questrade is a household name in Canada. It is an online brokerage with low investment fees and unique perks. This online brokerage has TFSA, RRSP, Margin, and other common investment accounts.

Furthermore, your Questrade investment is managed actively by One Capital Management. Although active management is great, sometimes, portfolio managers make bad investment decisions.

Nevertheless, Questrade has the features you need to make the most of your money.

3. Wealthsimple

Wealthsimple is a top competitor or alternative for Moka, and it’s one of Canada’s leading Robo advisors that help Canadians save and invest their money with all the automation and features they need.

Comparably, Moka and Wealthsimple share much in common. They are all safe, have SRIs, are all packed with extra features, invest in ETFs, and all provide round-up bonuses.

However, Wealthsimple has more features such as multiple account options, large investment opportunities, and so on. But this doesn’t imply that Moka isn’t a good option with limited accounts and limited investment opportunities.

It all boils down to your investment objectives and approach. So you need to ask yourself: can you save money regularly?

Obviously, Wealthsimple could be a suitable option since it is designed to accommodate large investments.

However, if you have hard time-saving money, Moka might likely be the suitable option for you since it improves your savings habit and is suitable for little automated investment.

Moreover, if you want to learn more about Wealthsimple, check out our comprehensive Wealthsimple Review.

Final Thoughts on Moka Review

Investing and saving your money are proven steps to attaining your financial freedom. However, how you invest and save your money determines the success or failure of your investment and savings. Hence, the need to use a reliable investment and savings vehicle at all times.

The Moka app is one of Canada’s leading investment and savings vehicles that help you make the best of your money automatically as you sleep.

From the above Moka review, you’ve learned about the pros and cons of Moka. You’ve also learned about Wealthsimple, its top competitors, and what they share and don’t share in common.

Let me know what you think about this Moka review in the comment section.

FAQs on Moka Review

How much does it cost to use Moka?

The price of Moka varies by account. A regular account costs $3.99 plus tax monthly. While Moka 360 account costs $15 plus tax monthly.

How do I connect my Bank account to Moka?

- Log in to the Moka app.

- Navigate to Linked Accounts under Account.

- Click the + symbol in the upper right corner.

What is a Moka Roundup?

Moka Roundup is a method of rounding up your spare change anytime you buy something. The spare change is rounded up to the nearest dollar and is deposited into your account.

How does Moka Roundup work?

Moka Roundup rounds up your spare change to the nearest dollar. For example, assuming you buy anything for $2.40, it will be rounded up to $3. Then Moka will automatically save $0.60 to your account

How do I set up Moka Roundup?

- Open a Moka account

- Connect your bank

- Select a charity and set up your goals.

- Make transactions with your debit or Canadian credit card.

How does Moka invest your money?

After you sign up, link your bank account(s), set a savings goal, and select your preferred way of financing, Moka works its magic.

Your funds would be transferred automatically from your designated funding account to your goals.

Subsequently, your portfolio manager will invest the funds in an account that meets your needs. This could be a TFSA, an RRSP, or an unregistered account.

Comments 2