Are you a Canadian investor looking to diversify your portfolio with exposure to the U.S. stock market? Want to invest in the U.S. stock market without breaking the bank? Well, I’ve got some exciting news for you. I’ll take a deep dive into the world of XUS ETF in this XUS ETF review!

If you’re looking for an affordable way to add U.S. stock market exposure to your portfolio, XUS ETF might be the solution you’ve been searching for.

In this article, we’ll dive into the nitty-gritty of Blackrock’s iShares Core S&P 500 Index ETF (XUS), including its fees, performance, and pros and cons. I’ll also compare it to other ETFs on the market to give you a comprehensive view.

So, sit tight and let’s explore the world of XUS ETF together!

XUS is a Blackrock ETF that tracks the S&P 500 index, trading on the Toronto Stock Exchange as "XUS.TO". It allows Canadian investors to access U.S. stocks without paying in U.S. dollars. XUS is a convenient option for adding U.S. stock market exposure to registered and non-registered Canadian accounts.

What is iShares Core S&P 500 Index ETF (XUS)?

iShares Core S&P 500 Index ETF (XUS) is one of the exchange-traded funds offered by Blackrock. XUS ETF tracks the S&P 500 index and trades on the Toronto Stock Exchange under the “XUS.TO” ticker symbol.

Incepted on April 10, 2013, XUS was designed to allow Canadian investors to gain exposure to U.S. stocks and companies without paying equities in U.S. dollars.

If you want to add exposure to the U.S. stock market without buying individual stocks, XUS ETF is a suitable option for your needs. It is eligible for both registered and non-registered accounts in Canada.

Key Facts About XUS ETF (As of January 11, 2024)

- Inception date: April 10, 2013

- Stock price: $79.24

- Assets under management: $4.7 billion

- Number of underlying holdings: 503

- Management fee: 0.08%

- MER: 0.09%

- Distribution yield: 1.57%

- 12-month trailing yield: 1.21%

- Distribution frequency: Semi-annually

- Price/Earnings Ratio: 22.13x

- Price/Book Ratio: 4.25x

- Currency: CAD

- Eligible accounts: RRSP, TFSA, RRIF, TFSA, DPSP, RDSP

Benefits and Drawbacks of XUS ETF

There are several benefits and drawbacks to buying XUS ETFs and getting exposure to the largest U.S. companies without paying foreign exchange fees.

You should consider a few pros and cons of XUS ETF before buying.

Pros

- Highly liquid

- Diversified exposure

- Low cost

- Holds its U.S.-listed counterpart, IVV, to reduce transaction costs

Cons

- Tech Heavy

- Only pays distribution semi-annually

- High MER compared to other ETFs

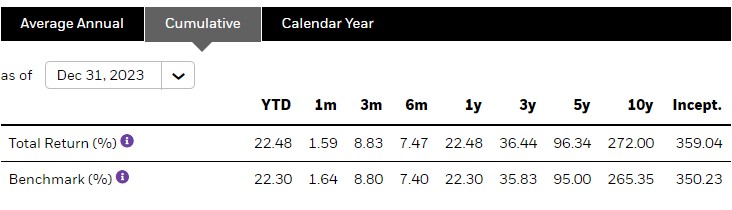

XUS ETF Returns/Performance

XUS ETF was designed to replicate the performance of the S&P 500, and it does that effortlessly, which is why XUS is an ETF to invest in.

XUS ETF has been a steady performer, but this does not guarantee that the historical returns don’t indicate future performance. Below is the breakdown of the cumulative returns of XUS ETF since its inception.

Source: www.blackrock.com

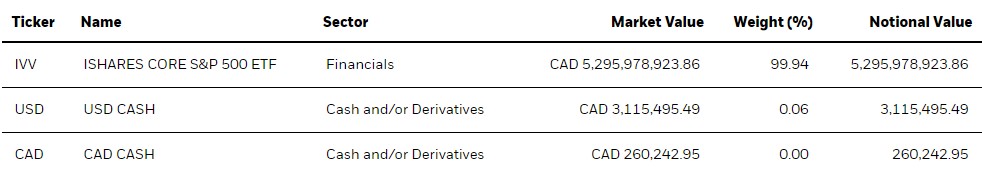

XUS ETF Holdings

XUS ETF is different from other index funds ETFs. It is not an all-stock fund; it includes another ETF (IVV) as the main holding.

