Are you always looking for ways to diversify your portfolio and minimise risk? Well, I have got some exciting news for you! If you’re like me, you want to make the most out of your investments without spending countless hours researching individual stocks.

As a self-proclaimed investing junkie, I know firsthand how challenging it can be to navigate the complexities of the stock market. That’s why I was over the moon when I discovered the ZSP ETF. It offers a simple and cost-effective way to invest in the US market without having to waste hours researching individual stocks.

In this ZSP ETF review, I will give you a detailed breakdown of this amazing investment tool, including its holdings, pros and cons, performance, and how to buy it in Canada. Trust me, after reading this review, you’ll be an expert on everything ZSP ETF!

So, whether you’re a seasoned investor looking to diversify your portfolio or a beginner trying to dip your toes in the market, this ZSP ETF review is for you. Let’s dive in!

The ZSP ETF is a BMO Global Asset Management Exchange-Traded Fund (ETF) that aims to mirror the performance of the S&P 500 Index. Launched in 2012, it is one of Canada’s largest ETFs, investing 99.92% in stocks and 0.08% in cash and equivalents. It's a great choice for Canadian investors who want to gain US stock market exposure without paying foreign exchange fees. With an AUM of over $9 million, medium risk rating, and a current trading price of $61.23, ZSP.TO is listed on the Toronto Stock Exchange.

- Low-risk asset class

- Diversified exposure to over 500 companies in the US stock market

- Holds the constituent securities directly

- Low-cost and high liquidity

- ZSP does not invest in fixed-income securities

- It does not offer geographical diversification outside the US Holdings

What is BMO S&P 500 Index ETF (ZSP)?

ZSP ETF is an Exchange-Traded Fund (ETF) offered by BMO Global Asset Management to replicate, to the extent possible, the performance of the S&P 500 Index.

Incepted on November 12, 2012, it is one of Canada’s largest ETFs in terms of market capitalisation.

The ZSP ETF is an all-stock option. It is invested 99.92% in stocks and 0.08% in cash and cash equivalents. Canadian investors looking to invest and gain exposure to the US stock markets without paying foreign exchange fees will find this a suitable option.

It has an AUM of over $9 million and currently trades at $61.23. The fund has a medium risk rating and trades on the Toronto Stock Exchange under the “ZSP.TO” ticker symbol.

Key Facts about ZSP ETF (As of January 10, 2024)

- Inception date: November 14, 2012

- Stock price: $61.23

- Assets under management: $9,512.13 million

- Number of stocks: 505

- Management fee: 0.08%

- MER: 0.09%

- Currency: CAD

- 12-month trailing yield: 1.30%

- Distribution yield: 1.42%

- Distribution frequency: Quarterly

- Exchange: Toronto Stock Exchange

- Price/Earnings Ratio: 27.5x

- Price/Book Ratio: 4.1x

- Eligible accounts: RRSP, TFSA, RRIF, TFSA, DPSP, RDSP

Benefits and Downside of ZSP ETF

Like most ETFs in Canada that track S&P 500 Index, ZSP has benefits and downsides. You must carefully consider the pros and cons of ZSP ETF before buying.

Pros

- Low-risk asset class

- Diversified exposure to over 500 companies in the US stock market

- Holds the constituent securities directly

- Low-cost and high liquidity

Cons

- ZSP does not invest in fixed-income securities

- It does not offer geographical diversification outside the US Holdings

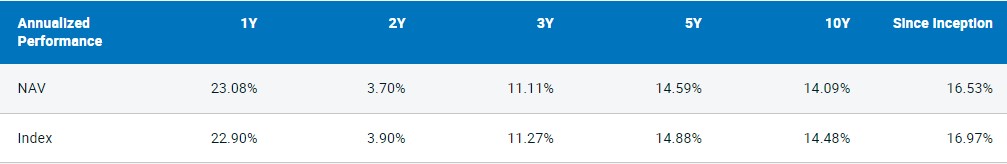

ZSP ETF Performance

Since its inception in 2012, ZSP stock has performed beyond expectations. It excellently mirrors the performance of the S&P 500 index.

Take a look at the cumulative average returns of BMO ZSP ETF:

ZSP ETF Holdings

BMO ZSP is an all-stock portfolio that tracks the performance of the S&P 500 index ETF and holds over 500 of the largest companies listed in the US stock market.

Canadian investors who like to gain exposure to the US stock markets will find BMO ZSP ETF a suitable option because it holds 100% US stocks.

Big tech companies make up a large portion of the ZSP ETF holdings. Tech companies like Apple, Microsoft, Amazon, Meta Platforms, etc.

Here is a list of the top ten ZSP ETF holdings:

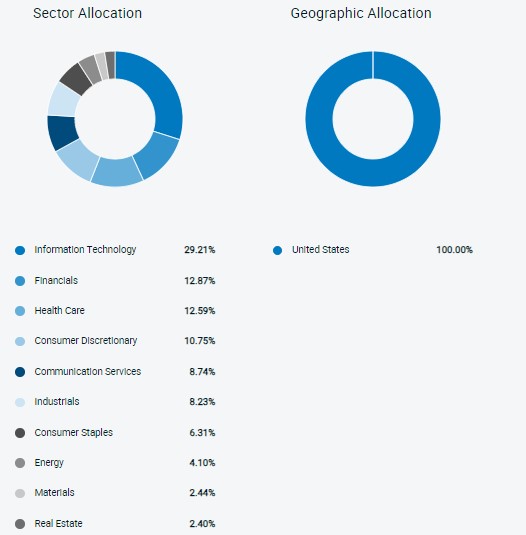

ZSP ETF Sector

When it comes to sector diversification, ZSP ETF allocated 27% of its portfolio to information technology. This is no surprise because it is the fastest-growing sector in the US market.

