The CRA My Account is a secure, online portal where you can view your personal income tax and benefit information and effortlessly manage your tax affairs online via the Canada Revenue Agency (CRA) website.

Opening a CRA My Account is essential for every Canadian. It allows you to quickly access your T4 slips, benefit payments, retirement contributions, carry-forward amounts, and account balances, make adjustments to past returns and submit documents directly online.

If you haven’t registered for your CRA My Account yet and want to open yours, this blog post will guide you step-by-step on how to register one easily in Canada. Without skipping a beat, let’s dive right into it.

What is the CRA My Account?

The CRA My Account is a fast, convenient and secure online service that allows you to view your income tax and benefit information. With the CRA My Account, you can easily manage all your tax affairs online, saving you from wasting time and resources doing everything manually.

It can be conveniently accessed from any desktop or mobile device with an internet connection. It offers up-to-date information on your transactions, benefits, or anything else you do in your personal account.

It is available 21/7 (i.e. 21 hours daily and 7 days every week), easy to use, fast, and secure, information is up-to-the-minute and transactions are processed immediately.

With the account, you can track your refunds, view and change returns, check your benefits, tax credits, and RRSP limit, receive email notifications, set up direct deposit, and do many more.

It is also highly secured. The CRA uses sophisticated security techniques to protect their site and your privacy. You will have a unique User ID and password, that allows you to access your personal account and block intruders.

What are the Benefits of a CRA My Account?

With the CRA My Account, you can:

- View the detailed status of your tax return.

- View your unused or carryforward amounts for tuition amounts, RRSP contributions.

- View your Notice of Assessment (NOA), Notice of Reassessment (NOR), or request an Express NOA.

- Change or update your personal information.

- Download information slips.

- Use the Auto-fill my return feature when you file online using certified software.

- View your Home Buyers’ Plan (HBP) and Lifelong Learning Plan (LLP) information.

- Start or manage your direct deposit details for benefits and credits.

- View your benefits’ status and payments.

- Receive email notifications from CRA.

- Authorize a representative.

Check out the full list of services you can access with your CRA My Account.

How To Register For CRA My Account

Registering your CRA My Account is a simple and straightforward process. You have two options to register: by creating a CRA user ID and password or with a Sign-in Partner.

There is a third option that is available only to residents of Alberta and British Columbia (BC). BC residents can register for the CRA My Account using a BC Services Card, and Alberta residents can register using MyAlberta Digital ID.

However, before you begin your registration, ensure that you have your previous year’s tax return (Line 101 on your taxes), your Social Insurance Number (SIN), your Postal code, and your Date of birth. The CRA will request this information as you proceed with your registration.

Option 1: How To Register A CRA My Account Using Sign-in Partner

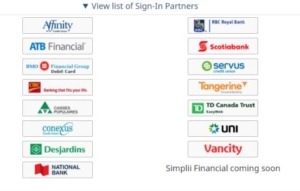

If you are currently banking online with any of the banks shown above, you can proceed with this option.

- Go to the CRA’s My Account for Individuals page.

- Click on “Sign-in Partner Login/Register” and wait a few minutes.

- Fifteen banks will be displayed on the next page; click on the bank you use for online banking.

- Then, input your online banking details/credentials and click on “Login”.

- Then, input your Social Insurance Number (SIN) and click on “Next”.

- Then, you will be required to validate your identity. Enter your postal code, date of birth and tax information (amount entered on Line 101 of your previous year’s tax return), and click “Next”.

- The next page will inform you that the CRA will mail your Security code to your home within 5 to 10 business days. Click “Next”.

- Then, you must verify your current postal or ZIP code and click next.

- You will have limited access to your CRA My Account. Whenever you receive your CRA security code, you will enter the security code to access the full features of the CRA My Account.

Note: If you enter any incorrect information, the CRA will flag it as incorrect information, and you will have to start over with your registration.

Option 2: How To Register A CRA My Account By Creating User ID and Password.

- Go to the CRA’s My Account for Individuals page.

- Scroll to Option 2, click “CRA register, ” and wait a few minutes.

- Then, input your Social Insurance Number (SIN), and click on “Next”.

- On the next page, you will be required to validate your identity. Enter your postal code, date of birth and tax information (amount entered on Line 101 of your previous year’s tax return), and click “Next”.

- On the next page, you will be required to create a user ID and password. Instructions will be given on how your UserID and password should appear.

- Next, you will be required to create security questions and answers.

- Next, read through the terms and conditions and click “I agree”.

- The next page will inform you that the CRA will mail your Security code to your home within 5 to 10 business days. Click “Next”.

- Other terms and conditions will appear on the next page; read through carefully and click “I agree”.

- You will be given limited access to your CRA My Account. Whenever you receive your CRA security code, you will enter the security code to access the full features of the CRA My Account.

CRA My Business Account

The CRA My Business Account allows business owners in Canada to access many amazing benefits relating to their business. It is very similar to the CRA My account but only focused on serving business entities.

Canadian business owners can use this account to perform a wide range of tasks, including income taxes, excise duties and taxes, payroll deductions, information returns, GST/HST and many more.

What is the Multi-factor Authentication (MFA)?

The CRA added the MFA as an extra security to their online services. In addition to your user ID and password, you will be required to verify your identity using the MFA. You will need to verify your identity by passcode grid or telephone.

RECOMMENDED READINGS:

- The 10 Cheapest Places To Live In BC (2024)

- What is a Routing Number in Canada? (2024)

- What is a Void Cheque? How to Get One Fast (2024)

- Withholding Tax RRSP: How to Avoid Withdrawal Taxes (2024)

Final Thoughts on How To Register A CRA My Account

Having a CRA My Account gives to access to many amazing benefits; you shouldn’t miss out on this. Why spend hours calling CRA on the phone or queuing at their office centres when you can easily register for a CRA My Account and enjoy its benefits from the comfort of your home?

So if you are looking for how to register a CRA My Account, follow the steps I have highlighted above and get your personal account.