The Saskatchewan Assured Income for Disability (SAID) program is a provincial program that provides monthly financial assistance to eligible individuals living with significant and long-term disabilities that prevent them from working.

The Saskatchewan SAID program is similar to British Columbia’s PWD benefit and Ontario’s ODSP, all designed to offer financial assistance to help individuals living with disabilities cover their daily living expenses.

In this blog post, we will share the upcoming SAID payment dates for 2024. We’ll cover all the essential details about the SAID program, including its benefits, rates, eligibility criteria, and application process.

Key Takeaways

- The next SAID payment date for 2024 is July 30, 2024.

- If you opt for direct deposit, you will receive your benefits during the last week of the month. For those receiving cheques, they are mailed a few days before the direct deposit payments.

- How much SAID benefit you could receive depends on your family size and location, ranging from $931 to $1,759.

- SAID Payments are usually disbursed towards the end of the month, allowing you to better budget and plan for your expenses and debt payments in the upcoming month.

- To qualify for SAID payments, you must live in Saskatchewan, be at least 18 years old, have a long-term disability, and demonstrate a lack of financial resources to support yourself.

SAID Payment Dates 2024

The following are the SAID dates for 2024:

Benefit Month SAID Cheque Dates SAID Direct Deposit Dates JANUARY December 22, 2023 December 28, 2023 FEBRUARY January 25, 2024 January 30, 2024 MARCH February 26, 2024 February 28, 2024 APRIL March 25, 2024 March 27, 2024 MAY April 25, 2024 April 29, 2024 JUNE May 28, 2024 May 30, 2024 JULY June 25, 2024 June 27, 2024 AUGUST July 25, 2024 July 30, 2024 SEPTEMBER August 27, 2024 August 29, 2024 OCTOBER September 25, 2024 September 27, 2024 NOVEMBER October 28, 2024 October 30, 2024 DECEMBER November 26, 2024 November 28, 2024

Source: www.saskatchewan.ca

SAID payment dates are usually determined by the kind of account you have set up. If you have chosen to receive your benefits by cheque in the mail, cheque payments will be mailed out to you before those who have opted for direct deposits receive their benefits.

Also, payment dates could be tailored to suit your situation sometimes.

Related: Canada Income Assistance Dates & Social Benefits for 2024

What is SAID Program?

The Saskatchewan Assured Income for Disability (SAID) is an income support program for individuals with significant and enduring disabilities. This program provides recipients with lasting financial assistance, wider service options, and enhanced community engagement opportunities.

The Saskatchewan Social Assistance program encompasses three primary components:

- Living Income: For basic needs like shelter, transportation, and food.

- Disability Income: Specially for disability-related costs.

- Exceptional Need Income: Specially for special food items, home care, and grooming animals.

Other components of SAID that people who receive it can enjoy include:

- Household Disability Support Benefit

- Supplementary Health Benefits

- Northern Living Supplement

- Personal Living Benefit

Who is Eligible For The SAID Benefit?

To qualify for SAID benefits, you must meet residency, age, financial, and health/disability requirements.

Age and residency requirements: To be eligible, you must be 18 years or older and reside in the province of Saskatchewan.

Financial requirements: This is a very important factor in your application process for SAID. It is necessary to prove that you do not have the money to pay for self-care.

The limit for cash or money stored in banks for an applicant is $1,500. This also applies to another adult in the applicant’s family. The limit for other members of the family is $500 each.

The following sources of income and assets are partially or fully excluded when evaluating your application for SAID:

- Canada Child Benefit

- Income tax refund

- Disability Housing Supplement payments

- Inheritances as high as $100,000

- GST Credit

- Gifts as high as $200/year

- Scholarships

Disability requirements: To qualify, your disability must be long-term and significant. Another way to look at this requirement is to require assistance from a service animal, person, device, or special environment/housing.

A doctor or a field professional must fill out a form for the disabled. This is an important phase of the application process for SAID.

Saskatchewan Assured Income for Disability Rates

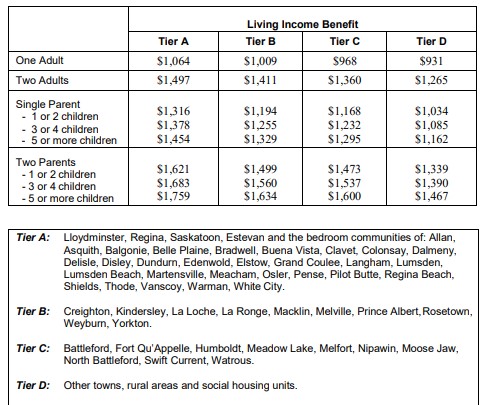

Your Living Income Benefit from the SAID program depends on your location and family size. It can be somewhere between $931 to $1,759 for each month.

