If you’re a resident of British Columbia living with disabilities and struggling to meet your basic needs like food and shelter, chances are you have heard of the PWD payment dates.

But what is the BC disability benefit? How much could you receive, and how do you know if you are eligible? Moreover, how can you apply for the BC PWD benefit? If you are one of those searching for answers to these questions, you are in the right place.

In this blog post, we will explore the intricacies of the BC disability program, including eligibility criteria, application processes, disability benefit amount, and the next PWD payment dates for 2024.

Key Takeaways

- The BC Disability payment dates are usually disbursed on the same dates as the income assistance benefits in British Colombia. The next BC PWD payment date for 2024 is April 17, 2024.

- They generally come on the third or fourth Wednesday of the month, also called “Welfare Wednesday”.

- BC disability cheque dates fall on the same dates as the BC PWD payment dates.

- To qualify for BC disability benefits, you must be 18 years or older and qualify as a Person with Disability (PWD).

- How much you could receive depends on your family size and individual situation. You could receive up to $935 as income support.

PWD Payment Dates 2024

The following are the PWD dates for 2024 are:

Payment For | Payment Dates |

February 2024 | January 17, 2024 |

March 2024 | February 14, 2024 |

April 2024 | March 20, 2024 |

May 2024 | April 17, 2024 |

June 2024 | May 15, 2024 |

July 2024 | June 19, 2024 |

August 2024 | July 17, 2024 |

September 2024 | August 21, 2024 |

October 2024 | September 18, 2024 |

November 2024 | October 23, 2024 |

December 2024 | November 20, 2024 |

January 2025 | December 18, 2024 |

However, if you opt to receive your BC disability payment via cheques, you can pick them up at your local ministry or have them mailed to you. The PWD cheque dates are usually mailed out before the Direct Deposit dates to ensure that there’s enough time to receive the cheques in the mail by the BC disability dates.

RELATED: Canada Income Assistance Dates & Social Benefits for 2024

What is BC Disability Assistance?

The BC Disability Assistance is a financial initiative that offers financial and health support to British Columbians struggling to meet their basic needs and is designated as Persons with Disabilities (PWD).

The PWD program offers monthly financial support to BC residents living with significant physical or mental impairments that hinder their ability to carry out daily activities without some form of assistance.

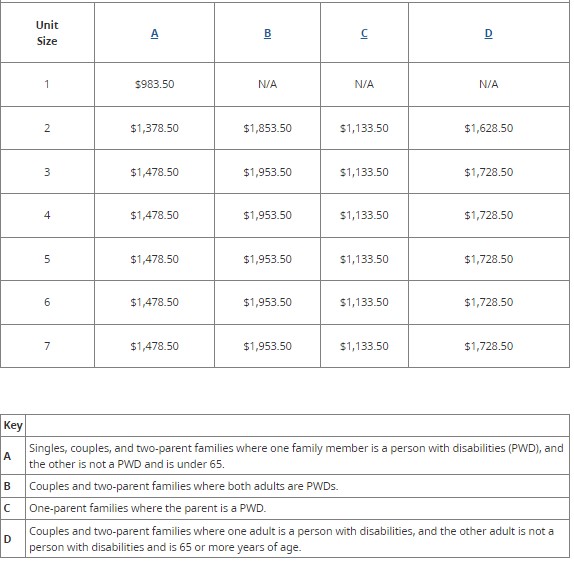

The amount of financial assistance you receive depends on the size of your family and the number of family members who are designated as Persons with Disabilities.

If you qualify for the PWD benefits, you may receive additional funds to cover expenses such as bus passes, camp fees, clothing, service dogs, holiday costs, travel security deposits, and various other necessities.

How Much PWD Benefit Will You Get?

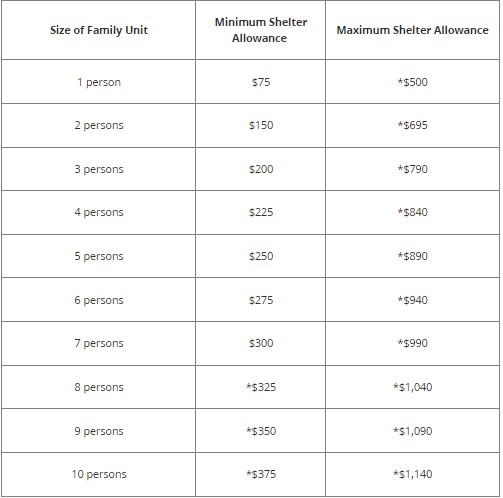

The amount of money you receive for PWD benefits depends on your family size and individual situation. For instance, consider a single person who could be eligible for a maximum of $935 in support. This includes a support allowance of $560 and a shelter allowance of $375.