XUS also has names of the highest weighted stock in the U.S. market under its holdings.

While a majority of XUS holdings are made up of iShares Core S&P 500 ETF (IVV), it also has weightings from other large companies like Apple, Amazon, Tesla, etc.

Source: www.blackrock.com

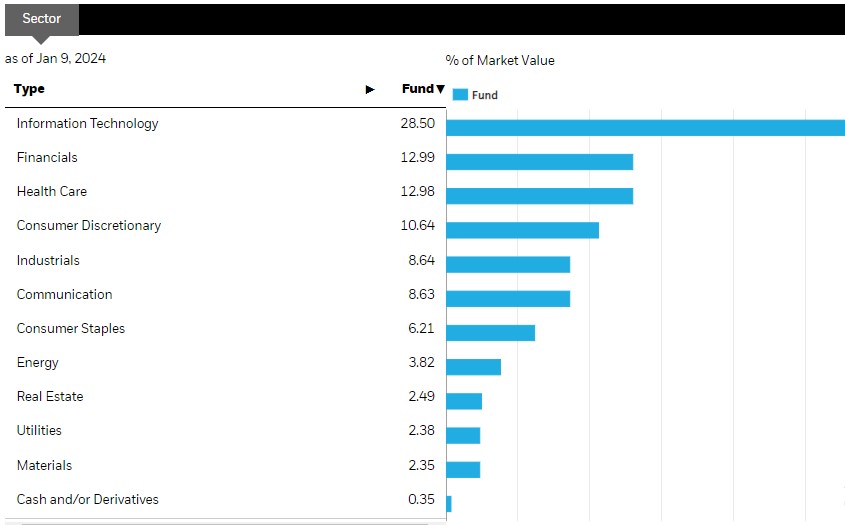

XUS ETF Sector Allocation

XUS not only offers exposure to over 500 companies in the U.S. market but also provides you with little extra growth opportunity and adds a little weight to the biggest companies in the S&P 500 index.

Below is the sector breakdown for XUS as of January 11, 2024.

Source: www.blackrock.com

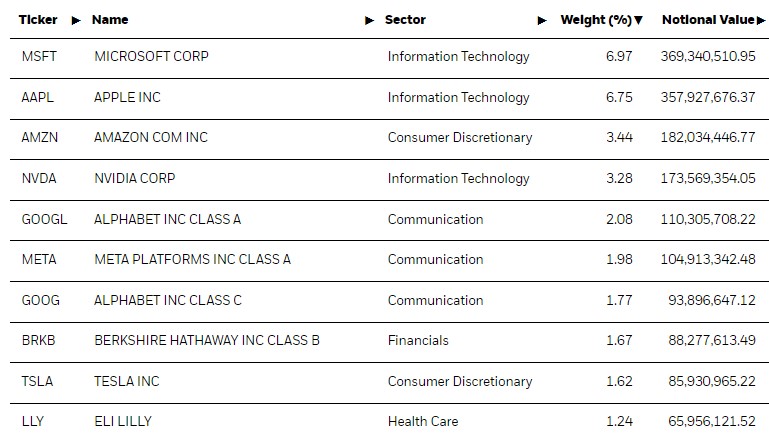

XUS ETF Underlying Holdings

As of January 11, 2024, Microsoft Corp has the largest holdings in XUS at a 6.97% weighting, followed closely by Apple Inc. at a 6.75% weighting. Eli Lilly is at the bottom of the list at a 1.24% weighting.

Source: www.blackrock.com

XUS ETF Fees

- Management fee: 0.08%

- Management Expense Ratio: 0.09%

Source: www.blackrock.com

XUS ETF charges reasonable amounts for its management fees and MER. Though it’s not the cheapest in the market, it is considerably lower than investing in an average mutual fund through Canadian financial institutions. An average mutual fund in Canada charges about 1.98%.

Is XUS ETF a Good Buy?

iShares S&P 500 ETF (XUS) is an affordable and diversified ETF that is highly regarded. Canadians who desire exposure to the U.S. stock market will find XUS ETF a good choice.

If you want to add balance to your portfolio and get exposure to the S&P 500 at a reasonable management fee, XUS ETF is the right ETF to add to your portfolio.

This Blackrock ETF provides diversification by investing in the S&P 500 index and investing in it with Canadian dollars.

