The Employment Insurance (EI) benefit offers financial support to working Canadians who lose their jobs through no fault of their own for up to 52 weeks of unemployment. Once you have passed the eligibility criteria and received approval for employment insurance benefits, you must continue to submit your biweekly reports to show that you are still eligible to receive the benefits.

You can submit a paper report at any Service Canada office, use the phone reporting system, or use the employment insurance internet reporting portal. However, it’s essential to note that the eI internet reporting service is the most popular and convenient method for filing your EI report.

In this blog post, we will answer all your questions regarding the EI online reporting service and guide you through the process of completing your EI report online.

What is EI?

Employment Insurance (EI) is Canada’s biggest income replacement program that aims to help Canadians who lost their jobs because of no fault of theirs by providing them with financial support while they are out of work for up to 52 weeks.

Also known simply as employment insurance, EI provides temporary income support to those who are unemployed and actively engaged in a job search or upgrading their skills. To qualify, individuals must have paid premiums and met the required minimum insurable hours.

The disbursement and approval of these benefits are governed by the Employment Insurance Act. This Act determines the qualifying amount based on factors such as your income details, the number of insurable hours accrued, and whether you have recently received EI benefits. Your eligibility for employment insurance benefits is contingent upon these considerations.

How The Employment Insurance Canada Online Reporting Works

To access the benefits provided by the Employment Insurance Program, you may choose to apply for EI online by completing an online application through Service Canada.

This includes telling Service Canada about your employment history, training, education, and other factors that may help you qualify for EI benefits. There is a waiting period of two weeks before you can get your first benefit.

Subsequently, you need to continue filing your employment insurance report every two weeks to inform Service Canada your employment condition hasn’t changed and that you are still eligible to receive future benefits.

If you worked during the two weeks you are filling for, you must state the hours you worked and the total amount you got or would get before deductions.

How To Submit Your Report

During your application for EI benefits, Service Canada mailed you a benefit statement with a 4-digit access code. You will submit reports using this code and your Social Insurance Number (SIN).

You can submit your reports by Internet or telephone. Internet Reporting Service is faster, simpler, more convenient, and more secure.

However, if you don’t have access to the internet, you can use the Telephone Reporting Service. Call 1-800-531-7555 to process your report.

Also, if you cannot submit your report online or by telephone, you can mail a paper report to Service Canada.

If you made a mistake on a report you have already submitted, you could quickly modify your report before submitting it when you send it by telephone or the Internet. Contact Service Canada as soon as possible so you don’t risk being overpaid and having to repay benefits.

Before You Submit Your Report

Before you start filling your report with the EI internet reporting service, it’s crucial to take note of these cautions:

- Incomplete Reports: If you disconnect or exit the report prematurely, your information won’t be saved, requiring you to start over.

- Missing Information: Reports with missing information cannot be processed. Ensure all necessary details are at your fingertips before commencing your report.

- Session Duration: To avoid disconnection, refrain from staying on one page for over 10 minutes. Never leave your computer unattended while logged in to your online report.

- Ending Your Session: Click “Log Out” to conclude your session once you’ve finished your report.

- Browser Cache: Remember that your browser automatically saves visited web pages. Safeguard your account information by clearing your browser’s cache after each session.

- Troubleshooting “Error 404”: If you encounter an “error 404” message during login, troubleshoot by clearing your browser’s cache, deleting cookies, or trying another browser. For Internet Explorer users, ensure ‘Compatibility View’ is turned off by checking the Tools menu on the Login page. If it’s on, click to remove the check mark and turn it off.

How To Access The EI Report Online

After applying for benefits, you’ll receive an EI benefit statement by mail. This statement contains your access code (a 4-digit number located in the shaded area at the top of the statement). To submit reports and access information about your claim, you’ll need both the access code and your Social Insurance Number (SIN).

You must keep your access code secure and store it separately from your SIN. By providing and submitting your SIN and access code, your online report will be considered signed.

What You Need To Report

For each report, you must indicate the following:

Work and Earnings

If you are currently employed or earning income while on EI, you are still eligible to collect benefits; however, it is imperative to report this information. The required details for your EI report include:

- The days you worked

- The number of hours worked

- Phone numbers for employers

- Total earnings before deductions for each reporting week

Always report your actual earnings before any deductions. Failure to do so may result in the need to repay some or all of the funds received. Additionally, report earnings during the specific week(s) in which they were earned.

For instance, if you worked during a particular week but will receive payment later, report the hours worked during that specific week, not when you receive the payment. Reporting earnings should be based on each calendar week (Sunday to Saturday).

