Are you tired of the traditional nine-to-five grind and looking for a way to make money while sipping margaritas on a sunny beach? Well, I’ve got some exciting news for you! Today, we’re diving into the world of passive income in Canada. We will explore how you can make money while you sleep, relax, or pursue your passions.

Imagine waking up in the morning to find your bank account a little bit fatter, all thanks to the income streams you’ve set up. Sounds like a dream, doesn’t it? But it’s not just a fantasy reserved for the lucky few. Passive income is a real possibility, and it’s within your reach.

This article will unleash a treasure trove of passive income ideas tailored to the Canadian market. Whether you’re a student, a stay-at-home parent, or a seasoned professional looking to diversify your income, we’ve got you covered.

Get ready to discover the power of generating money without wasting your time. We’ll reveal the best passive income opportunities to fit your lifestyle, interests, and financial goals. From real estate investments to online businesses, we’ll explore it all.

So, prepare for an adventure into the world of passive income in Canada. Let’s get started!

20 Passive Income Ideas To Make Money in Canada for 2024

goPeer Peer-Peer Lending in Canada goPeer is a Canadian-regulated consumer peer-to-peer lending platform for attractive returns on consumer loans. goPeer helps diversify your portfolio with a new fixed income asset class (a.k.a consumer loans) and uncorrelated returns to other asset classes. Investing with goPeer also guarantees decent gross returns of between 7.5% to 28% - much higher than what you'll get from any bank. Moka is one of the best investment Robo-Advisors (or App) in Canada. It helps you save and invest effortlessly while growing your money at the same time with a decent return of between 5% - 18% depending on your investment type, market fluctuations, etc. They do the heavy lifting by helping you find the right stocks, ETFs, and investment options for your risks level.

Here are 30 incredible passive income ideas specifically curated for the Canadian market in 2024. From investing in real estate and dividend stocks to starting an online business or creating digital products, we have a wide range of opportunities to help you make money while you sleep.

So whether you’re a beginner or a seasoned entrepreneur, these ideas are designed to inspire and empower you on your journey to financial independence. Let’s dive in and discover the wealth of possibilities waiting for you in the world of passive income in Canada.

1 . Invest With a Robo-Advisor

Have you ever fantasised about going on a worry-free vacation while your money works hard for you? Or you’ve wished for a way to effortlessly grow your wealth without constantly monitoring your investments. Well, my friend, let me introduce you to the game-changer known as a Robo-advisor.

Imagine having an automated financial advisor by your side, tirelessly managing your finances and steadily increasing your net worth. That’s exactly what a Robo-advisor does. It’s like having a personal financial guru who never sleeps.

So, what exactly is a Robo-advisor? It’s an online portfolio manager that crafts personalised investment portfolios using exchange-traded funds (ETFs). These software-based financial advisors utilise sophisticated algorithms to handle your money based on your unique investment preferences.

The beauty of Robo-advisors lies in their simplicity and efficiency. They have gained immense popularity because they require minimal time and human interaction to design a custom portfolio that perfectly aligns with your goals and opportunities.

Check out the Best Robo Advisors in Canada.

2. Become an Event Planner

Are you the life of the party? Do you thrive on the excitement of organising people and events? If that sounds like you, then event planning could be the perfect passive income idea to make some serious cash. It’s a competitive field, but compared to other passive income ventures, event planning is surprisingly accessible and less daunting. The best part? There are countless opportunities to earn extra money as an event planner.

You have the flexibility to charge either by the hour or at a flat rate, depending on your expertise level and the event’s complexity. Whether you decide to launch your own event-planning business or join an established company, the choice is yours. You can cater to social events, corporate conferences, glamorous parties, or even fairy tale weddings.

Becoming an event planner allows you the freedom to shape your business in any way you desire. So, what are you waiting for? Start reaching out to friends, family, and colleagues to kick-start your journey into planning unforgettable events and unlocking the potential for a rewarding passive income stream. Let the celebration begin!

3. Rent Your Spare Room

Are you looking for a simple yet effective way to earn passive income in Canada? Here’s an idea that might just turn your unused space into a goldmine. Have you ever considered renting out a spare room in your house? It’s a fantastic opportunity to generate extra income without much effort.

Imagine having a spare room in your home that’s not occupied by any family member. Instead of letting it collect dust, why not turn it into a source of steady cash flow? You can unlock the potential for significant passive income in Canada by renting out that room.

The demand for rental accommodations is always high, which means there’s a pool of potential renters just waiting for a suitable space. You can tap into a lucrative income stream by capitalising on this demand.

So, renting out a room can be smart if you have a spare room sitting empty or considering investing in a property. It’s a relatively easy and accessible way to make money while leveraging your assets.

