Do you want to save money on international transfers? Are you looking for a way to avoid the high fees and hidden charges typically associated with traditional banks and instead enjoy transparent, low-cost transactions that save you time and money? Look no further than Wise!

Wise is a popular online money transfer service that has gained much attention in recent years. This innovative platform has revolutionised how people transfer money abroad, providing a fast, easy, and cost-effective way to send and receive funds in different currencies.

In this Wise review, we’ll take a closer look at Wise and explore its features, benefits, and potential drawbacks, including its fees and safety, so you can decide if it’s the right choice for your international money transfer needs.

So, let’s dive in and discover what Wise has to offer!

What is Wise (Formerly TransferWise)?

Launched in 2011 by Taavet Hinrikus and Kristo Karmann, Wise is a financial technology company that aims to make international money transfers easier, faster, and cheaper than traditional banks.

It was formerly called TransferWise, and its company is based in London with many offices in other parts of the world. The company serves millions of customers who transfer over $9 billion monthly.

Since its launch, Wise has been providing top-notch money transfer services to individuals and businesses worldwide. They offer low-cost money transfer services by cutting out the middleman.

With Wise, you can transfer money in up to 750 currencies to over 80 countries. You can transfer money to your account, friend, family, business or anyone else at a low cost.

How Does Wise Work?

Wise lets you send, receive and spend money internationally to over 80 countries affordably. Typically, sending money abroad involves a middleman (traditional banks) who markup the exchange rate and other hidden fees, costing you many charges.

However, Wise requires a small upfront fee, and they will exchange the currencies at a mid-market rate. The mid-market rate is similar to what banks use when conducting transactions with each other. You can easily confirm online from Google, Yahoo, or Xe.com.

The good part is that the transparent fee charged by Wise and the real exchange rate conversion offers significant saving opportunities.

So, for example, if you want to send $500 CAD to a friend in the US, Wise doesn’t transfer the money across the Canadian/US border. Instead, Wise adds your money to their account in Canada and pays your friend in the US from their USD account in the US. Do you get it?

And if your friend wants to send you money, Wise keeps the USD in their US accounts and sends you money from their Canadian bank accounts.

This strategy cuts the transfer costs by removing the need to transfer money across borders. However, to use Wise, you must create an account.

Fortunately, creating a Wise Account takes just a few minutes, as only your email or Facebook account is required. Once you’re done, you can start transactions immediately.

Sending your money from Canada may take 1-3 working days for Wise to receive your money, depending on your payment method. Before making any transfer, Wise first shows you the transfer fees. This varies according to the amount, currency and method of payment.

Take note of these transfer limits:

- Local wire transfer: $1.5 million CAD per transfer

- Direct debit CAD transfers: $9,500 CAD per 24 hours and a bi-weekly limit of $30,000

- Credit and debit cards: $3,000 CAD per transfer

Take note of these banks that support automatic debit from your account to WOse in Canada:

- Bank of Montreal (BMO) – Institution number 001

- Bank of Nova Scotia – Institution number 002

- Royal Bank of Canada (RBC) – Institution number 003

- Toronto Dominion Bank (TD) – Institution number 004

- National Bank of Canada – Institution number 006

- Canadian Imperial Bank of Commerce (CIBC) – Institution number 010

- President’s Choice (PC) / Simplii (new name) – Institution number 010

- HSBC Bank Canada – Institution number 016

- Tangerine Bank (ING Bank) – Institution number 614

- La Caisse Centrale Desjardins Du Quebec – Institution number 815 or 865 or 829 or 890

- Vancity – Institution number 809

Benefits and Drawbacks of Wise

Here are the good and ugly sides of Wise (TransferWise):

Pros

- Low and transparent transfer fees

- Easy to use

- Safe and secured

- Low mid-market rate

- Flexibility (can be used by individuals and businesses).

Cons

- Cash advance charges for credit card deposit

- Limited currencies

- Account verification delay (2-3 days)

- Limited payment options (no cheques, bank drafts, cash pickup etc.)

What Currencies Can You Send and Receive On TransferWise?

When choosing an international money transfer service, currency coverage is an essential factor to consider.