How To Buy XUS ETF in Canada

Buying XUS ETF is simple, especially when you use platforms like Wealthsimple Trade and Questrade.

- Wealthsimple Trade: Wealthsimple Trade is a newly launched but popular investment platform in Canada from Wealthsimple financial institutions. It allows you to buy and sell ETFs like XUS at a charge of $0. It is available on desktop and mobile apps and has a very user-friendly interface making it easy to start your XUS ETF investment.

Wealthsimple Trade is a great trading platform that offers commission-free buying and selling of thousands of stocks. Its user-friendly interface and mobile-optimized investing dashboard make it easy to navigate and accept various payment methods, such as bank transfers and debit cards. In addition to traditional online stock trades, Wealthsimple Trade allows you to engage in other investment activities. It supports both taxable and registered (non-taxable) accounts such as RRSP and TFSA, and there is no minimum balance requirement when opening an account, making it accessible for investors with little money.

- Questrade: Questrade has been around for a long time and has gathered the trust of many Canadian investors. You can buy ETFs like XUS for free on Questrade, but you must pay at least $4.95 when you want to sell your ETF.

Questrade is an online discount brokerage established in 1999 with a $25 billion asset under management. Its popularity in Canada lies in its low commission, low trading fees, and multiple ranges of accounts. As a result, both beginners, intermediate and seasoned investors in Canada find Questrade attractive for DIY and active management investing.

Key Features

- Free tax-loss harvesting

- Low management fees

- Several investment options

- Automatic portfolio rebalancing

- Active management

- Ease of use

XUS Vs XSP

XUS and XSP are two similar ETFs from the iShares line of Blackrock. They track the performance of the S&P 500.

However, the difference between both is that XSP is the hedged version of XUS. XSP is hedged against the Canadian dollar to protect it from currency fluctuations.

XSP holds little portions of U.S. and Canadian dollars, so if anyone fluctuates, the hedged XSP stabilizes your portfolio and eliminates foreign exchange fees.

Also, XSP has management fees of 0.09% and MER of 0.10% to match XUS. It also pays out distributions on a semi-annual basis.

XUS Vs VFV

VFV is an all-stock ETF from Vanguard Canada that directly mirrors the S&P 500 index. It trades on the Toronto Stock Exchange in CAD dollars and eliminates the need for foreign exchange fees.

It offers lower management fees and MER than XUS ETF. VFV offers management fees and an MER of 0.08%.

Also, in contrast to XUS, VFV ETF pays out its distribution quarterly.

XUS Vs XUU

iShares S&P US Total Markets Index (XUU) tracks the entire U.S. market and offers four other iShares ETFs. XUU holds iShares Core S&P Total US Stock RTF (ITOT), the iShares Core S&P Small-Cap ETF (IJR), the iShares Core S&P Mid-Cap ETF IJH), and s 50.26% weighted holdings of IVV.

XUU is hedged to hold both Canadian and U.S. dollars as well. It has a management fee and MER of 0.07%, and its distribution is paid out quarterly.

Final Thoughts on XUS ETF Review

The iShares Core S&P 500 Index ETF (XUS) is an excellent investment option for Canadians looking to gain exposure to the US stock market. It offers a low-cost way to invest in a diversified portfolio of US stocks and has a proven track record of delivering solid returns.

If you’re considering investing in XUS, it’s essential to understand the risks involved and research before making any investment decisions. Be sure to consult with a financial advisor to help you determine if XUS is the right investment option for you.

Don’t miss out on the opportunity to invest in this fantastic ETF. Start your journey towards financial freedom today! However, if you are looking for other ETFs or other S&P 500 ETFs, you can consider options like VFV or VSP.

FAQs on XUS ETF Review

Is XUS hedged?

XUS ETF is not hedged against the Canadian dollar. It doesn’t hold any currency and is subject to foreign exchange fluctuations. However, it has a closely similar ETF from Blackrock that is hedged called XSP.

Is XUS a good investment?

Protecting your investment portfolio with ETF funds is a move in the right direction. And with XUS ETF, you have a good investment. It offers you relief with an index that exhibits consistent gains and volatility.

Does XUS pay dividends?

XUS ETF pays dividends in the form of distributions semi-annually. The distribution yield is 1.08% as of November 1, 2022.