Source: saskatchewan.ca.

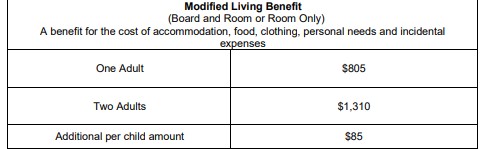

If you have a room and board or room-only arrangement, then you may qualify for the Modified living benefits outlined in the table below.

Source: saskatchewan.ca.

For those who live in a room only or board and room, as seen above, one adult gets $805 while two adults get $1,310. The amount per child for this arrangement is $85.

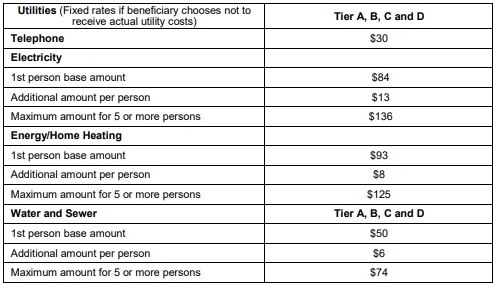

Further, you may also qualify for fixed utility benefits and laundry allowance, as displayed in the table below.

Source: saskatchewan.ca.

SAID beneficiaries can also receive the following at the rates indicated:

- Northern Living Supplement rate is $50/member of a family unit

- The Disability Income Benefit rate is $70 per month

- Exceptional Needs Activity Benefit rate is $25 per month

- The Household Disability Support Benefit rate is $25 per month

While receiving SAID benefits, you may earn employment income without any penalty provided it is under the following annual benchmark:

- One person: $6,000

- Couple: $7,200

- Family: $8,500

If you earn more than these defined amounts, then your SAID payments will be clawed back.

You may also be able to get provisional SAID benefits while awaiting your Disability Impact Assessment and SAID application’s completion.

How To Apply for SAID in Saskatchewan

You can apply for SAID benefits by visiting your local Social Services Office or by phone at 1-888-567-7243. If you have a hearing impairment, call their office at 1-866-995-0099 (TTY) instead.

Upon completing your application, a Disability Impact Assessment (which involves an interview) will be set up for you on a given date.

If your application is denied, you may tender a plea within 15 full days of your notice.

SAID Program Increase 2024

Recently, many supporters and beneficiaries of SAID recipients have called for an increase in SAID payments in Canada.

In the 2021/2022 budget, the Ministry of Social Services of Canada proposed an additional $54.4 million. This increased the SAID benefit funding by $19 million.

Since then, the government hasn’t announced a potential monthly payment increase.

Other Income Assistance Programs in Saskatchewan

You could be eligible for the following income assistance programs if the circumstances are right:

1. Saskatchewan Income Support (SIS): Recipients who qualify may get income backing if they make a low income (or need help with caring for basic needs due to unemployment).

The basic benefit for SIS goes as high as $350 per adult and $65 a child. It is also possible to be eligible for shelter payments as high as $1,150 (if it is a family with three or more children).

2. Provincial Training Allowance (PTA): Adult students who make little money and are enrolled in vocational skills training programs or full-time Adult Basic Education could be eligible for the provincial training allowance.

The living allowance goes as high as $1,476 (including northern allowance and daycare). Beneficiaries could also be eligible for employment plus training benefits.

3. Saskatchewan Employment Supplement (SES): Families with low-income earners (and children) could be eligible for the monthly SES benefit.

They get as high as $562.50 and can also get as high as $4,070/month for employment income benefits. This is dependent on the number of eligible children in your family.

Final Thoughts on SAID Payment Dates

The SAID program offers financial support to eligible people with lasting or long-term disabilities. It can be a great option if you have a disability that has limited your ability to work to your full capacity and earn income to meet your basic needs.

As long as you meet the eligibility criteria, you can get up between $931 to $1,759 for each month. So go ahead and apply for the SAID benefit and expect to receive your payment on the upcoming SAID payment dates.

FAQs on SAID Payment Dates

Is the SAID Benefit Taxable?

No. Benefits gotten via the SAID program are non-taxable. This means you do not need to add the payments to your tax returns for income.

What Are the Other Disability Assistance Programs in Canada?

Some of the most prominent disability assistance programs are listed below:

- Assured Income for the Severely Handicapped (AISH) in Alberta.

- Disability Support Program in Nova Scotia

- AccessAbility support in Prince Edward Island

- Person With Disabilities (PWD) assistance in British Columbia

You can also check out our article on Canada benefits for low-income families and also read about income assistance dates.