But with Wise, you can send and receive payments from the following 25 currencies:

Australian Dollar (AUD) | Japanese Yen (JPY) | Indonesian Rupiah (IDR) | Bulgarian Lev (BGN) |

Indian Rupee (INR) | Brazilian Real (BRL) | Croatian Kuna (HRK) | Hungarian Forint (HUF) |

Indian Rupee (INR) | Emirati Dirham (AED) | Hong Kong Dollar (HKD) | Malaysian Ringgit (MYR) |

Canadian Dollar (CAD) | Norwegian Krone (NOK) | Swiss Franc (CHF) | New Zealand Dollar (NZD) |

Czech Koruna (CZK) | Polish Złoty (PLN) | Danish Krone (DKK) | Romanian Leu (RON) |

Euro (EUR) | Turkish Lira (TRY) | Pounds Sterling (GBP) | Swedish Krona (SEK) |

What Currencies Can You Send to Local Banks On TransferWise?

Here is a list of some of the countries/currencies that you can transfer money to through Wise:

United Arab Emirates Dirham (AED) | Argentine peso (ARS) | Australian dollar (AUD) | Bangladeshi taka (BDT) | Bulgarian lev (BGN) |

Brazilian Real (BRL) | Botswana Pula (BWP) | Swiss franc (CHF) | Chilean peso (CLP) | Chinese yuan (CNY) |

Colombian peso (COP) | Georgian Lari (GEL) | Ghanaian cedi (GHS) | British pound (GBP) | Fijian Dollar (FJD) |

Japanese yen (JPY) | Indian rupee (INR) | Israeli shekel (ILS) | Indonesian rupiah (IDR) | Hungarian forint (HUF) |

Croatian kuna (HRK) | Hong Kong dollar (HKD) | Euro (EUR) | Egyptian pound (EGP) | Danish krone (DKK) |

Czech koruna (CZK) | Costa Rican colón (CRC) | South Korean won (KRW) | Sri Lankan rupee (LKR) | Moroccan dirham (MAD) |

Kenyan shilling (KES) | Nigerian Naira (NGN) | Malaysian ringgit (MYR) | Norwegian krone (NOK) | Mexican peso (MXN) |

Philippine peso (PHP) | Peruvian nuevo sol (PEN) | New Zealand dollar (NZD) | Nepalese rupee (NPR) | United States dollar (USD) |

Ugandan shilling (UGX) | Uruguayan peso (UYU) | Vietnamese dong (VND) | West African CFA franc (XOF) | Zambian kwacha (ZMW) |

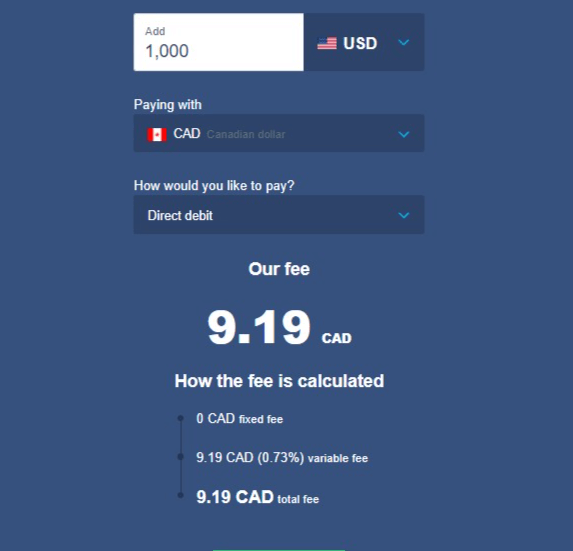

Wise Fees

Wise is one of the cheapest and most transparent money transfer services worldwide. Before making any transfer, Wise will show you the fees and how they arrive at that amount.

Accordingly, fixed and variable fees add up to your total fees. The fixed and variable rates will depend on your and the recipient’s currencies.

In the end, the amount, fixed and variable fees, and the transfer method constitute the overall cost of your transfer on Wise. Here’s an example:

Wise Multi-Currency Account (Formerly Borderless Account)

Wise offers a multi-currency account that you can use to send and receive payments in different currencies at the real exchange rate without fees or a minimum balance. It was previously called the TransferWise Borderless Account.

The Wise Multi-Currency account allows you to hold your money in over 40 currencies. This account is great for freelancers or individuals who transact with other businesses abroad.

The Wise Multi-Currency Account offers you the free:

- European IBAN

- US account number and routing number

- Canadian account number

- Turkish Lira account and IBAN

- British account number and sort code

- Australian account number and BSB code

- New Zealand account number

- Romanian Lei account

- Hungarian forint and account number

- Singapore dollar account

You can receive these ten currencies and others through your Wise multi-currency account. Instead of opening a US Dollar account in Canada and individual accounts for other currencies, the multi-currency account lets you access multiple foreign accounts that function like local bank accounts.

Wise Debit Card

Wise Multi-currency (Borderless Account) has a debit card with low conversion and $0 transaction fees. Combining a borderless account with a debit card can save you money by reducing your fees.

