As technology advances, many traditional payment methods are fading into the background, giving way to mobile banking and digital payments, but not cheques. Even now, cheques remain a fundamental and trusted way to transfer funds securely.

According to Statistics Canada’s Survey on Business Conditions, seven in 10 businesses still accept cheques as a viable payment method in Canada. So it is still important that you know how to write a cheque, specifically in Canada.

In this comprehensive blog post, we will guide you on how to write a cheque in Canada. We’ll take you through each step, discuss the essential elements of a cheque, and equip you with the information you need to handle your financial transactions confidently.

How to Write a Cheque in Canada: A Step-By-Step Guide

To learn how to write a cheque correctly, you need to know how to read the different fields that make up a cheque, especially the parts that must be filled up while writing a cheque.

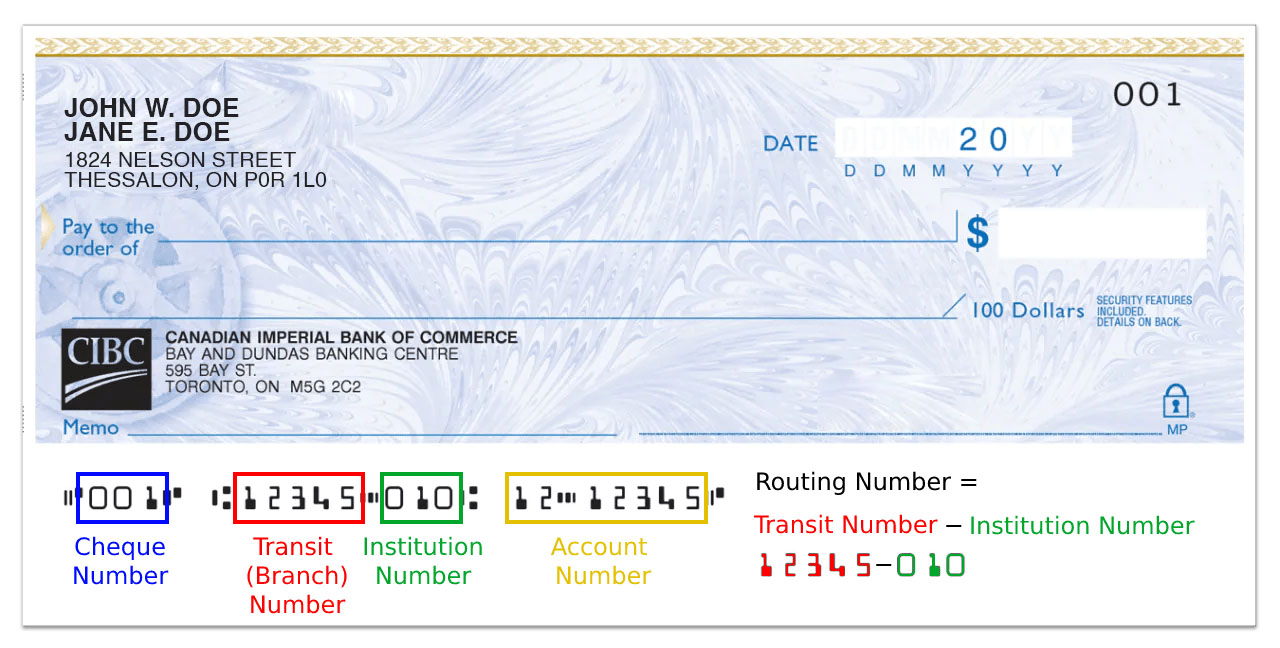

How To Write a Cheque: CIBC Cheque Sample

The image above is a sample of a CIBC cheque, and I will use this sample to explain in detail how to write a cheque properly. Without skipping a beat, let’s get to the fun part of learning how to write a cheque in 6 quick and easy steps.