4. Create an App

If you have a knack for creativity and the ability to develop a captivating app that people can’t resist downloading, then you’re in luck! App development offers a fantastic opportunity to generate passive income.

There are various avenues to explore in this field. One option is directly selling your app on popular platforms like the Google Play Store or Apple App Store, which attract millions of visitors daily. You can generate substantial income with the right app and a loyal user base.

Another approach is to collaborate with companies or brands and incorporate their products into your app, opening up possibilities for sponsorship and partnerships. Additionally, you can monetise your app by selling advertising space to interested advertisers.

Lastly, you can establish an affiliate business model to recommend products and services from other companies to your app users, earning a commission for every purchase made through your app. The opportunities in app development are abundant, and with the right strategy, you can tap into the immense potential of passive income in this ever-growing industry.

5. Become a Resume writer

Are you a wordsmith with a passion for writing? Do you find joy in helping others craft their professional stories? If so, let me introduce you to an exciting opportunity: becoming a resume writer. Not only does this profession allow you to flex your writing skills, but it also has the potential for generating passive income.

Countless individuals struggle with creating compelling resume, editing their LinkedIn profiles, and crafting attention-grabbing cover letters. While it may seem simple to document one’s experience and education, it can actually be quite challenging to present it most effectively.

As a resume writer, you have the power to make a real difference in someone’s career trajectory. By leveraging your expertise, you can help job seekers land their dream positions and stand out from the competition. And the best part? You can get paid handsomely for your valuable service.

6. DIY Investing

Are you seeking a powerful strategy to build your investment portfolio and grow wealth? Look no further than DIY investing! This approach allows you to take control of your financial future by creating a diversified portfolio of proven assets.

The beauty of DIY investing lies in its ability to generate passive income. By carefully selecting a mix of stocks and bonds, you can watch your money grow through the interest they generate.

7. Open a High-Interest Savings Account

If you’re looking for a reliable and hassle-free way to earn passive income, one of the top options is to make interest. And guess what? Opening a high-interest savings account is an excellent way to get started.

Luckily, Canadians have access to some of the best high-interest savings accounts in the market. Let’s take a look at a few noteworthy options:

- EQ Bank Savings Plus Account

- Saven Financial High-Interest Savings Account

- Neo Financial High-Interest Savings Account

- National Bank High-Interest Savings Account

RELATED: Best High-Interest Savings Accounts in Canada (2024)

8. Start Blogging

When it comes to generating passive income in Canada, blogging has emerged as a powerhouse. The beauty of blogging lies in its ability to generate thousands of dollars with just a few hours of work each week.

But here’s the catch: you need to choose a niche that truly ignites your passion. Once you’ve found your niche, it’s all about dedicating the time and effort to build a loyal audience.

9. Use Cash Back Apps

In today’s digital age, Canadians are discovering a smart and effortless way to earn passive income while shopping: cashback apps. With the rising popularity of these apps, it’s never been easier to get rewarded for your everyday purchases.

Thankfully, Canada offers many cashback apps that partner with a wide range of online and in-store retailers, allowing you to earn a percentage of your purchases as “cash back.” Whether you’re shopping for groceries, clothing, electronics, or anything in between, these apps have got you covered.

10. Invest in Real Estate

Are you intrigued by the idea of generating passive income in Canada? If so, real estate could be the perfect avenue for you. With its potential for long-term investment and steady cash flow, investing in real estate offers many benefits.

Personally, one of the major attractions for me is the ability to earn passive income while I sleep, thanks to rental properties that consistently generate income month after month.

11. Create an Online Course

Are you ready to tap into the endless possibilities of earning passive income through the power of the Internet? Among the countless opportunities available, one method that stands out is creating and selling online courses.

Imagine sharing your expertise, knowledge, or unique skills with a global audience, all while generating a steady income stream. With the accessibility and convenience of online learning, people from all corners of the world can benefit from your valuable insights.

So, if you have something valuable to offer, whether it’s cooking, photography, programming, or any other skill, there’s a thriving market waiting for you. Get ready to embark on a journey of financial freedom and join the ranks of successful online course creators.