Also,

- Round earnings to the nearest dollar (e.g., $125.49 becomes $125, while $125.50 becomes $126).

- Only report full hours worked during each calendar week (Sunday to Saturday). For instance, if you worked 38 hours and 45 minutes, enter 38 hours.

- If you commence full-time work, specify the start date. Report all employment, whether it is for someone else or self-employment.

Note: There is a reporting calendar that can help you keep track of hours and earnings to make it easier to fill your report. You must report hours and earnings from any job, including self-employment.

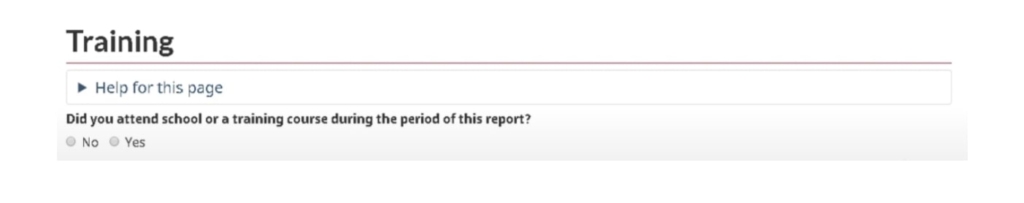

Training

If you attended school or training, please report the number of hours spent in training and the amount of any training allowance received. Exclude allowances related to living away from home, commuting, travel, or dependent care.

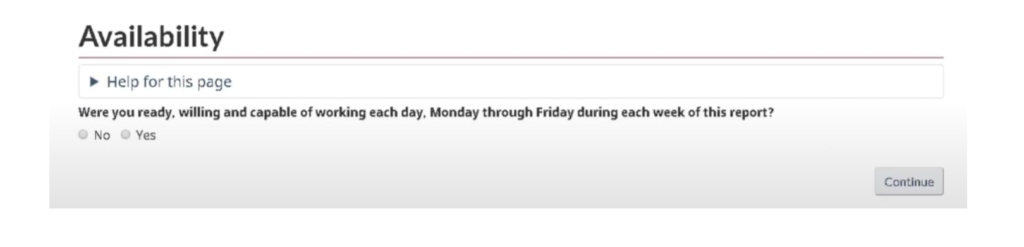

Availability

You will encounter the following question: “Were you ready, willing, and capable of working each day, Monday through Friday, during each week of this report?”

If, for any reason (e.g., illness, injury, vacation), you were not available for work or not actively seeking employment, respond with a “no.” Specify the days you were unavailable. Additionally, report any instances of leaving Canada during the reporting period.

How to Fill Your EI Report Online (A Step-by-Step Guide)

If you are an employment insurance claimant, you must complete an EI report every two weeks. The report confirms your job search for the past two weeks. The reports are used to calculate how much money you will receive every two weeks.

Filing your EI report online is relatively straightforward if you have all the necessary information. The following steps will guide you through the process:

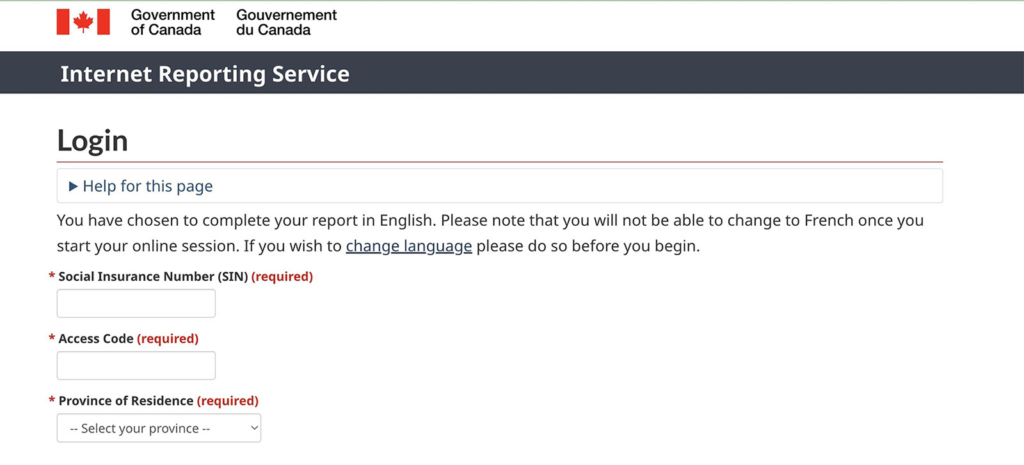

Step 1: Signup or Login to the EI Internet Reporting Portal

To file your EI report online, you must first sign up or log into the EI Internet reporting portal.