Step 1: Date the Cheque

Write the date in the date box located at the top right corner of the cheque. Use the format dd/mm/yyyy (date/month/year) when dating the cheque. For example, January 17, 2024, should be written as 17/01/2024.

Use the same date the cheque is written and signed unless it’s a post-dated cheque for the future. If you give a post-dated cheque to a merchant, they cannot deposit it before the payable date you’ve written on the cheque. The merchant must wait until the payable date to cash or deposit the cheque.

Cheques are generally valid for six months from the date written on the cheque, and the bank will honour them within this period.

Step 2: Fill in the Payee Information

Write the recipient’s name correctly in the ‘Pay to the Order of’ line. If it’s a person, use their legal first and last names. For organizations, write their official name, avoiding abbreviations unless necessary, such as Ltd, Inc, etc.

Always ensure you include the payee’s name before signing the cheque. If you don’t, the cheque may become cashable by anyone, including potential thieves, turning it into a blank one.

Double-check that the payee’s name is spelt correctly according to their bank records to avoid difficulty tracing their identity if any issues arise.”

Step 3: Write the Numerical Amount

Fill in the amount you want to send to the recipient in numbers in the box after the ‘$’ sign.

Separate dollars and cents with a decimal point, and use two decimal places for cents (e.g., 25.50).

Avoid using symbols like ‘$’ and ‘¢’ in the numerical amount, and refrain from using commas or spaces within the amount.

Always review before finalizing the cheque to avoid errors.

Step 4: Write the Amount in Words

To clarify the amount you want withdrawn, it is recommended to spell out the dollar amount in words on the line below the recipient’s name. Although not legally required, it helps provide clarity. Always include the cents as a fraction (e.g., 25/100 or 89/100).

Start on the left-hand side of the line when writing the dollar amount in words. After writing the dollar amount, use the word “and” followed by the cents portion. If there are no cents, simply write “zero cents”. For instance, if you express “$500.75” numerically, write “Five hundred dollars and seventy-five cents” in words.

Ensure the numerical amount matches your intended payment. Double-check figures and calculations to avoid errors before converting the amount into words.

Step 5: Sign the Cheque

At the bottom right corner of the cheque, you will see a signature line where you must sign. Your signature is important as it signifies your consent to transfer funds from your account to the recipient.

It is a legally binding agreement between you and the bank, ensuring the validity and authorisation of the payment. The cheque may be considered incomplete and potentially rejected during processing without your signature.

Creating a clear and easily readable signature ensures a smooth payment process. Avoid scribbling or using a complex signature that may be challenging to interpret. A legible signature helps prevent any confusion or errors during payment processing.

Additionally, it is advisable to maintain consistency in your signature across different cheques. This consistency establishes your unique identity and provides a recognisable pattern for verification purposes.

Step 6: Fill in the Optional Memo Line

The memo line on a cheque is a designated space provided by the issuer to include additional information or instructions about the transaction. It is usually found at the bottom left or right corner of the cheque, labelled as “Memo” or “For.”

Examples of what you can write in the memo line include “July rent payment” or “Phone bill.” While not mandatory, filling in the memo line can help the recipient remember the purpose of the cheque for record-keeping.

Remember, the memo field is optional, but don’t forget to sign the cheque!

What To Do After Filling Out Your Cheque

After filling out your cheque, first, tear off the cheque from your chequebook and keep a record for yourself. It’s essential to retain a cheque record for your own reference and documentation purposes.

If you have an old-school carbon-copy chequebook, give the recipient the top copy of the written cheque. This copy will serve as their proof of payment. Keep the lighter copy, typically retained in the chequebook, for your records.

Next, record the transaction in your cheque register. It is good practice to record your cheques and transactions in your cheque register while the details are still fresh in your mind.

Your bank often provides “The cheque register” when you order your chequebook. You can use any notebook as a makeshift cheque register if you didn’t receive one.