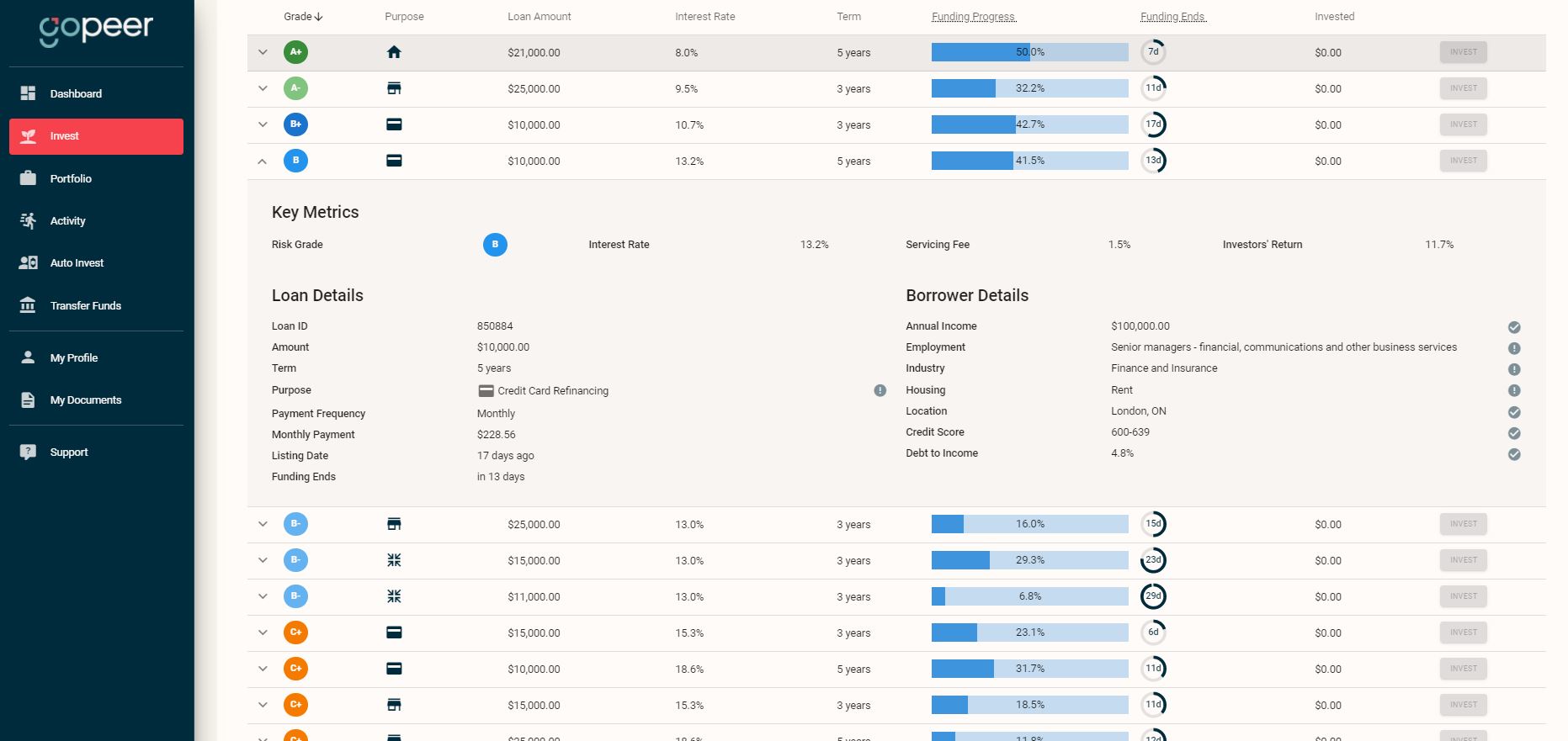

12. Lend on Peer-to-Peer Platforms

Peer-to-peer (P2P) lending is a popular form of alternative lending that has taken the financial world by storm. P2P lending platforms act as matchmakers, connecting borrowers needing loans with individuals who are ready to lend them money.

As a lender, you can profit by collecting interest on these loans, while borrowers benefit from accessing low-interest funds. It’s a win-win situation offering an exciting opportunity to grow wealth and earn passive income.

13. Start a YouTube Channel

Are you someone who loves capturing life’s moments on your phone? Perhaps you’ve always dreamed of becoming the next YouTube sensation, entertaining and inspiring people worldwide. Well, guess what? Starting a YouTube channel can fulfil your creative aspirations and provide a pathway to passive income.

But here’s the key: to generate significant passive income on YouTube, you must find a niche in high demand. In other words, you need to discover that special something that sets your channel apart and attracts a dedicated audience. After all, the more views your videos receive, the more passive income you’ll earn.

14. Join Affiliate Marketing

Joining an affiliate program is a fantastic opportunity that allows you to earn extra money by promoting products or services on behalf of companies.

Why do companies love affiliates? It’s simple; they get to tap into a wider audience and boost their sales. As an affiliate marketer, you’ll earn a commission for every sale you make or every customer you refer. It’s a win-win situation for everyone involved.

15. Take Online Surveys

Taking surveys is a quick and easy method requiring no special skills. You can get started right away and complete surveys at your own convenience.

The best part? Not only will you be earning money, but you’ll also be providing valuable feedback to businesses and helping them improve their services.