The reporting portal is a web-based application that allows you to complete, submit and view the result of your EI report online.

You’ll need to enter your SIN, access code, and the province of residence; then, you go ahead and log in.

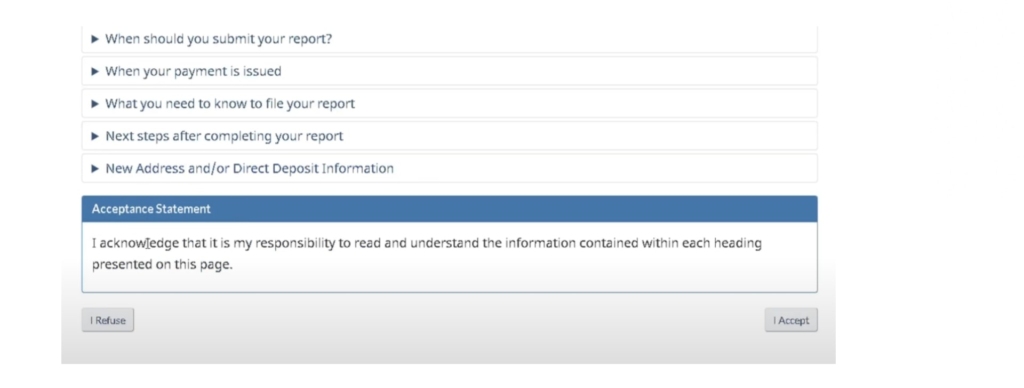

Step 2: Go Through The Acceptance Statement

After logging in, you’ll be taken to a page with all the information you need to complete the report.

Analyze the data, double-check the dates and frequency of filing, and then click the “I accept” option.

Before continuing, it is essential that you read over all of the information presented.

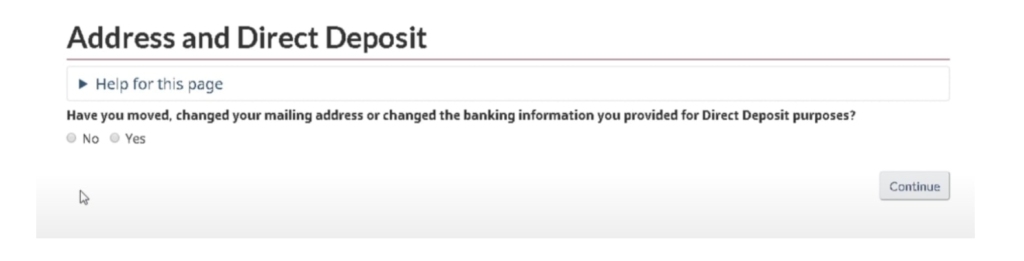

Step 3: Update The Postal and Direct Deposit Information

The postage and direct deposit page will open after clicking the ‘I accept’ button. Remember that choosing direct deposit is the right choice, as you will get your funds within two business days after the mandatory waiting period of 2 weeks.

Click No or Yes as it applies to you concerning your address. Click “No” if you’ve not changed your address and kept the direct deposit details they used to pay you the last payment. Click “Yes” to enter your new address.

You must always update your account and supply Service Canada with the most up-to-date information to ensure your next EI payment arrives promptly.

Before proceeding to the next step, you must confirm your decision by clicking “I Accept.”

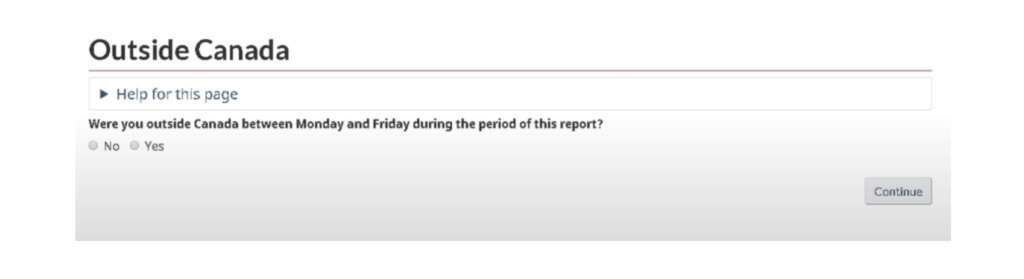

Step 4: Provide Information About You Leaving The Country

This page will ask you to provide information about your leave of absence from the country.

If you leave the country during the period you are entitled to benefits, the government will not pay for those days.

If you lie, you may face criminal charges, so be honest about where you were. Be sure to click ‘continue’ after filling out this information.