After the information technology allocation, the remainder is evenly distributed across the rest of the industries in the US.

Here is a breakdown of ZSP ETF sector allocation:

ZSP ETF Fees

- Management fees: 0.08%

- Management Expense Ratio (MER): 0.09%

BMO ZSP ETF offers competitively low management fees and MER compared to other S&P 500 ETFs n Canada like XUS.

Also, compared to average mutual funds that are actively managed, ZSP ETF is cheaper. An average mutual fund charges about 1.98%.

So, if you invest $1000 in ZSP ETF, you will be charged an annual management fee of $0.80.

ZSP Vs ZUE

BMO S&P 500 Index ETF CAD-Hedged (ZUE) is similar to VSP and XSP. ZUE is the BMO ETF hedged to the Canadian dollar to protect against currency fluctuations.

ZUE is also offered by BMO Global Asset Management and tracks the S&P 500 index, just like the ZSP ETF.

ZUE ETF is not an all-stock fund. It comprises mainly of ZSP and cash equivalents to hedge the currency. It has the same MER of 0.09%, just like ZSP.

ZSP Vs VFV

Vanguard S&P 500 Index ETF (VFV) from Vanguard Canada is an ETF that tracks the S&P 500 Index in Canadian dollars, and like ZSP, it is also traded on the Toronto Stock Exchange.

ZSP and VSP are closely similar. They hold underlying securities directly, have the same MER of 0.09% and management fee of 0.08%, and were established within days of each other. However, VFV has outperformed ZSP with a higher rate of returns over the years.

If you want to gain exposure to the US equity market, VFV ETF is a viable alternative to ZSP.

ZSP Vs XUS

Blackrock’s iShares Core S&P 500 Index ETF (XUS) is an ETF designed to track the performance of the S&P 500 index, just like BMO ZSP.

However, in contrast to ZSP, XUS has iShares IVV as its primary holdings. IVV is the US version of the ETF tracking the S&P 500 index.

iShares IVV has about 96% of the total holdings in XUS, and the remainder is divided across the other equity securities held by XUS.

Like ZSP, XUS is also passively managed and comes at a low cost. However, XUS charges a higher fee than ZSP. XUS has a management fee of 0.09% and MER of 0.10%, while ZSP has management fees of 0.08% and MER of 0.09%.

Also, Blackrock’s XUS ETF offers a lower annualised distribution yield of 1.08% compared to BMO ZSP ETF, which offers 1.45% as annualised distribution yield.

How to Buy ZSP ETF in Canada?

If you want to invest in ZSP ETF, look no further. Canada’s two most popular brokerage platforms offer ZSP ETF at zero commission.

- Questrade: Questrade is one of Canada’s most popular brokerage platforms that offers a long list of investment assets, like stocks, ETFs, and mutual funds. It allows you to buy ZSP at a $0 charge but charges $4.95 if you want to sell your ETFs. However, Questrade offers a straightforward and exciting user interface on desktop and mobile platforms.

Questrade is an online discount brokerage established in 1999 with a $25 billion asset under management. Its popularity in Canada lies in its low commission, low trading fees, and multiple ranges of accounts. As a result, both beginners, intermediate and seasoned investors in Canada find Questrade attractive for DIY and active management investing.

Key Features

- Free tax-loss harvesting

- Low management fees

- Several investment options

- Automatic portfolio rebalancing

- Active management

- Ease of use

- Wealthsimple Trade: Wealthsimple Trade is another top finance platform in Canada, especially among young Canadians. Wealthsimple Trade allows you to buy and sell ZSP ETF in Canada at a $0 charge.

Wealthsimple Trade is a great trading platform that offers commission-free buying and selling of thousands of stocks. Its user-friendly interface and mobile-optimized investing dashboard make it easy to navigate and accept various payment methods, such as bank transfers and debit cards. In addition to traditional online stock trades, Wealthsimple Trade allows you to engage in other investment activities. It supports both taxable and registered (non-taxable) accounts such as RRSP and TFSA, and there is no minimum balance requirement when opening an account, making it accessible for investors with little money.

Final Thoughts on ZSP ETF Review

I hope you found this ZSP ETF review helpful and informative. Investing in the US market can be intimidating, but with the ZSP ETF, you can easily diversify your portfolio and minimise risk.

To sum it up, the ZSP ETF is a low-cost investment tool that offers exposure to the entire US market, making it a great option for cost-conscious investors. Its diversification, simplicity, and performance make it an ideal choice for new and experienced investors.

If you want to invest in the US market, give the ZSP ETF a closer look. Remember, always research before investing and consult a financial advisor if you need help making investment decisions.

So, what are you waiting for? Go ahead and invest in the ZSP ETF today! Happy investing! However, if you are unsatisfied with ZSP, consider other ETFs or S&P 500 ETFs in Canada.

FAQs on ZSP ETF Review

Is ZSP ETF hedged?

BMO ZSP ETF is not hedged to Canadian dollars. However, the ETF has a twin fund called ZUE that is hedged to the Canadian dollar to protect against currency fluctuations.

Does ZSP Pay Dividends?

Like most ETFs in Canada, ZSP ETFs pay out dividends quarterly. ZSP dividends are currently 1.38%.