The Manitoba Employment and Income Assistance (EIA) program offers monthly financial support to eligible individuals who need assistance to meet their essential needs.

If you are a Manitoban and find yourself struggling to meet your basic needs, you can apply for the Manitoba EIA program and anticipate the next EIA payment dates. The EIA benefits are usually paid out on the last week of each month.

In this comprehensive guide, we’ll delve into the key details you need to know about the Manitoba EIA program, including the benefits, rates, eligibility requirements, application process, and the EIA payment dates for 2024.

Manitoba EIA Payments Dates 2024

Manitoba welfare payment dates for 2024 are:

EIA Benefit Month | EIA Payment Dates |

January 2024 | December 28, 2023 |

February 2024 | January 29, 2024 |

March 2024 | February 27, 2024 |

April 2024 | March 27, 2024 |

May 2024 | April 24, 2024 |

June 2024 | May 29, 2024 |

July 2024 | June 26, 2024 |

August 2024 | July 24, 2024 |

September 2024 | August 28, 2024 |

October 2024 | September 25, 2024 |

November 2024 | October 29, 2024 |

December 2024 | November 27, 2024 |

It is important to note that these EIA payment dates only apply to those who set up direct deposits. If you haven’t set up your direct deposits, or if you opt to receive your EIA payments via cheque, you will receive your EIA payments in the mail later than those who receive by direct deposits.

Furthermore, you have the option to receive your EIA payments outside the scheduled EIA payment dates. The EIA program allows beneficiaries to align their EIA payment dates with their circumstances.

You can receive your EIA payments weekly, bi-weekly, or mid-monthly. This added flexibility distinguishes the EIA benefit from other provincial income assistance programs such as BC PWD, Ontario Works, AISH, etc.

What is EIA?

The Manitoba Employment and Income Assistance (EIA) program is a financial initiative funded by the provincial government of Manitoba that offers financial assistance to low-income individuals and families struggling to meet their basic needs.

The EIA program is similar to other provincial income assistance initiatives across Canada, such as SIS in Saskatchewan, AISH in Alberta, OW in Ontario, and BC Income Assistance. It offers financial assistance to cover food, clothing, personal and household needs, housing costs and health-related supplies and also offers employment support to help you find and start a job.

Those living in remote or northern regions of Manitoba receive additional benefits to cover extra costs from the EIA program.

The Rent Assist initiative from the EIA is designed to alleviate the housing and utilities expenses for EIA beneficiaries and other low-income renters across the province.

The Manitoba EIA program is sub-divided into three categories:

- The EIA for single parents

- The EIA for persons with disabilities

- The EIA for general assistance

How much you can receive depends on your income, family size and which category you are under.

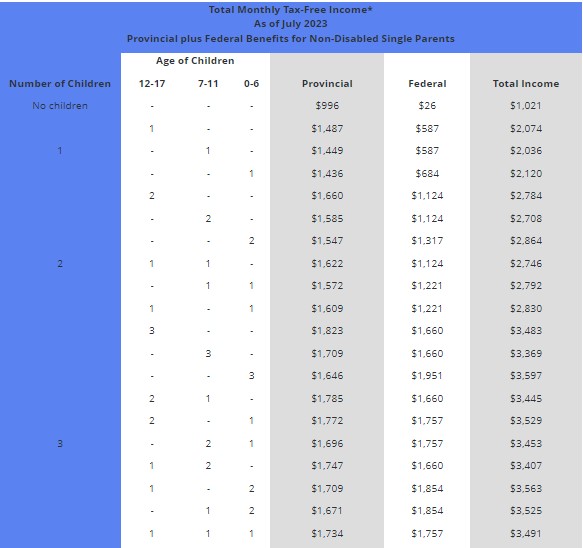

Manitoba EIA for Single Parents

This program is specially designed for single parents and those without spouses or common-law partners.

To be eligible for the Manitoba EIA for single parents, you must:

- Live in Manitoba and be 18 years or older

- Have custody of a dependent child or children, or be in your 7th, 8th, or 9th month of pregnancy.

- Be unmarried, separated, divorced, widowed, or have a spouse in prison

- Meet the EIA financial eligibility criteria

How Much EIA Will You Get?