Step 5: Update Work and Wages Information If You Are Self-Employed

On this page, you will be required to answer these two questions:

- Do you have your own business?

- During the reporting period, did you work or earn any income? This covers paid and unpaid labour and self-employment, such as farming.

Click “Yes” or “No” as it applies to you.

In the case of self-employment, you will have to provide relevant payment and work details. Income from self-employment, including home-based gigs, part-time work, and side hustles, will impact your benefits.

When reporting income, it’s critical to remember to include the pre-tax earnings approximated to the latest dollar number.

If you’ve just started a new job and haven’t yet been paid, add your hourly rate to your total hours.

Step 6: Provide Information On School or Training Attendance

On this page, you will be required to provide two pieces of information:

Please click “Yes” if you attended or completed a school, trade school, or training program to provide the following information:

- The number of hours you spent training or attending school

- Your compensation, excluding commute costs, relocation expenses, and dependent allowances

Step 7: Demonstrate Your Availability To Work

The government will only pay you for a legitimate cause. You must demonstrate you are willing, competent, and available to work but cannot find employment.

By selecting ‘Yes,’ you assure the government that you were ready to work throughout the reporting period. That proves you weren’t at fault for being unemployed.

Also, you should update the availability tab of your schedule if you were not available during a working day because of caregiving or illness.

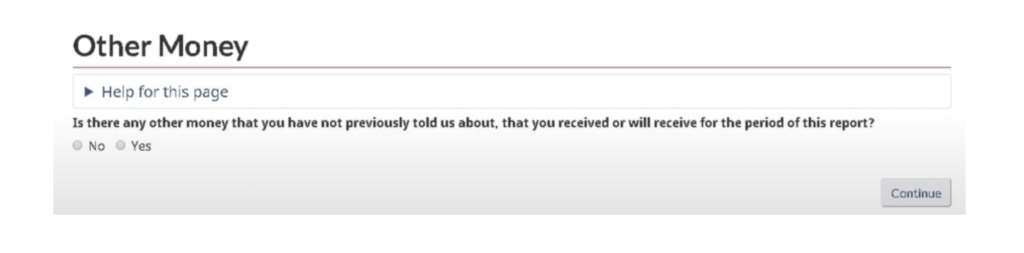

Step 8: Declaration of Monies from Other Sources

Please be truthful with the government about any additional money you received during the reporting period.

If you received any additional money throughout the week that is relevant to your job and you forgot or neglected to indicate it earlier, you must include it here.

These earnings may include Group wage-loss insurance, social income assistance, and worker’s compensation benefits.

You can choose “No” and continue if you haven’t received any qualifying income. If you have, you must supply information about the income, including the sum, the payer, and the kind of payment.

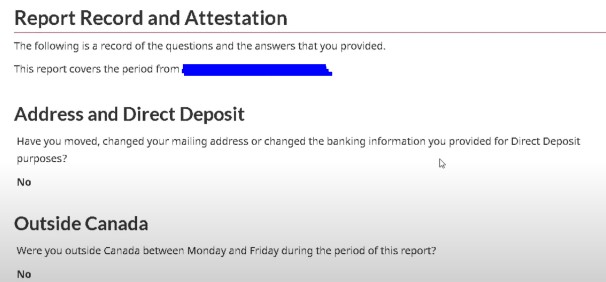

Step 9: Final Confirmation Statement

Once you have answered this question, you will have the opportunity to review all your answers before clicking ‘I accept’ to confirm they are accurate.

When you click “I accept,” you won’t be able to change anything once your report has been submitted, so please take your time on this page.

Then once you accept, you’ll receive an email confirming your report and the date of your subsequent reporting.

When To Submit Your Next Report

When you submit your report, you will immediately be given the date for your next report. Mark this date on your calendar.

You cannot submit your report before this due date, but you have three weeks from this due date to submit your next report.

Ask For An Exemption From Reporting

As an EI beneficiary, you can choose to be exempted from reporting if you meet certain conditions. You can request an exemption at any time during your benefit period or cancel it at any time.

During the benefits application process, you can agree to this exemption. You can choose to be exempted if:

- you are enrolled in a training program for apprentices

- paternal, maternity, or caregiver benefits are being paid to you

- a work-sharing contract applies to you

However, if you’re exempt and your circumstances change, you must immediately inform the EI program by completing the report.

If you don’t report, you may not receive your benefits until a review is done. This means there will be a delay before you receive your money again.

If a review shows that you were not eligible to be exempt, you may have to repay some of the benefits you received.