Your cheque register helps you track the following information:

- The cheque serial number

- How many cheques you have written

- How much money you have issued

- Who you have paid the money to

- When and why you made these transactions

Filling out your cheque register is optional, but listing all your transactions can help you monitor your money’s flow and lower the risk of fraud. You can also use your register to keep track of cheques people give you if it pleases you.

Security Tips For Keeping Your Cheques Secure in Canada

If you have doubts about using cheques because you want your money safe, here are some safety measures you can take:

- To stop anyone from erasing and rewriting the cheque, write it with a pen instead of a pencil.

- Have a consistent signature that is very hard to forge.

- When filling out the cheque, don’t just leave lots of blank spaces open, and don’t allow anyone to fill out the cheque for you.

- It is advisable not to make any cheques payable in cash. This is a popular culprit for loss or theft because it allows cash withdrawal without depositing a cheque.

- Draw a line through unused spaces on your cheques to prevent others from adding or altering your information.

- Shred cheques that are no longer usable.

- Regularly review your account balance to ensure no money was withdrawn without your knowledge.

What if I Make a Mistake While Writing a Cheque?

Mistakes happen, and handling them properly when writing a cheque is crucial to avoid any problems or complications.

Using correction fluid on a cheque is generally unacceptable because it can raise suspicion about its validity. Banks may consider a cheque with correction fluid as altered, which could lead to rejection.

To correct a mistake on a cheque:

- Draw a single line through the error, ensuring the original information remains readable. For instance, draw a line through the incorrect amount or payee name. Make the cancellation line neat and clear.

- Write the correct information above or beside the cancelled mistake, ensuring it is clear and easy to read. If correcting the amount, use both digits and words to prevent any confusion.

- To confirm the correction, initial or sign next to the alteration. This indicates that the change was intentional and not fraudulent.