Here are the current EIA rates for single parents as of July 2023:

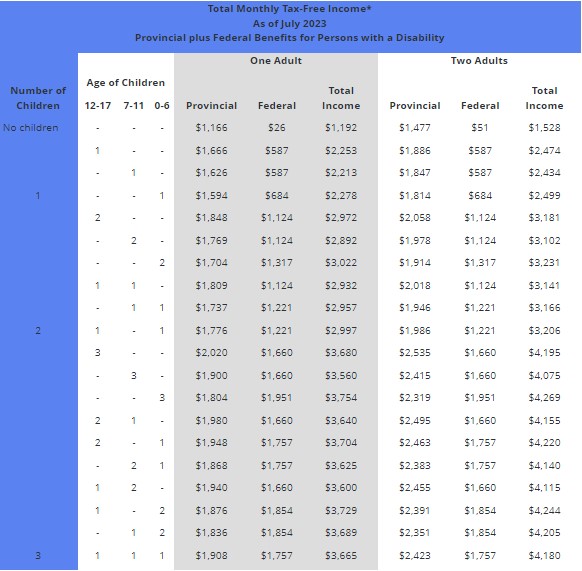

Manitoba EIA for Persons with Disabilities

This program is specially designed for Manitobans living with disabilities. To be eligible for the EIA for persons with disabilities, you must:

- Live in Manitoba and are 18 years or older

- Have a mental or physical disability that will likely last more than 90 days and keeps you from earning enough income to meet your family’s basic needs

- Meet the EIA financial eligibility criteria

How Much EIA Will You Get?

Here are the current EIA rates for persons with disabilities as of July 2023:

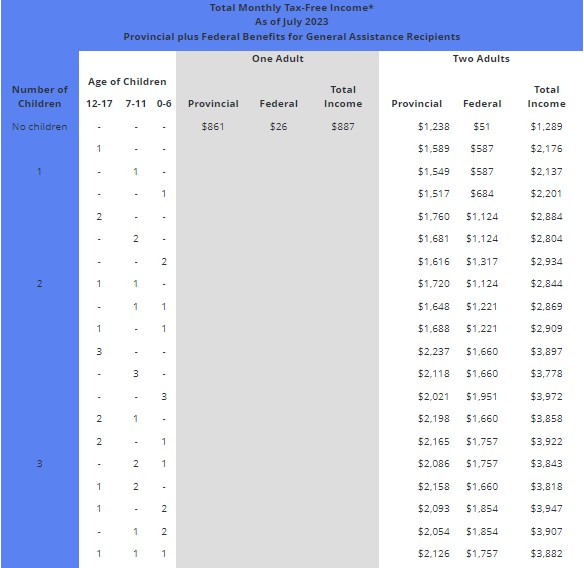

Manitoba EIA for General Assistance

You can apply for the EIA benefits in the general category. To be eligible, you must:

- Live in Manitoba and are between the ages of 18 and 65

- Have no disabilities

- Be a single person without dependents or children, be a couple without dependents or children or a two-parent family.

- Meet the EIA financial eligibility criteria

How Much EIA Will You Get?

Here are the current EIA rates for general assistance as of July 2023:

EIA Financial Eligibility

To qualify for EIA, your total monthly cost for basic needs and shelter (or your family’s) must exceed your total financial resources (your income and assets).

For EIA, the total monthly cost for basic needs is determined by your family size, the number of people in your family, their ages, and relationships to each other. Additionally, the cost of some ongoing medical needs is taken into consideration. However, Rent Assist is based on the cost of shelter, utilities, and fuel.

Sources of income that may count as financial resources include money earned from working, self-employment, child or spousal support, rent paid to you, pension, insurance benefits, allowances, financial settlements from injury lawsuits, interests, dividends, inheritances, business profits, windfalls, etc.

Income that is not regarded by the EIA as financial resources includes the Canada Child Benefit (CCB), foster home maintenance payments, tax credit refunds, Manitoba Prenatal Benefit Program benefits, RDSP withdrawals, cash contributions from friends or family, etc.

Additionally, certain assets count as financial resources, such as cash, investments, bonds, property or real estate, trust funds, money in bank accounts, vehicles, collections or valuables, and insurance policies.

In contrast, assets that do not count as financial resources include RESP, EIA Disability Trust Fund, RDSP, children’s trust funds, your home, automobiles, etc.

EIA Employment Assistance

EIA recipients are generally encouraged to seek employment unless hindered by a disability. This is known as “work expectation”. Recipients can participate in training programs and access financial support for childcare, phone services, and other work-related costs.

For single parents who are receiving EIA, the requirement to seek work commences when all their children are at least 2 years old.

When single parent transitions out of the EIA program, they might become eligible for a health plan that covers prescription medications, vision care, and dental benefits for up to 2 years. Moreover, you might qualify for an additional allowance of up to $25 each month to address miscellaneous expenses, and if you’re employed full-time, you could receive up to $100 per month.