What You Need to Apply for Employment Insurance Online

To fill out your EI report online, you will need the following:

- a reliable internet connection

- your Social Insurance Number (SIN)

- Your access code. You will need to get your Access code via mail, not online. If you lose your access code, you will need to contact Service Canada at 1-800-206-7218 or visit one of its offices

- your province of residence information

- your banking information if you elect to receive your benefits through direct deposit

- your address and your postal code if it has changed since the last report

- details of extra allowances, tips, commissions, and income

- you may also register for your My Service Canada Account

How Long After EI Report Do You Get Paid?

Once you have successfully completed your Employment Insurance (EI) report, the processing time for payment largely depends on the method you have chosen for receiving your funds.

Typically, individuals who have chosen direct deposit can expect their EI payments to be deposited into their bank accounts within 2 to 3 business days after the completion of the report.

How Do I Check My EI Status?

Checking the status of your Employment Insurance (EI) application is a straightforward process through the My Service Canada Account (MSCA).

Once you have applied for EI benefits, Visit the My Service Canada Account portal and log in using your credentials. Once logged in, select the option that says “View my claim status and message.”

In the designated section, you’ll find details such as your EI claim status, specifics about your claim, and any messages you may have received from the authorities.

Is EI Paid Weekly or Biweekly?

Once you’ve received your initial Employment Insurance (EI) payment, subsequent payments are made on a biweekly basis. You can choose to receive your payments either through direct deposit or by mail cheque.

For those utilizing direct deposit, payments are typically deposited into your bank account every two weeks.

If you opt for receiving payments by mail cheque instead of direct deposit, it’s important to note that this method may result in slightly longer processing times. In such cases, additional days, ranging from a few days to a week, may be needed for postal delivery, potentially causing a delay in receiving your EI payment.

How Long Does It Take EI To Make A Decision?

The timeframe for Employment Insurance (EI) to reach a decision on your application is generally around 28 days from the date of your application submission. This applies if you meet the eligibility criteria and have furnished all the necessary information. Upon a positive decision, you can expect to receive your initial payment within this period.

Why Is My EI Payment Late?

There could be a few reasons why your EI payments may be delayed, and here are some common ones to consider:

- If you haven’t submitted all the necessary documents, it might be causing a delay in processing your EI payment.

- You might not be eligible for EI benefits, leading to a delay in payment. It’s crucial to ensure you meet all the eligibility criteria.

- Problems with your bank account, such as incorrect details or issues on the bank’s end, could contribute to a delay in receiving your EI payment.

- If you receive your payments by mail, issues with postal services or incorrect mailing information may be causing the delay.

Final Thoughts on EI Online Reporting

In closing, using the EI Internet Reporting service to file your EI report is not that difficult, especially if you have all the correct information beforehand.

I hope this article has consolidated all the information on this subject matter and provided you with all the important information on EI Online reporting. Now, you can complete your reports on time and avoid payment delays.

Use these tips, and have confidence as you navigate the process of filling your next EI report.

If you are still confused about using the EI Online reporting system, you can contact Service Canada to learn more about this.

RECOMMENDED READING:

FAQs on EI Online Reporting

How Often Should I Fill out my Employment Insurance online report?

Every two weeks. As soon as you receive your first EI benefit payment, you must file your EI report every fortnight until you get a new job.

You must complete your report for each benefit period as quickly as possible. When you complete a report, the system will tell you when to submit the next one.

If you forget to complete and submit your EI report form on time, it’s essential that you file it as soon as possible.

You may not receive payment for a reporting period if you miss the deadline to submit your report. To check the status of your claim, you can log in to your Service Canada Account.

What Should I Do if the EI Internet Reporting System is Down?

Use the EI reporting phone number: 1-800-531-7555.

The EI Online Reporting website is available 24 hours, seven days a week. However, routine maintenance may cause the system to go down occasionally. You can check the EI website or the @CitImmCanada on Twitter for notices and updates on when the system will be inaccessible.

You can also try to log into the EI Internet Reporting System at a different time to determine if it is an intermittent problem with your internet connection.

Can I Be Denied EI Benefit After I Was Approved?

Yes! You may be denied EI benefit even though you may have been initially approved and made a claim successfully in the past few weeks.

EI Eligibility is reassessed continually, and you must always demonstrate your eligibility before you can benefit from the EI program.

One of the reasons you may be denied EI is if it can be proven that you are not actively seeking employment or if you left your part-time employment for no good reason.

You may also be denied EI if you made much money from your side gigs or hustles. However, this may be temporary since side gig earnings are not permanent in nature. So, you may have a successful claim in the coming weeks.