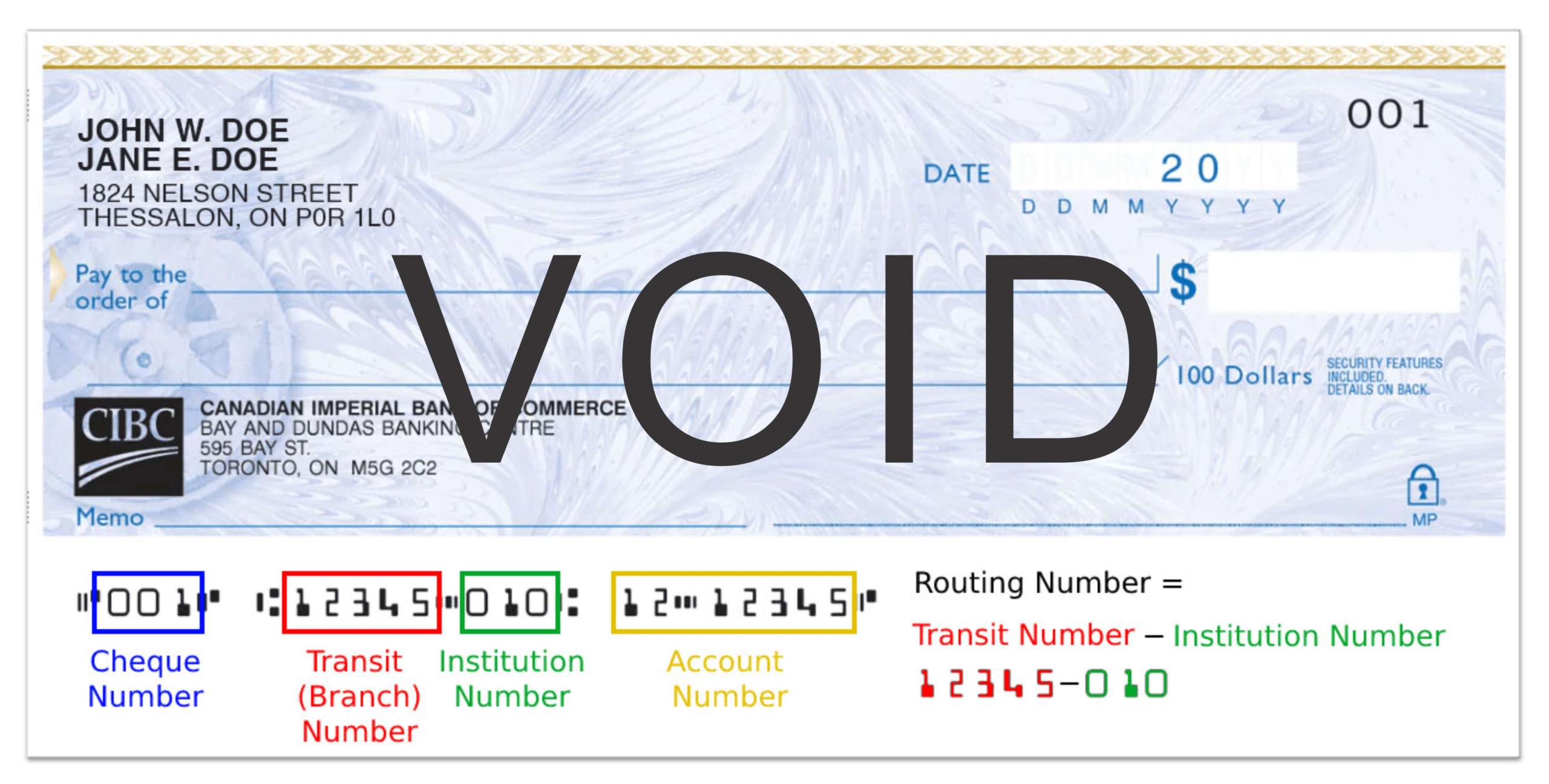

- Write “VOID” across the entire cheque if the error is beyond repair and cannot be corrected. This is necessary to ensure the cheque is no longer considered valid.

- After correcting, review the cheque again to ensure that all the details, including the date, payee, and amount, are accurate.

How to Write a Void Cheque

A void cheque is a simple and important banking tool that provides your banking details without allowing any withdrawals. If you need to set up direct deposit, electronic funds transfer (EFT), or pre-authorized debits, here’s how to get one:

Obtain a blank cheque from your chequebook or request one from your bank. Ensure it is from the account you intend to use for the void cheque.

Take a pen or marker and write the word “VOID” in large, bold letters across the front of the cheque. Ensuring the entire cheque, including the account number and other details, is clearly marked as void is essential.

Be careful not to cover the banking information in the cheque’s lower left corner, as this information may be necessary for processing the void cheque.

Before providing the void cheque to anyone or using it for any purpose, double-check that the word “VOID” is prominently visible and no other information on it is legible. This step is crucial to prevent unauthorized use of the voided cheque.

Store the voided cheque in a secure location, such as a locked drawer or a safe, to safeguard your banking information from falling into the wrong hands.

How to Write a Cheque to Yourself

Writing a cheque to yourself is a simple process, and it can be useful if you need to transfer money between your bank accounts or if you want to withdraw cash from one of your accounts.

To write a cheque to yourself, put your name on the ‘Pay to the order of’ line. Fill out other parts of the cheque accurately, like the date, amount, and signature.

Endorse the back of the cheque in the endorsement area at your bank and show your valid ID to the teller.

How To Cancel a Cheque

To cancel a cheque, act quickly before it is presented for payment at the bank. Once you realize the need to cancel, contact your bank immediately. Call or visit the nearest branch. The sooner you inform the bank, the better the chances of stopping the payment.

Provide essential details such as the cheque number, date, payee’s name, and the exact amount. This helps the bank identify the cheque. The bank will check if the cheque has cleared. If it has cleared, cancellation is impossible, and you’ll need to discuss alternatives with the bank.