How To Apply for Manitoba EIA

The Manitoba EIA application process begins with an initial pre-intake orientation presentation (PIO) with an EIA staff member.

During this orientation session, the EIA staff member will introduce you to the program and outline your rights and responsibilities while on EIA. They will also provide information about the necessary documents and details required for the application process.

A comprehensive intake appointment will be arranged for you to formally complete the EIA application.

As part of the EIA application process, you must present evidence of your income and assets. Bringing all the pertinent documents and supporting information to your intake appointment is essential.

To ensure you have everything in order, you can download the application checklist, which contains a comprehensive list of the documents and information needed for the EIA application.

For further assistance and information on the EIA application process, you can contact your local EIA office in both Winnipeg and locations outside Winnipeg.

Alternatively, you can make contact through the provided phone numbers: 204-948-4000 if you are in Winnipeg or use the toll-free number 1-877-812-0014.

Should your EIA application face rejection, there is an avenue for appeal. You have the option to submit an appeal to the Social Services Appeal Board within 30 days from the date of the decision.

Manitoba EIA Increase 2024

Like other provincial social assistance programs, the Manitoba EIA initiative undergoes annual adjustments based on the Consumer Price Index (CPI). For instance, in July 2021, the Rent Assist benefit was increased by up to 11% for specific families.

Moreover, in August 2022, the Manitoba government introduced a $50 monthly increase per adult for every recipient under the EIA general assistance category. A $25 monthly increase per household was designated for each EIA disability recipient. This enhancement was implemented in October 2022.

However, as of 2024, there have been no increments or visible plans for increasing the EIA payments.

Is Manitoba EIA Taxable?

Your monthly Manitoba EIA benefit payments are non-taxable. This also applies to the Rent Assist benefits; they are entirely exempt from taxes.

Furthermore, any federal benefits you may receive, such as the GST/HST Credit or Canada Child Benefits, are not subject to taxation either.

You don’t need to incorporate these amounts in your tax returns when you file your annual income tax returns.

Manitoba Financial Benefits and Assistance Programs

The Department of Families in Manitoba offers a range of social assistance programs tailored for eligible low-income individuals. These programs include various financial benefits aimed at supporting those in need. Some of these key programs include:

- Manitoba Child Care Subsidy: This program targets families with children aged 12 weeks to 12 years who attend licensed early learning and childcare centres. It assists by partially covering the fees associated with childcare. The amount provided to each family depends on several factors, including their income and the number of children under their care.

- Manitoba Child Benefit: Designed for families with dependent children under 18 years of age who already receive the Canada Child Benefit, this program offers a yearly payment of up to $420 for each child, equating to $35 per month.

- Children’s Opti-Care Program: Designed for children already benefiting from the Manitoba Child Benefit, this initiative assists in covering the costs of obtaining eyeglasses. The benefit begins at $84 per child annually, though it can be higher for children with special needs.

- Social Housing Rental Program: Administered by Manitoba Housing, this program aids lower-income Manitobans by providing a subsidy that bridges the gap between the market rate for housing units and the actual payment made by beneficiaries.

- Manitoba Rent-Assist: Another housing-focused initiative catering to low-income earners. Eligible Manitoba EIA beneficiaries also gain access to Rent Assist as part of their benefits.

- 55 PLUS Program: This program provides quarterly benefits to seniors in Manitoba aged 55 and above with a low income. The benefit amount stands at $161.80 for a single individual, and if eligible, a spouse or common-law partner can receive $173.90 for each person.

Final Thoughts on Manitoba EIA Payment Dates

Navigating the intricacies of financial assistance can be daunting, but armed with the knowledge of EIA payment dates, you’re better equipped to plan and manage your finances effectively.

Remember, staying informed about EIA payment dates empowers you to make timely decisions that align with your financial goals and needs.

Don’t hesitate to reach out if you’re looking for more in-depth information or have specific questions about Manitoba EIA payment dates, benefits, eligibility, or the application process.

FAQs on Manitoba EIA Payment Dates

How much does disability pay in Manitoba?

You can receive up to $1,093 under Manitoba EIA as a single individual living with a disability or $1,418 for two adults.

How much money can you make while on EIA?

If you are a two-adult family with 3 children between 0 to 6 years of age, you can receive up to $3,898 per month.

How much does a single person get on EIA in Manitoba?

If you are a single person with no child, you can get $948 per month and up to $1,093 for a single person a with disability with no child.