The Wise debit card is now available in Switzerland, the US, Singapore, Canada, the UK, New Zealand, Malaysia, Australia, and most parts of the Eurozone.

Here are the key features of the Wise debit cards:

- Zero transaction fees.

- Low conversion fee

- Automatic conversion of money at a real exchange rate

- 2 Free monthly ATM withdrawals (up to £200).

Wise Coupon

You can earn extra income by inviting your friends and family to Wise. How? By sharing the TransferWise coupon.

You will be automatically assigned a coupon when you open a Wise account. The coupon contains a promo code so that anybody that clicks on it to sign up gets discounts on their first transfer while you get paid.

Finally, Wise has different rewards for people who share their promo codes with friends and family.

Once you commit yourself to sharing the promo code, you may earn an amount to offset your transaction costs.

How to Create a Wise Account

Creating a TransferWise account is free and easy for everyone who can operate a smartphone.

However, there are two options for creating a Wise account: with an email or a Facebook account: Here are the step-by-step processes of opening a Wise account with an email:

- Step 1: Visit the Wise sign-up page

- Step 2: Sign up with your email

- Step 3: Indicate the type of account you want to create (personal or business)

- Step 4: Enter your country of residence

- Step 5: Verify your phone number

- Step 6: Create a password (containing a letter and a number)

- Step 7: Verify your email

However, you may need to provide your ID or proof of address to execute a transaction on Wise.

Is Wise (TransferWise) Safe & Legit?

Wise is a safe and legitimate company regulated by relevant authorities in Canada, the US, and other countries in which they operate.

For example, in the UK, TransferWise is licensed by the Financial Conduct Authority (FCA) as an Authorised Electronic Money Institution.

TransferWise is regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the Authority des Marches Financiers (AMF) in Canada.

Also, TransferWise is regulated by the Australian Securities and Investments Commission (ASIC) and the US Financial Crimes Enforcement Network (FinCEN).

In India, it is approved by the RevenueBank of India and regulated by the Kanto Local Financial Bureau in Japan as a Funds Transfer Provider.

Furthermore, TransferWise has two-factor authentication (2FA) and advanced digital protection for your money. It has a 4.6/5 rating based on over 139,000 reviews on Trustpilot.

How To Contact Wise in Canada

Depending on the account you open, you can contact TransferWise in Canada in different ways.

If you open a personal account, call 1-888-445-2780. But if you signed up for a business account, call 1-888-403-2696.

Furthermore, you can contact TransferWise through mail or in-app chat on an iOS or Android.

Wise vs PayPal: Which is Better?

When it comes to international money transfers, Wise and PayPal are two of the most popular options.

PayPal is a more established platform widely used for online payments and money transfers. While PayPal offers international money transfers, its fees can be higher than TransferWise, especially for larger transactions. PayPal also uses its own exchange rates, which may not always be as favourable as mid-market rates.

In terms of user experience, both Wise and PayPal are relatively easy to use and have user-friendly interfaces. However, Wise may have a slight edge regarding transparency and ease of use, as it provides more detailed upfront information about fees and exchange rates.

So, if you’re looking for a low-cost, transparent way to send and receive money internationally, TransferWise may be the better choice. But if you’re already a PayPal user and value its convenience and familiarity, it may be a more convenient option.

RELATED: Cash App Canada: 9 Alternatives for Canadians in 2024

Final Thoughts on TransferWise Review

If you’re looking for a reliable, cost-effective, and easy-to-use online money transfer service, Wise (formerly TransferWise) could be your perfect choice.

With its low and transparent fees, safe and secure platform, and flexibility for individuals and businesses, Wise is a revolutionary way to send and receive money internationally.

The platform offers over 750 currencies to over 80 countries, and with a simple signup process, you can start transferring money within minutes.

While there may be some limitations, Wise is an excellent option for those who want to save money on international transfers.

So, if you’re ready to experience the benefits of Wise for yourself, sign up today and start saving on your international money transfers!

FAQs on TransferWise Review

Do Both Parties Need Wise?

No. Only the sender needs a TransferWise account. The recipient can receive the money with any bank account.

Does Wise Refund Money?

Yes. TransferWise refunds money but only before completing the transaction. Once Wise sends the money to the recipient, it can’t refund it. However, you can ask the recipient to send it back.

How Long Does It Take Wise to Refund Money?

It may take TransferWise up to 10 business days to refund your money.

How Long is Wise Verification?

TransferWise verification takes two to three business days to complete, and you will be notified by email about it.