If the cheque has not cleared, request a “stop payment” on it. This prevents the bank from honouring the cheque and deducting funds when the payee tries to cash or deposit it. Note that the bank may charge a fee for this service. Inquire about the cost beforehand.

Ask the bank for written confirmation of the stop payment request to have proof. This can be useful in case of disputes. Monitor your bank account to ensure the cheque isn’t processed after placing the stop payment. If you notice any discrepancies, contact the bank immediately.

Remember, stopping a payment on a cheque is not guaranteed, especially if it has already cleared. Always be cautious when writing cheques and double-check all the details before handing them out.

Final Thoughts on How to Write a Cheque

Now that you’ve learned how to write a cheque, you’re equipped with timeless financial skills. Whether it’s paying your landlord, reimbursing a friend, or covering large expenses, cheques can come to the rescue in various situations.

So why not put your newfound knowledge into practice? Grab a pen and a chequebook, and start making those payments confidently! Cheques may not be as prevalent as once, but they still hold their ground in certain circumstances.

If you have any questions or need further guidance, please don’t hesitate to reach out. I’m here to help you on your financial journey. Happy cheque writing!

FAQs on How to Write a Cheque

How Long Does it Take for a Cheque to Conclusively Clear?

Cheques on or below $1,500 are 4-5 days. For cheques over $1,500, the max period of holding is 7-8 days. Keep in mind that cheques could clear sooner in some cases.

People with a trustworthy history with their bank can leverage this by writing the cheque and asking their bank to help them clear it quickly.

What Is A Cheque?

A cheque is a type of payment issued by banks. It is a convenient way to transfer funds between parties who don’t share the same financial institution. For instance, if you don’t have an account with a local bank, you can still pay someone who does by using a cheque.

Can I Deposit a Cheque Written out to my Maiden Name?

According to Payments Canada (an authority in settling financial transactions in Canada), there is no official statement on whether the name on a cheque must be in line with the name of the account holder who is depositing. A financial institution’s individual policy determines how they go about it.

Can I Write a Cheque to Myself?

Yes. It is not unusual to want to write yourself a cheque. It is perfectly legal to write a cheque to yourself, maybe from one personal bank account to another.

When Should I Sign the Check?

It is better to sign a cheque just before you deposit it. It is best if you want to prevent fraudulent persons from depositing a cheque made out to you.

How to Write a Cheque with Cents?

Write the full amount in the box for numeric amounts, including dollars and cents. For example, you should write 709.50 and not 709.5.

In the line for the amount in words, write the same amount in words and include the cents. For $709.50, write, ‘Seven hundred and nine dollars and 50/100’.

How to send money without using cheques in Canada?

Writing a cheque or even cashing it may look like a lot of work nowadays, where we have many options for making instant, fast and easy payments. You can make most of your daily payments using Credit Cards, Debit Cards, Cash, Interac E-Transfers, Bank Transfers, Automatic Bill payments through the bank, or Global Money transfers.

How do I Post-date a Cheque?

A post-dated cheque is usually dated for the future. If you want to send a cheque prematurely, you should post-date the cheque. To post-date a cheque, you only have to date it in the future. If today is March 1, you can date the cheque for April 15 if you will be depositing the cheque on April 15.

How Long is a Cheque Valid for?

Regular cheques are stale-dated after six months, and you can no longer deposit them. However, your bank can decide if it will accept stale-dated cheques. Note that money orders, bank drafts, and federal government cheques are never stale-dated.

How to Write a Cheque Scotiabank

Write a Scotiabank cheque as you would for any other cheque. Fill out the all-important part with the correct information. Write the date, name, and amount, and sign your cheque.

How to Write a Cheque RBC

Writing RBC cheques are as easy as every other cheque. Follow the steps outlined above and fill out all the necessary parts of the cheque.

How to Write a Cheque TD

TD bank cheques are the same as every other cheque and should be written as such. Include the date, amount, and name in words and numbers, and do not forget your signature.