The current rate table for 2024 is below:

Shelter Allowance

Source: gov.bc.ca

Who Qualifies for BC PWD Benefits?

To be eligible for the BC disability assistance, you must:

- Be 18 years old (you can begin your PWD application process six months before your 18th birthday)

- Prove that you meet the financial eligibility criteria to receive the PWD benefit.

- Have a significant physical or mental impairment that may continue for more than two years.

- Be significantly restricted and unable to perform normal daily activities

- Require assistance to perform daily living activities from another person, an assistance animal, or an assistive device.

Asset Eligibility

You must meet the PWD income and asset criteria before receiving disability assistance. However, Certain general assets are excluded from consideration, like personal possessions that can be easily converted into cash, personal interest held in a trust, and cash.

The limits for exemptions on general assets are as follows:

- $100,000 for individuals, couples, or families where one person holds the PWD designation.

- $200,000 for couples where both adults possess the PWD designation.

Other assets that are allowed and do not factor into the overall asset limits include your home, one motor vehicle, clothing and necessary household equipment, RDSP, and assets held in a qualifying trust.

How To Apply For B.C. Disability Assistance

The PWD application process is very easy and straightforward. The application process has two steps:

- An Assessment of your financial eligibility

- Completing the persons with disability designation application

You can determine your financial eligibility for disability assistance by using the Estimator Tool on the My Self Serve portal, accessible through the Ministry of Social Development and Poverty Reduction (SDPR).

This tool allows you to assess your qualification for PWD benefits and calculate the potential amount you could receive. If your income and assets meet the criteria, you can proceed with the PWD Designation application.

Persons with Disabilities Designation Application

Contact the ministry to request the application. The application consists of three sections: you (the applicant) will complete the first section, your doctor or nurse will handle the second section (medical report), and a prescribed professional will fill out the third section (assessor report).

The prescribed professional may be a doctor, a registered nurse, or a social worker. After you’ve filled out and submitted your application, it will undergo a review process to ensure that you meet the eligibility requirements for obtaining the PWD designation.

Simplified Application Process

If you already receive benefits from programs like the Community Living BC (CLBC), CPP Disability Benefits, etc., you can use a simplified PWD application process.

You will complete a short PWD application form, allowing the ministry to verify your eligibility through one of these existing programs.

This means you won’t need to go through the entire PWD application process or obtain a new diagnosis.

Teens with Intellectual Disability

You can also use the simplified PWD application process if you are between 17½ and 19 years old and have a confirmed intellectual disability.

In this case, you’ll only need to provide an existing psychological assessment and diagnosis instead of going through the entire PWD application process.

Persons with Persistent Multiple Barriers to Employment (PPMB) Benefits

The Persons with Persistent Multiple Barriers to Employment Benefit (PPMB) is different from disability assistance (PWD). It is designed for people who can’t work due to a health condition lasting a year or more, along with other obstacles like homelessness or lack of education.

PPMB supports those with long-term employment obstacles until they qualify for PWD benefits. PPMB recipients are usually exempted from employment-related obligations.

However, to encourage those who wish to work, there is an earnings exemption that allows recipients to explore employment opportunities, gain valuable experience, participate more actively in the community as much as possible, and increase their income.

Final Thoughts on BC PWD Payment Dates

Staying informed about BC PWD payment dates is crucial for a seamless financial journey. As someone who values timely and reliable support, I know that these payment dates are more than just numbers – they are lifelines that empower us to navigate life’s challenges confidently.

Are you ready to take control of your financial future? Mark your calendar, set reminders, and ensure you never miss a payment. Empower yourself with the knowledge of BC PWD payment dates, and experience the peace of mind that comes with staying on top of your finances.

FAQs on BC Disability Dates

Will BC PWD Increase in 2024?

Unfortunately, there is no announcement about the BC disability rate increase for 2024. But you can expect to see a minor increase with the annual indexation by October 2024.

Is BC disability assistance taxable?

No, the BC disability assistance is not taxable. You are not required to report it when filing your tax returns.

Does inheritance affect disability benefits BC?

No! If you declare the income to the government and it’s within your asset level, your inheritance will not affect your BC disability benefits.

Can you collect CPP disability and PWD?

Yes, you can receive CPP disability benefits alongside PWD benefits if you meet the eligibility criteria.