Ready to get started? Here are some popular survey sites you can join right away:

- Swagbucks

- Survey Junkie

- InboxDollars

- LifePoints

- MyPoints

16. Become a Social Media Manager

If you find yourself scrolling through social media daily, why not turn your love for it into a profitable venture? Instead of using social media solely for fun, you can leverage your skills and passion to earn a passive income.

In today’s digital age, social media has become a crucial component of online marketing, and companies are constantly seeking skilled social media managers to help them build their brand presence.

This presents an incredible opportunity for you to step into the role of a social media manager and start earning a long-term income. As a social media manager, you’ll have the flexibility to manage multiple companies’ social media accounts at your own convenience, making it an ideal option for those seeking a flexible and rewarding job.

17. Coach Others

Are you passionate about sharing your knowledge and helping others succeed? If so, coaching could be the perfect avenue for you to explore. Coaching allows you to leverage your expertise and guide others towards achieving their goals. But with so many coaching possibilities, how do you choose the right path?

Selecting a coaching area that aligns with your skills and passions is key. Focusing on subjects you excel in and are truly passionate about will create a more enjoyable and effective learning experience for your clients. Teaching what you already know and love will make the coaching process smoother and more rewarding for both you and your learners.

Don’t be afraid to venture into new territories, either. There’s a wealth of diverse interests and skills out there, and you have the opportunity to expand your knowledge and share something new.

18. Sell Products Online

Are you eager to tap into the vast potential of the Internet and reach customers far beyond the borders of Canada? Look no further! The online world presents an incredible opportunity to promote and sell your products without being limited by location. With millions of potential customers just a click away, you can expand your reach and boost your sales like never before.

Gone are the days of tirelessly promoting your products in every country. Instead, you can harness the power of online platforms to reach a global audience right from the comfort of your own home. Whether you’re an artist, a crafter, or a business owner, the internet offers a level playing field where your products can shine.

Setting up your own online store is a crucial step in your passive income journey. With platforms like Amazon and Shopify at your disposal, you can easily create a digital storefront to showcase your products and attract buyers from around the world. It’s a fantastic opportunity to generate income while you focus on other aspects of your life or business.

19. Find Freelance Jobs

Curious about what exactly a freelance job entails? Well, let me break it down for you in simple terms. A freelance job is a unique work arrangement that differs from the typical office job yet offers its own set of rewards.

It’s all about utilizing your skills and expertise to work for clients online, providing services and completing assignments remotely. The beauty of freelancing lies in the flexibility it offers. You have the freedom to set your own schedule and choose the projects that align with your passions and abilities.

Whether you’re a talented web designer or a wordsmith with a knack for writing, there’s a freelance opportunity out there just waiting for you. And the best part? It’s a fantastic way to earn passive income while doing what you love.

20. Write E-books

In today’s digital age, e-books have taken the world by storm. With platforms like Apple’s iBooks and Amazon’s KDP dominating the market, writing and publishing e-books has become a lucrative passive income idea.

The beauty of e-books lies in their potential to generate long-term income. Once you’ve put in the effort to create and publish your book, it can continue to earn you money for years to come. Plus, the audience for e-books is virtually limitless, thanks to the vast reach of the internet. You can sell your masterpiece to readers all around the world with just a few clicks.

So, if you have a story to share, knowledge to impart, or a passion to explore, writing an e-book could be the perfect avenue for you to create a sustainable passive income stream.

Final Thoughts on Passive Income in Canada

I hope this article has opened your eyes to the incredible opportunities that passive income in Canada can offer.

From real estate investments to dividend stocks and online businesses to e-commerce, there are countless avenues waiting for you to explore and start earning while you sleep.

So, what are you waiting for? Take that first step towards financial freedom and begin your passive income journey today. Start by choosing one or two ideas that resonate with you and dive in headfirst.

Building passive income takes time and effort, but the rewards are well worth it. So go ahead, unleash your potential, and create the life of freedom and abundance you’ve always dreamed of. Take action now and start your passive income journey in Canada today!

RELATED: How to Start a Trucking Company

FAQs on Passive Income in Canada

How much money do you need to make passive income?

It depends on the type of passive income idea you choose. Some passive income streams, such as surveys, don’t require money to start. But other passive income streams like DIY Investing need specific starting capital.

What are the two types of income?

Active and passive income. Active income is regarded as your primary income, while passive income is anything extra which you earn in addition to your primary income.

Is passive income taxed differently?

Yes, passive income is taxed differently from active income. How passive income is taxed depends on the type of income and how you earn it.

Are royalties passive income?

Given that royalties are a percentage of sales, they are also a form of passive income.

If you are going for best contents like myself, simply go to see this website everyday since it provides quality contents, thanks